Dive Brief:

- The Biden administration’s plan to build a carbon-free electricity grid by 2035 and achieve net-zero carbon emissions by 2050 “will heighten credit risks for many entities in carbon-intensive industries while creating significant opportunities for those that adjust their business models to align with accelerated policy trends,” Moody’s said.

- Stricter federal emissions regulations and tougher enforcement of current rules may erode profit margins and increase the cost of capital for carbon-intensive companies, Moody’s said in an analysis, citing potentially higher costs to the oil sector from tighter restrictions on methane emissions.

- Companies that adapt their business models to tougher climate-related regulations can prosper, Moody’s said, noting that the oil and gas industry could invest in renewable energy and create new products.

Dive Insight:

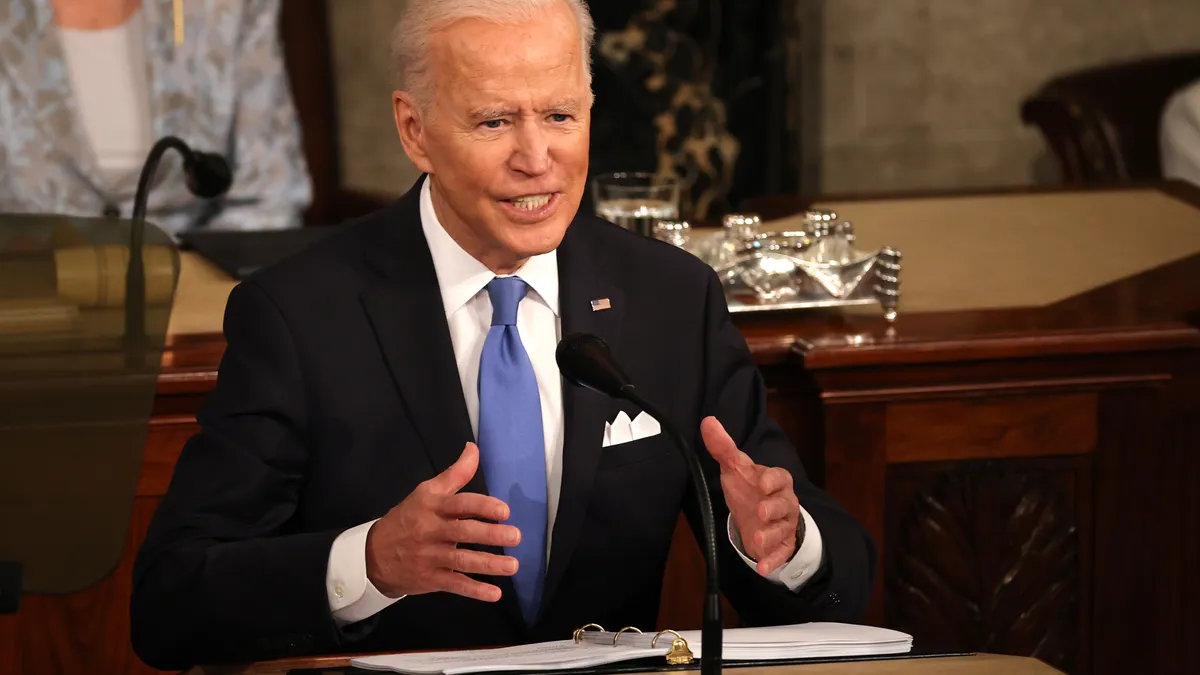

During his first 100 days in office Biden has altered regulations and proposed legislation that may change the credit outlook for a range of industries, from automakers and utilities to payday lenders and oil and gas companies, Moody’s said.

For example, Biden’s proposed $2 trillion plan to rebuild infrastructure would be “credit positive” for automakers and utilities, supporting their transition to low-carbon business models, Moody’s said.

Biden’s push for record fiscal spending and rapid progress on distributing vaccines will likely spur consumer spending services and in-person retail, with Moody’s noting that spending on services has drifted along at 8% below pre-pandemic levels since the end of the second quarter 2020.

Government assistance such as increased unemployment benefits and higher tax credits will boost consumption and ease debt repayments by lower- and middle-income households, reducing risks for banks, consumer-facing companies and providers of discretionary services.

Biden seeks to pay for new infrastructure by increasing the corporate tax rate to 28% from 21% and the minimum tax on the foreign profits of U.S. companies to 21% from 10.5%. The higher taxation would have limited impact on companies’ credit outlook, Moody’s said.

“The proposed corporate tax increases would likely only modestly reduce cash flow for the universe of nonfinancial corporations that we rate,” Moody’s said. “We view the economic outlook, interest rates and companies' financial policies as more significant drivers of corporate credit quality than tax policy.”

Biden’s “Made in America” tax proposal has drawn fire since the administration announced it early this month. It would increase taxes on U.S. multinational corporations in 2022 by 81%, to $104 billion, and by 72% over the next decade, to $1.2 trillion, according to a Tax Foundation study.

Tax rates on domestic income would rise more than on foreign income, resulting in a net increase in profit shifting by U.S. companies outside the country and a reduction in their U.S. tax liabilities by $75.5 billion over 10 years, the Tax Foundation said.

The Biden plan would also put U.S. companies at a competitive disadvantage and may compel them to sell foreign subsidiaries.

Yet Biden’s spending and tax proposals face big obstacles in Congress, Moody’s said.

“The Biden administration is taking a ‘whole of government’ approach to policy making, using regulatory, administrative and legislative channels to advance its stated policy goals,” Moody’s said. “However, the administration’s path forward will be complicated given the Democrats' slim majorities in Congress, rising concerns about the implications of proposed spending on the sovereign’s fiscal position and the specter of rising inflation.”