The following is a contributed article from Anthony Coletta, CFO of SAP North America. Opinions expressed are author's own.

It’s a new decade, but one thing remains a constant for CFOs: the need to think ahead, and invest today to transform for the unknown tomorrow. Innovation cycles are shortening, and constantly changing business environments are impacting news headlines and executive boardroom discussions. Against this backdrop, here are a few things I expect will be top of mind for CFOs this year.

Qualitative financial analyses

CFOs are the chief marshals for ensuring investment in innovation drives value for internal and external stakeholders. As real-time information gathering has emerged, stakeholder value and ROI has evolved beyond one-off transactions in favor of ongoing experience feedback loops.

This is the experience economy in action. This means CFOs, for the sake of customers, must help create cultures that measure success in customer value creation, not product sales. One way this will take shape is in reporting. CFOs speak the language of numbers, but this needs to change. Look for key groups, including investors, board members and employees, to expect more qualitative and creative financial analyses (beyond simple product sales) from their finance leads in 2020. Successful CFOs will embrace this.

Business shock-proofing

There’s little probability 2020 will see a global recession and we should stay cautiously optimistic at the macro-level, especially in North America. However, CFOs should be prepared to act as the key resource for their c-suites and extended organizations to help the business navigate challenges at a global scale.

These challenges will involve production, suppliers, consumers, raw materials and international business development. What this will mean for CFOs managing business environments in an election year and shifting regulatory fields is that they will likely see more requests from peers to create response plans that account for any dips in activity.

I expect these response plans to involve robotic process automation (RPA), simplified structures, and even the reevaluation of their fundamental operational practices.

Sustainability as investment factor

Climate change is already having a substantial impact on many industries and communities around the world. In 2020, CFOs will face pressure to weigh sustainability as a leading investment factor and find more opportunities for their businesses to invest in innovation that addresses sustainability challenges. This call to action has been expressed by active funds and investors and there is growing pressure from end-consumers.

By implementing sustainable solutions and reducing their footprint, CFOs can help their company address pressing issues while also improving customer perception and brand image. There’s no reason why sustainability practices can’t augment a company’s growth aspirations and create new opportunities so long as these efforts are done thoughtfully and in alignment with a company’s ambitions.

For example, SAP recently announced the next phase of its Plastics Cloud initiative, which uses data analyses to help our customers shift to alternatives to single-use plastics, which we believe will help our customers drive sustainability while controlling costs.

Shorter supply chains

Across industries, we’re seeing a proliferation of real-time order procurement that enables automotive, beverage, consumer product and other companies to reduce inventory carrying costs by tens of percentage points. CFOs will be more involved in the process in 2020 because enabling these enhancements directly translates into improved cash flow for additional digital investment and revamped balance sheets.

Increasing investment in more efficient supply chains also carries the benefit of helping CFOs shock-proof their business. The reason: shorter supply chains will help control variables as the global economy is further impacted by trade conflicts and other geopolitical issues. This is reinforced by industry trends where consumers pay greater attention to localization, sourcing and value.

In a digital world, speed of delivery or the overall experience are crucial and they both require adequate supply chains.

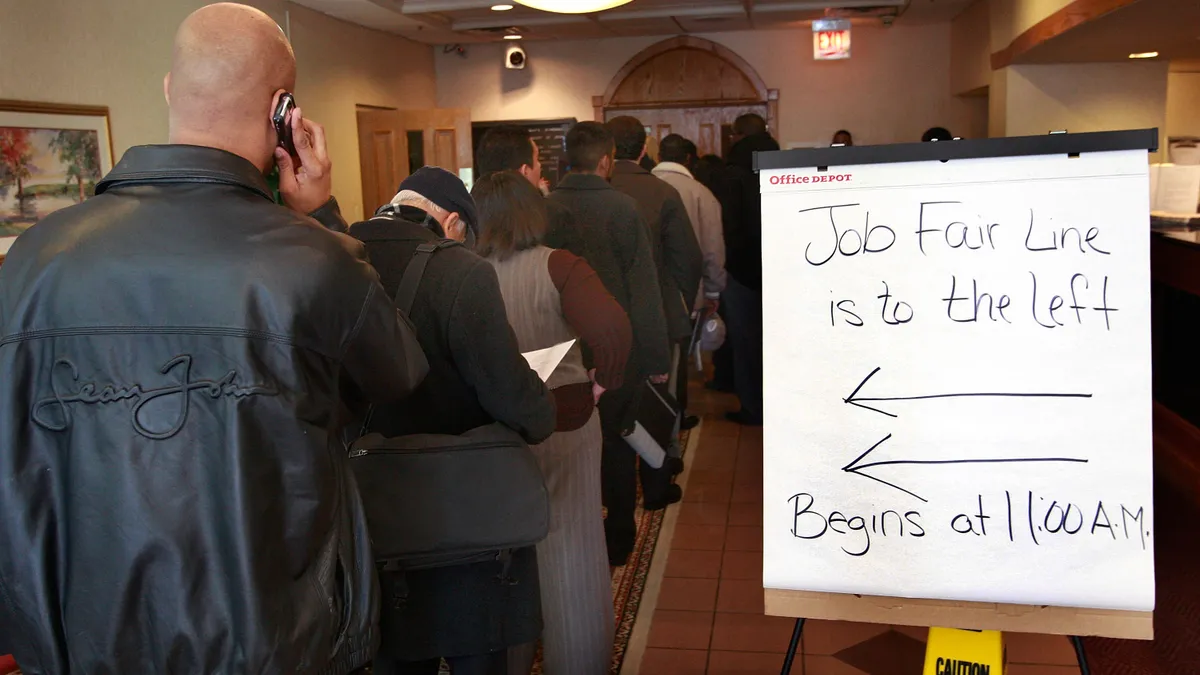

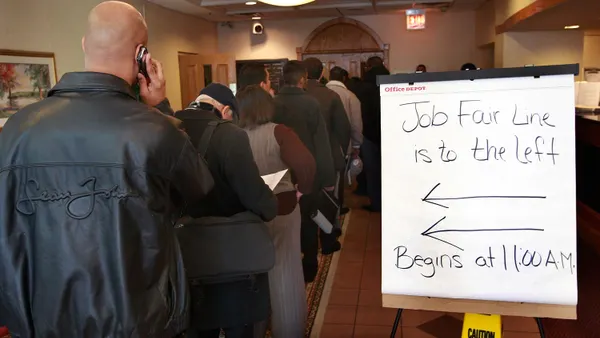

Creative approaches to diversity and inclusion

High-performing finance organizations place the same value on employee experience as they do customer experience because they’re directly related. We’re about ten years past “pipeline problems” — too few qualified diverse candidates available — being a valid excuse not to invest heavily in ensuring your workforce reflects the five-generation diversity of your customers. On top of this, a happy, inclusive workforce with a diverse group of employees maximizes innovation potential.

In 2020, future-ready CFOs will work with their HR departments to identify new (perhaps non-traditional) talent pools for recruitment, leverage technology to identify unconscious biases impacting employee experience, and take a heavier hand in fostering inclusive cultures. Our recent top spot on Forbes list for D&I is a testament to the value of innovative approaches to challenges of inclusion. For finance leaders who want to join this wave, here are a few helpful steps you can incorporate in 2020.

Keeping these predictions in mind, 2020 shouldn’t scare the CFO as much as it should inspire them to take advantage of the tremendous opportunities in front of them. 2020 is bound to be a year full of changes for CFOs at every kind of company. However, if you embrace these trends you will help your organization stay ahead of the curve and come out even stronger.