Dive Brief:

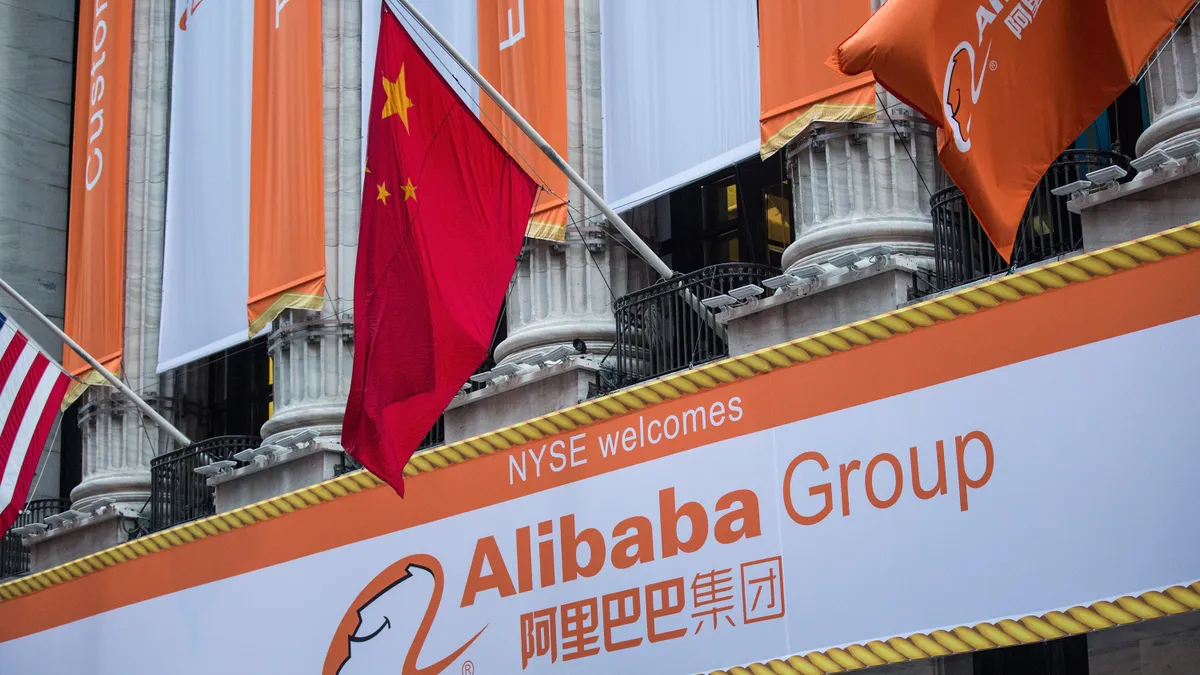

- Chinese e-commerce goliath Alibaba Group announced its intent to split into six separate groups, a move “designed to unlock shareholder value” and increase its market competitiveness, according to a Tuesday post on its English corporate website, Alizila.

- The company will split into six independent groups, each headed by a CEO responsible for company performance and who will report to a board of directors. Each group except for one will also “retain the flexibility to raise outside capital and seek an initial public offering,” according to the Tuesday announcement. The outlier group will remain wholly owned by Alibaba group, which will function as a holding company and which will be headed by current CEO and Chairman Daniel Zhang.

- The new governance and organizational structure of the company will “empower all its businesses to become more agile, enhance decision making, enable faster responses to market changes, and promote innovation to capture opportunities in their respective markets and industries, thereby unlocking the value of Alibaba Group’s various businesses,” it said in a Wednesday announcement. The firm will hold a conference call to discuss the changes later Wednesday, according to the announcement.

Dive Insight:

Zhang will also head the newly created Cloud Intelligence Group, which will include Alibaba’s cloud and artificial intelligence businesses, according to the company.

The five groups include the Taobao Tmall Commerce Group, which will house digital marketplaces including Taobao and Tmall among others; Local Services Group, which will include its navigation platform Amap and other business; Cainiao Smart Logistics; Global Digital Commerce Group comprised of its international commerce businesses such as AliExpress and Alibaba.com; and Digital Media and Entertainment Group which will host long-form video platform Youku among other businesses.

Each separate entity will be headed by its own CEO and will seek out IPOs with the exception of Taobao Tmall Commerce Group.

“The market is the best litmus test, and each business group and company can pursue independent fundraising and IPOs when they are ready,” Zhang said in an email to Alibaba employees quoted in the Tuesday Alizila article.

The U.S. IPO market has largely frozen in recent months due to volatility in the regional banking space, rising interest rates, discussions over the federal debt limit and other headwinds, but a “brand name” such as Alibaba can prove helpful to break the ice when markets do begin to thaw, Jim Cox, CFO of Clearwater Analytics, wrote in an email. Clearwater is a SaaS provider of investment accounting, reporting, and analytics solutions.

While they do not have specific knowledge of Alibaba’s plans, “As a management team that led a company through the IPO process, we know it takes months of preparation to get an IPO successfully across the line,” Cox wrote. “So even though the current IPO space is frozen, if you have any plans to go public in the near future, preparations should be prioritized regardless. Simply put, it is better to be ready to jump on a budding market than to be caught waiting for markets to reopen.”

While the company indicated several executives who would be taking CEO positions at its newly created groups, its Tuesday announcement did not fully indicate how such leadership teams would be structured; the company did not announce whether its CFO, Toby Xu, would be taking on a leadership post at such a group or remain as the finance chief for the holding company, for example.

A veteran of PricewaterhouseCoopers where he was a partner for 11 years, Xu has served as the Hangzhou, China-based company’s CFO since April 2022, according to the company. Prior to taking on the top financial seat, Xu served as Alibaba’s deputy CFO. He is also a member of the Chinese Institute of Certified Public Accountants.

Alibaba did not respond to request for comment regarding Xu’s placement in its new reorganization structure.

Often revered as the top international challenger to fellow e-commerce giant Amazon, Alibaba’s planned split comes at a time when both startups and large companies alike are reevaluating their strategies in the face of market change.

The e-commerce company’s reorganization follows a crackdown by the Chinese government on the country’s technology sector begun in 2020, when newly passed regulations on fintechs caused Alibaba subsidiary Ant Group — both of which were founded by billionaire Jack Ma — to pause a $37 billion IPO, according to a January report by CNN.

Economic turmoil and sliding tech valuations also prompted Japanese financial institution Softbank to reduce part of its stake in Alibaba late last year, reducing it from 23% to 14.6% with the physical settlement of prepaid forward contracts, a Bloomberg report said.

The announcement of its reduced stake came shortly after the bank — whose Vision Funds backed notable tech startups such as Uber and WeWork — reported a record quarterly loss of $23 billion that August, followed by another $5.9 billion loss in the quarter ended December 2022.

The crackdown began to ease at the beginning of the year when the Chinese government shifted its focus back to growth, with some viewing Alibaba’s coming split as a sign that such pressure is beginning to lift. Both Softbank and Alibaba shares rose Wednesday morning following the announcement of the split, according to a report by Morningstar.

Editor’s Note: This story was updated to include comments from Jim Cox, CFO of Clearwater Analytics.