The following is a contributed article from Doug Seaberg, vice president of Nvoicepay. Opinions expressed are author's own.

Every business has to pay its suppliers. It's just part of the cycle. In the early stages of a company's life, decision-makers often place less emphasis on internal accounts payable (AP) processes in the interest of getting payments out the door before incurring late fees. But as their company grows, familiar, manual workflows become costly, convoluted and unscalable. At this point, the only way to alleviate the strain is to initiate a process overhaul.

In recent decades, we've witnessed significant changes to finance workflows, which modernized and simplified day-to-day tasks. Enterprise resource planning (ERP) systems, invoice ingestion, and workflow software are among the improvements. However, the process of actually making payments remained untouched by technology until relatively recently.

Even though ePayments technology is available and the rate of adoption increases every year, many companies—even mature ones—still hold out. The disconnect lies in the already fragmented collection of partially automated processes, which companies stitch together through manual efforts. Decision-makers look at their overworked AP and have no interest in adding more operations to the mess.

But innovations delivered by the financial technology industry are rewriting the adoption trajectory by adding a new and more advanced stage of payment processing maturity. They are offering organizations the opportunity to skip over painful adoption processes, no matter where they are within the four stages of B2B payment processing. Here's a look at those four stages and how companies can move beyond them.

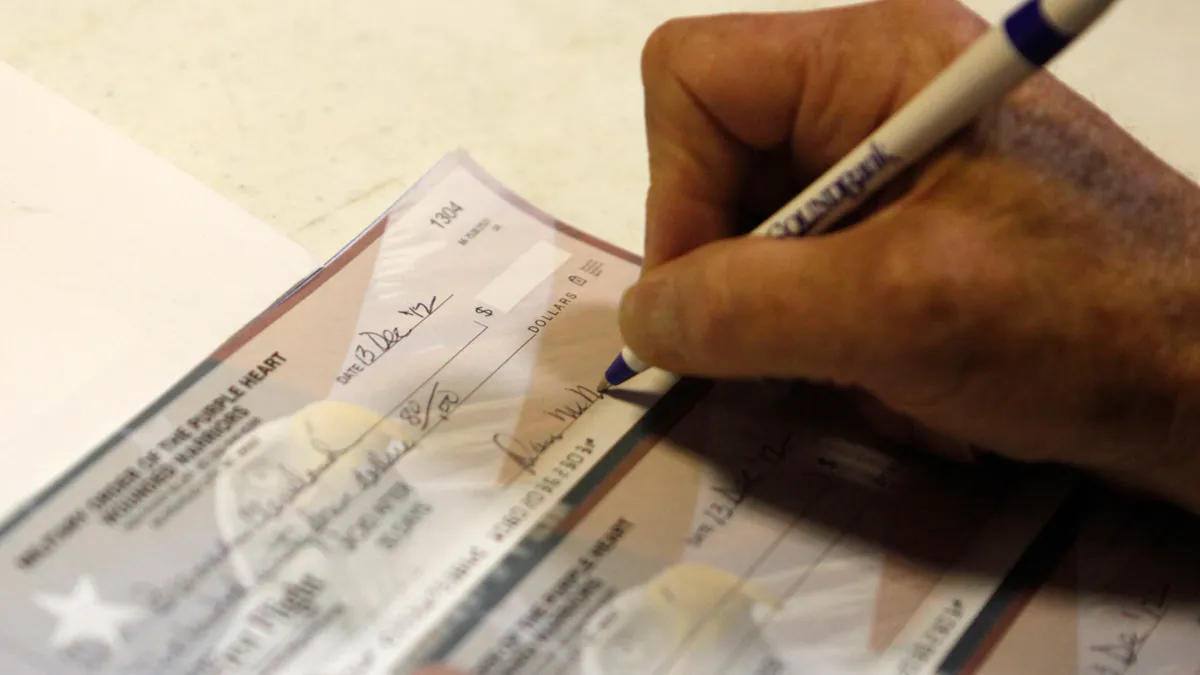

Stage 1: Paper check pragmatism

When most companies take off, they make all of their payments by paper check, because it's easy. They open a bank account, order some check stock, and they're ready to go. At this point, they're probably not making many payments, so paper management isn't that painful.

Many companies are still in stage one — and not just small businesses. Surprisingly, a significant number of mid-market companies are still check-based, especially in paper-heavy industries like construction, regional healthcare, automotive dealership, and hospitality management companies.

It's not that these companies are unaware of the existence of electronic payment methods. They likely considered adding automated clearing house (ACH) or card payments to the mix long ago but ran into barriers along the way. After assessing the situation, they made the pragmatic decision to put electronic payments on the back burner.

Electronic payments require coordination with suppliers, which can be time-consuming. ACH payments also require liability assumption for storing suppliers' banking data. Most AP teams don't have the resources to take all of that on. It's all they can do to get payments out the door. Instead, they settle for automated positive pay protection from their bank to address check fraud and keep plugging away.

It's a lot of repetitive, manual work, but they've got the routine down. Although it seems absurd to make check payments in a digital world, companies do so to avoid the problems in stages two and three.

Stage 2: Dabbling in electronic payments

As companies add suppliers — whether organically or by acquisition — they will find that some ask for electronic payments, or even demand it as a condition of doing business. An increasing number of high-value suppliers no longer accept payment by check: They want to get paid fast, and they don't want to process checks. To avoid the influx of paper, they may negotiate terms around the procurement process. For example, suppliers sometimes offer discounts in exchange for net 15 and electronic payments.

Companies making fewer than 5,000 payments a year can probably manage individual ACH payments to suppliers who demand it. They don't need an integrated process, because AP can complete and upload the file manually, and prepare and email the remittance information.

Organizations at this stage may start dabbling in card payments, which are sold to them by their bank with the promise of rebate revenue. It's a lot of work to find out which suppliers accept card, so the program hasn't grown past the small number of suppliers the bank initially set up. There's usually some attrition from the initial group, so they're not going to hit that promised rebate number.

At this stage, companies might have 10-20% of their payments moving electronically. They've made some suppliers happy, but it's a reactive approach. There's no strategy behind it, and no efficiency gains. If anything, there's more work. They still have the check workflow, and now two more workflows on top of that, each with separate reconciliation and error resolution processes. It's getting complicated, and may even be hurting AP's morale.

Stage 3: Complexity and risk

Companies in stage three make thousands of payments monthly and still run a check workflow for 60-70 percent of them. By now, they might have even expanded globally and added a fourth workflow for international wires. There's been intentional effort to improve the process and make more payments electronically. Even so, the lack of appropriate technology is hamstringing efforts.

At this point, AP is usually drowning in bank accounts, accumulated through mergers, acquisitions, business restructuring, and changing bank relationships. Large enterprises are known to make payments out of a hundred or more bank accounts. Tack on multiple accounting and ERP systems, and AP's nightmare multiplies exponentially.

There's no visibility into the company's cash position, and that's becoming a problem for executives and finance teams, who want to be proactive in their decision-making. With so many separate systems and workflows in play, it's nearly impossible to track the information necessary to make conscious business decisions.

At this point, cybersecurity and fraud become more significant threats, and absolutely cannot go ignored. ACH fraud is on the rise, and it's harder to catch than check fraud. The most challenging fraud to combat is social engineering — schemes that trick humans into willingly paying fraudsters. The constant stress of getting payments out amid all this complexity makes businesses more vulnerable to these kinds of hacks.

Payment errors are also on the rise, with error resolution now taking up a significant amount of time. AP is grinding away, and there aren't enough resources to strategically improve their processes. Turnover may be high, and it's getting harder to attract people willing to do the manual work required to continue enabling suppliers. Everyone's fighting with their processes and electronic payment growth stagnates.

Stage 4: Automated payments

Stage four marks the smart, strategic use of modern technology. Outsourced services handle payment processes, from supplier enablement to payment completion. At this stage, 80-90 percent of payments are made electronically — about 25% by virtual card — which dramatically increases rebate revenue.

By working with an electronic payments provider, and using APIs to connect with banks and established payment networks, companies can replace the tangle of workflows with one intuitive web interface. Payments intelligently route via the most advantageous means: Virtual card, ACH, international wire, then print check for the holdouts. On the back end, a single dashboard provides visibility into the status of all payments, as well as card rebate revenue.

Some fintechs also handle supplier service, a missing step that held companies back from making more payments electronically. Instead of spending valuable time resolving common payment issues, AP can focus on more strategic tasks. They take on the liability for securely storing suppliers' banking data, and indemnify their customers against payment fraud. They also work with suppliers directly to resolve payment issues.

Some payment automation providers handle more than just the basic "send money from A to B" plan. They may support or completely assume supplier service responsibilities, including error resolution and general supplier inquiries. Many also take on the liability for securely storing suppliers' banking data and indemnify their customers against payment fraud. If you already have a payment automation provider, or if you're in the market for one, ask which additional services they offer and take advantage of them.

Freed from repetitive manual work, AP can spend more time on strategic tasks. They may improve supplier relationships, develop invoice workflows, and review and approve payments.

Born mature

Here's some good news: businesses today don't have to endure each painful stage to achieve payment automation enlightenment.

Companies only previously followed the four-stage trajectory because today's payment automation solutions didn't exist when those companies were taking off. Banks and card networks provided those companies ways to move funds electronically but did nothing to alleviate front-end payment processing or back-end reconciliation and supplier support. For decades, electronic payments remained out of reach. That is no longer the case.

With modern APIs, integration takes less than half a day of IT time. With tens of thousands of suppliers already enabled for electronic payment in these cloud networks, many suppliers are ready for payment on day one, with more enabled each day.

By implementing a scalable ePayments solution, AP teams are cleaning up their processes without experiencing growing pains caused by stages one through three. In my experience, companies that say goodbye to manual processes never look back.