INmune Bio CFO David Moss wants to make sure he can fund the half-dozen clinical trials his company has in the works, but he doesn’t want to raise capital in a way that will hamstring him in the future, which he sees happening today.

“You’ve got to be careful about how you maintain your capital structure,” Moss told CFO Dive. “One of the things that has been forgotten about in today’s world, where we’ve had a lot of money being thrown at the stock market and businesses, is the cap structures.”

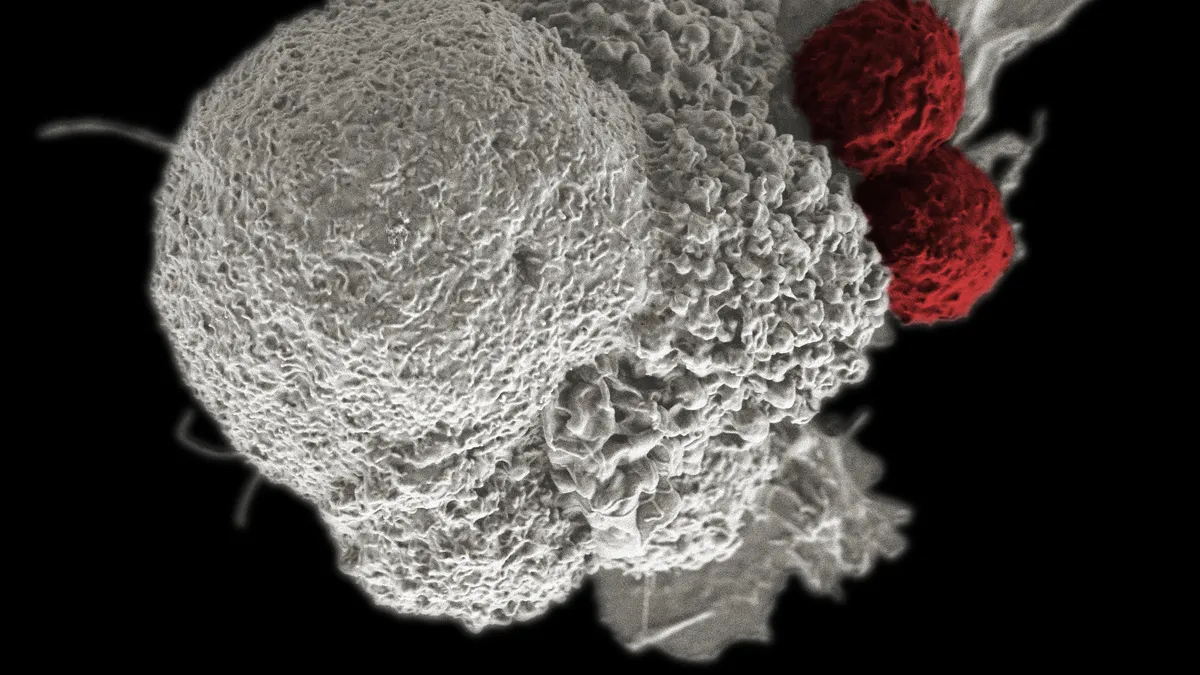

With two scientist partners, Moss helped found INmune Bio four years ago to tackle diseases using immuno-oncology therapies. He has since made capital simplicity a hallmark of his financial leadership.

The company’s original funding came from a close circle of supporters. When it went public in early 2019, the offering was structured entirely as common stock. That way, the value of the company is transparent, all investors have equal standing, and executives don’t cede control of the company to investors who don’t have the company's best long-term interests in view.

“If you’ve got more than common stock and debt outstanding, and covenants on the debt, and covenants on preferred stock, and if you have A, B, C, D, E and F preferred stock, and you have different conversion rights, different voting rights, and some have warrants on top of that, and the warrants have special provisions in them that allow the investors who hold those warrants to do special [things], you risk [your ability] to control your destiny,” Moss said.

Tight controls in place

Keeping tight control over their capital will become especially important this year as the company moves to phase 2 trials for the drugs it has in development, which tend to be more expensive than phase 1. A phase 2 trial can cost anywhere from $5 million to $25 million, compared to $1 million to $3 million for a typical phase 1 trial, Moss said.

The company is planning two phase 2 trials this year, one for its Soluable TNF Inhibitor, INB03, which targets growth of advanced cancer tumors, and one for its LIVNate DN-TNF Inhibitor, which targets non-alcoholic fatty liver disease, and it’s expecting to finish a phase 1 trial for Alzheimer’s. It also plans to launch two phase 1 trials for other types of cancer. “That’s a lot of programs in one year,” he said.

Each of the drugs will eventually be tested under a phase 3 trial — the biggest, most rigorous, and also the most expensive of the trials — before it’s submitted for regulatory approval.

Moss said the phase 3 trials can run $50 million to $100 million, which changes the complexion of the investors who can be tapped for money at that point.

“As you get further down the line, [investors] are more institutionally oriented, because they can write a $50 million check,” he said.

That reinforces the importance of not compromising on the capital structure, he said.

“The way Wall Street works, once a financing has been done that is — let’s call it ‘bad’ — they’re going to do another financing that is going to at least replicate the bad financing and make it worse,” he said. “So, you start this spiral that’s difficult to get out of.”

Moss said INmune Bio pays for its trials as it goes. The Alzheimer’s trial, for example, is being funded by Alzheimer’s Association. The other trials are funded by previous capital raises.

Preparing for liquidity event

The next important decision point for the company will be when it completes the phase 3 trial for one of the drugs. If the trial goes well, the company will have the data to either form a partnership with another company that can take the drug to market, or keep the drug in-house and go to market itself.

“Once we get data from some of these trials we’ll seek business development relationships” — what he called a liquidity event — “with some of these large pharma companies,” he said. “We do not have them yet, but it’s something we will do in the future.”

The long-term goal, he added, will be “to retain one or two of these programs internally on our own, hopefully to commercialization as an independent organization. So, we may sell off some of our assets as we generate data to raise cash to help the financing of some of the core therapies we hope to retain.”

The company’s simplified capital structure will help it attract partners, Moss believes, because investors will be able to see clearly the value of the $60-million company at the point it completes its final trial.

“Cap structures are like the birth record of the business,” he said. “If you’re able to go through the cap structure from day one of inception, to where they are today, it tells you a lot about their history. If the capital structure gets so complex that you and me, as the average investor, don’t think you could ever come to understand it [...] you shouldn’t invest in it. And that’s what happens with a lot of businesses.”