The following is a contributed article from Joseph Galanti, senior managing director at BDO USA LLP, and Peter Halprin, partner at Pasich LLP. Opinions expressed are authors' own.

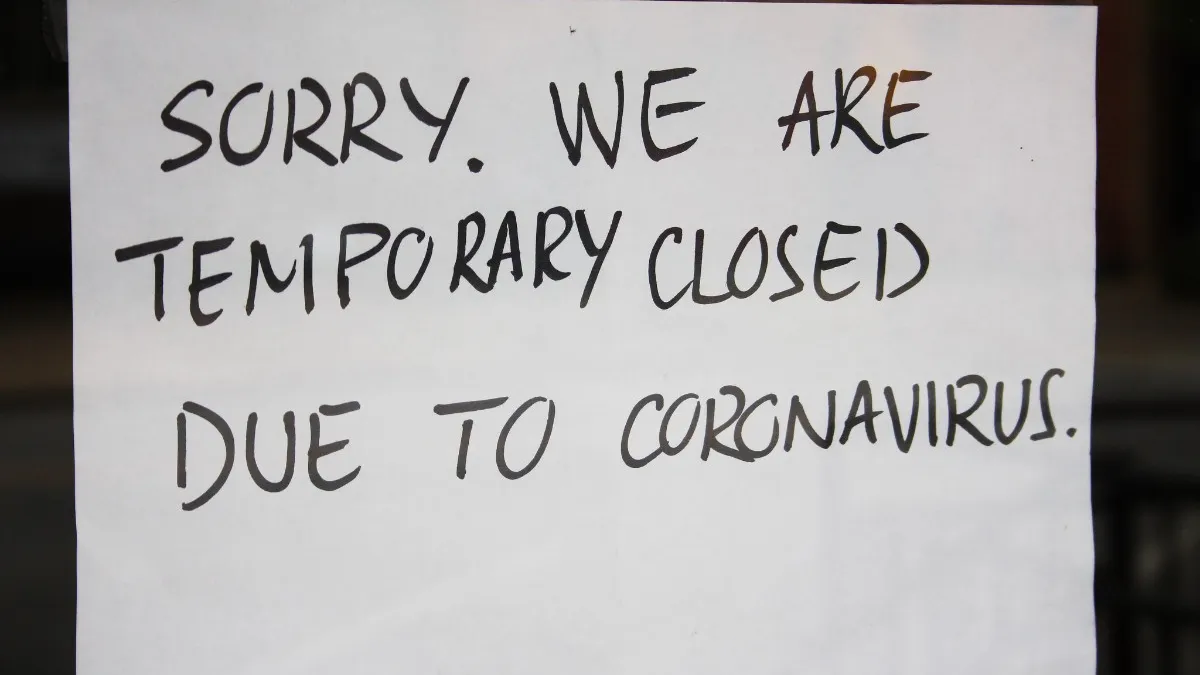

Most businesses would like a 2020 do-over. COVID-19 brought an abrupt halt to economic activity. Government orders to shelter-in-place and close non-essential businesses ravaged companies large and small. Numerous companies that weathered COVID and had just begun reopening then found themselves facing challenges related to the social unrest our country is experiencing as a result of longstanding racial injustices. Now a third threat looms: a hurricane season that is expected to see a number of severe storms.

Fortunately, many businesses carry insurance to protect against income losses. This so-called business interruption insurance is designed to protect a policyholder “against losses arising from [their] inability to continue the normal operation and functions of [their] business, industry, or other commercial establishment,” according to a 2013 case, Northrop Grumman Corp. v. Factory Mut. Ins. Co.

Unfortunately, insurers are challenging COVID-19-related business income claims, and industry publications suggest there might be related challenges ahead for policyholders looking to collect on looting or hurricane-related business income claims.

What do you need to know from an insurance perspective as you help your business navigate these risks?

COVID-19

There are a number of potential insurance coverages available if your business has lost revenue because of stay-at-home mandates. These coverages include business interruption as well as extra expense, civil authority, ingress/egress, and contingent business interruption (including attraction property).

At present, there are nearly 800 insurance litigations in the United States regarding COVID-19 coverage. The key issues concern whether class action or multidistrict litigation will be available to provide relief and whether COVID-19 causes “direct physical loss of or damage to property.” Another issue is whether exclusions, including an exclusion for loss due to virus or bacteria, are applicable, and whether the application of sublimits applies to the pandemic.

While these litigations are moving forward, the federal government and state governments have considered legislation which could impact the proceedings.

The two primary proposals at the federal level are the Pandemic Risk Insurance Act of 2020 (PRIA) and the Business Continuity Protection Program (BCPP).

PRIA is similar to the Terrorist Risk Insurance Act (TRIA), enacted after 9/11. It establishes a public-private partnership to create a market for private business interruption insurance. Under PRIA, the federal government, the insurance industry, and policyholders share in the risk of future pandemics subsequent to January 1, 2021. PRIA wouldn’t apply to COVID-19.

As an alternative, the insurance industry has put forth BCPP, a program to create federally funded insurance for future pandemics. BCPP shifts the risk of future pandemics to the federal government and away from the private insurance market.

In New York, to provide an example of state-level efforts, a bill was introduced in March to address coverage for business interruption claims. The now twice amended bill proposes, among other things, that any policy providing coverage for loss or damage to property (including business interruption), shall be construed to cover business interruption from COVID-19. And any clause which allows an insurer to deny coverage based on a virus, bacterium, or other microorganism that causes disease, illness, or physical distress or that is capable of causing disease, illness or physical distress shall be null and void. Other provisions set limits on when it applies and to whom it applies to, among other things. Other states such as New Jersey and Massachusetts have similar proposed legislation.

The challenge associated with these legislative solutions is that, even assuming one were to provide present relief, insurers are likely to challenge the constitutionality of regulations requiring insurers to provide coverage. What’s more, if the insurers do not prevail, the passage of time will be unkind to those businesses in need.

Civil unrest

Although the protests in response to George Floyd’s death were largely peaceful, a small minority of individuals have used the protests as a cover to engage in looting and vandalism, resulting in property damage or business interruption.

In terms of insurance coverage, vandalism and looting are typically covered under business insurance policies. In addition, the costs incurred to mitigate damages and preserve property (such as hiring security and boarding up windows) are generally covered.

New York issued an emergency amendment to Regulation 64 – Unfair Claims Settlement Practices and Claim Cost Control Measures. The amendment addresses claims filed after May 30 arising out of damage to real property, loss of or damage to personal property, or other liabilities for loss of damage to or injury to persons or property that resulted from the recent civil unrest in New York.

The amendment focuses on three matters: 1) the prompt adjusting and payment of claims, 2) the policyholder’s right to make immediate repair and provide reasonable proof of loss, and 3) mandatory mediation of claims. Other states may have similar regulations designed to assist policyholders in navigating these claims.

A challenge might arise as businesses that were closed or in decline due to COVID-19 stay-at-home orders seek to make business income claims following looting or vandalism.

In addition, some businesses that were recently granted permission by the government to reopen, were then told to close due to government curfews implemented to curb violence and property damage.

Hurricanes

Many businesses, having already weathered the proverbial storms related to the pandemic and social unrest, , now face the specter of an expected above-average hurricane season. Severe storms could be the knockout blow for businesses still reeling from the economic devastation caused by months of COVID-19 closures and a resurgence of new cases.

The two primary Atlantic hurricane season forecasts – NOAA’s 2020 Atlantic Hurricane Season Outlook and Colorado State University’s updated June 2020 outlook – both predict an above-average storm season.

2020 Atlantic hurricane season forecast

NOAA predicts a 60% chance the Atlantic hurricane season will be above normal, a 10% chance it will be below normal, and a 30% chance it will be near normal. Colorado State University predicts 19 named storms, nine of which will form into hurricanes (with sustained winds in excess of 74 m.p.h.), and four of which will be CAT 3 hurricanes or greater (with sustained winds in excess of 111 m.p.h.). Accordingly, enhanced focus on BI claims and hurricane preparedness by risk managers and their organizations will likely result.

While many businesses often defer to their risk management team on anything insurance-related, CFOs and other finance leaders are playing an ever-increasing role in BI claims, particularly considering the ongoing impact of COVID-19. Claims often represent significant financial transactions with profound cash flow implications and strategic importance, thus warranting broader management involvement.

Insurance recoveries

Given the level of risks, CFOs should closely monitor developments and take steps to protect their rights to recover under their insurance policies and to maximize those recoveries. Here are some ideas on how to do that.

Identify and review policies. When it comes to insurance, the devil is in the details. In a memorable 1970s case, Universal Underwriters Ins. Co. v. Travelers Ins. Co., the court referred to most insurance policies as “a virtually impenetrable thicket of incomprehensible verbosity.” Policyholders will want to carefully review all potentially relevant insurance policies, and may have claims over multiple years depending upon the inception dates of their policies. The review also should encompass limits, sublimits, exclusions, and deductibles applicable to each potentially available coverage.

Give notice. Policies sometimes have contractual suit limitation provisions which reduce the statute of limitations available to the insured to periods as low as one or two years from the date of loss. While written tolling agreements can extend these periods, policyholders need to be careful not to forfeit their right to sue. Relatedly, there may be other time-based requirements in the policy – such as pertaining to proofs of loss or repairs – which should be reviewed and noted.

Tally your losses. BI claims can often be challenging to calculate and document, particularly for policyholders that do not have many losses and are unfamiliar with the claim process. The triple threat of COVID, civil unrest, and hurricanes – should your businesses suffer from them – will make loss adjustment significantly more difficult. The resurgence of COVID in July and new government orders forcing closures of reopened businesses will also complicate BI calculations.

Policyholders should first seek to get their arms around a high-level estimate of their claim by calculating what revenues they lost and what expenses they saved as a result of each peril.

In addition, they should calculate any extra expenses they had to incur as a result of the peril. For COVID-related claims, that may include atypical extra expenses such as incremental cleaning costs, personal protective equipment, retrofitting common areas for safety, sanitizer stations/supplies, signage, UV lighting, revamped HVAC/HEPA systems, new technologies (e.g., touchless systems to call elevators, open doors), increased marketing, additional security, and specialized training.

Earmarking losses attributable to each peril will be complex. For example, losses resultant from hurricane damage may be greater than expected due to exacerbated supply chain issues which were already problematic due to COVID. In addition, indemnity periods to repair hurricane damage may be longer than anticipated due to COVID-related construction material shortages and extended repair timelines.

Once the high-level loss estimate is prepared, coverage counsel can help categorize losses and match them to specific policies and coverage provisions to put the policyholder in the shoes they otherwise would have been had no perils occurred. The resulting analysis with amounts and coverage buckets can then be used by management to help guide the best path forward and develop a strategy to achieve an appropriate recovery.

Push the insurers to pay promptly

Particularly in the current environment where insurers and their adjusters are overwhelmed with claims, policyholders will need to push insurers, adjusters, and other agents of the insurers to promptly adjust and pay claims.