Dive Brief:

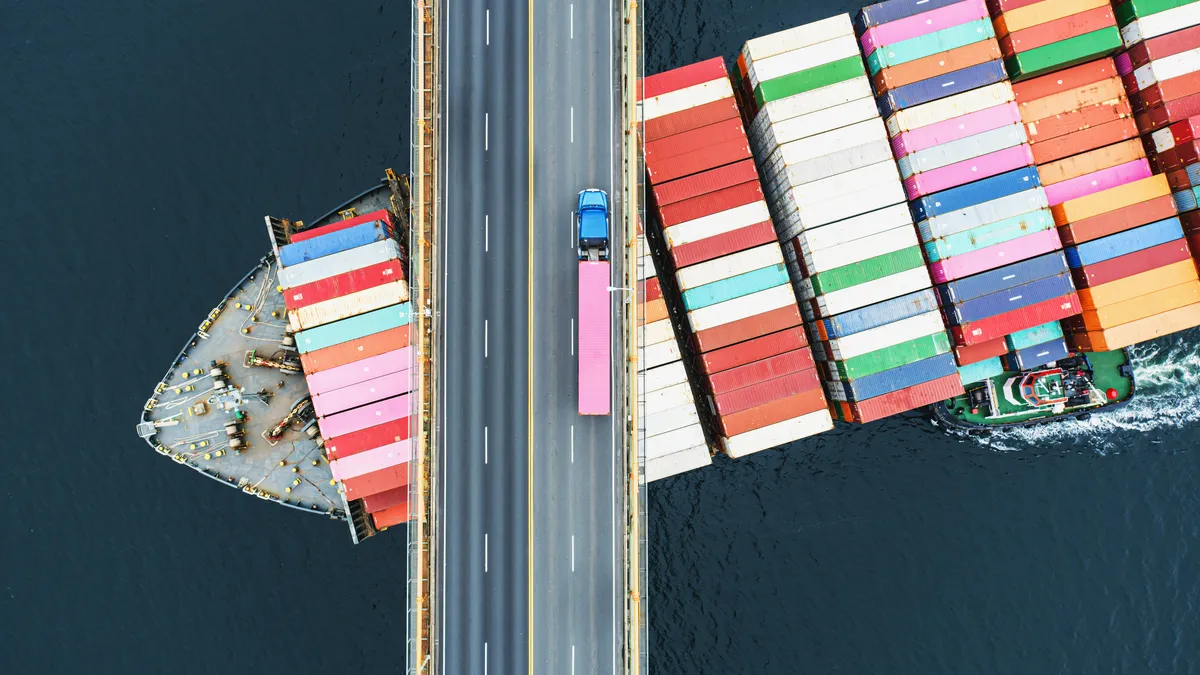

- CFOs seeking to navigate a shifting economic enviornment are reconsidering their supply chain models as inflationary and other such pressures linger, according to a recent study released by global consulting firm Protiviti.

- Forty-five percent of CFOs and VPs of finance stated they are moving away form efficiency-based supply chain models to revenue assurance models with more flexibility and resilience, the study of 1,064 CFOs, VPs, directors and managers of finance found. The shift, “however long-term or temporary, appears to result from the “out-of-stock” dynamic experienced in a number of industries due to supply chain failures and impediments during the height of the pandemic and thereafter,” Chris Wright, managing director and global leader of Protiviti’s business performance improvement practice wrote in an email.

- “A lot of just-in-time inventory models became out-of-time inventory realities, and while there are substantial working capital implications to building safety stock, there are many organizations who have chosen to do so in order to be able to serve their customers and clients,” he wrote.

Dive Insight:

CFOs are left contemplating changes to their supply chains as they attempt to navigate shifting economic trends; factors such as the ongoing war in Ukraine and the lingering impacts of the pandemic as well as inflation have continued to throw up stumbling blocks for organizations across their supply chains.

The study found 72% of respondents said their companies had experienced disruptions or delays due to supply chain challenges, inflation’s effect on third-party vendors, and ongoing pandemic-related issues, for example.

Financial executives are taking various steps to address these challenges, with 45% of CFOs and VPs of finance noting they are transitioning away from efficient supply chain models to revenue assurance models, for example. Companies will likely put such models to the test next year as supply and demand begins to balance, Wright wrote.

“Over the next 12 months, or perhaps even over a shorter time horizon, there will likely be a fair amount of reality testing of the new approaches, as the supply and demand dynamics will start to balance, and a number of organizations will see how well they forecasted both,” he wrote in an email.

Financial executives are also keeping a close eye on inflation. The survey —conducted between June and July 2022, when inflation in areas such as consumer prices had slowed somewhat — found 69% of CFOs indicated addressing the impact of inflation was a top priority. Comparatively, 72% of VPs of finance or non-CFO executives pointed to inflation’s impact as a top priority.

“Largely, the inflation dynamic is immediately impacting CFOs in the FP&A area — they need to be able to forecast costs in order to re-align revenue and margin models (if they can pass those costs along, if they can’t), and also understand how that affects their companies broadly in the market,” Wright said in an email regarding how CFOs are considering inflation.

Perhaps in light of lingering supply chain challenges, many CFOs are also reassessing the potential of emerging technologies at their organizations, as well as taking a second look at their data privacy and security practices.

Seventy-two percent of survey respondents stated blockchain and smart contracts were a top priority for their businesses, compared to the 68% who said the same in the prior year, per the study. Automation, meanwhile — a new category not present during the 2021 study — was cited as a top priority by 72% of both CFOs and VPs of finance.

“The blockchain uptick can be seen as an indication that this technology allows for solutions to two CFO imperatives: supply chain visibility in general, and sustainable supply chain/ESG visibility in particular,” Wright said in an email regarding the spike in interest in emerging technologies. “Automation tech is driven by the need to streamline processes, adapt permanently to lessons learned while working remotely, and allow the finance teams to focus on analysis, rather than generation, of data.”

Both CFOs and other financial executives listed data privacy and security as their top priority for the next 12 months, with 73% of survey respondents indicating this was the case for their organizations over that period.

However, while security topped this year’s list of priorities, the 73% of executives citing it as their main concern this year is slightly lower than the 83% who did so in 2021 — a downward trend potentially indicating CFOs are gaining better control over this space, according to the study.

CFOs and other financial leaders should take care not to become complacent in their security efforts, warned the study, but should instead take steps to lead discussions surrounding cybersecurity. This includes helping their companies’ data privacy leaders connect their own activities to business objectives, per the study.