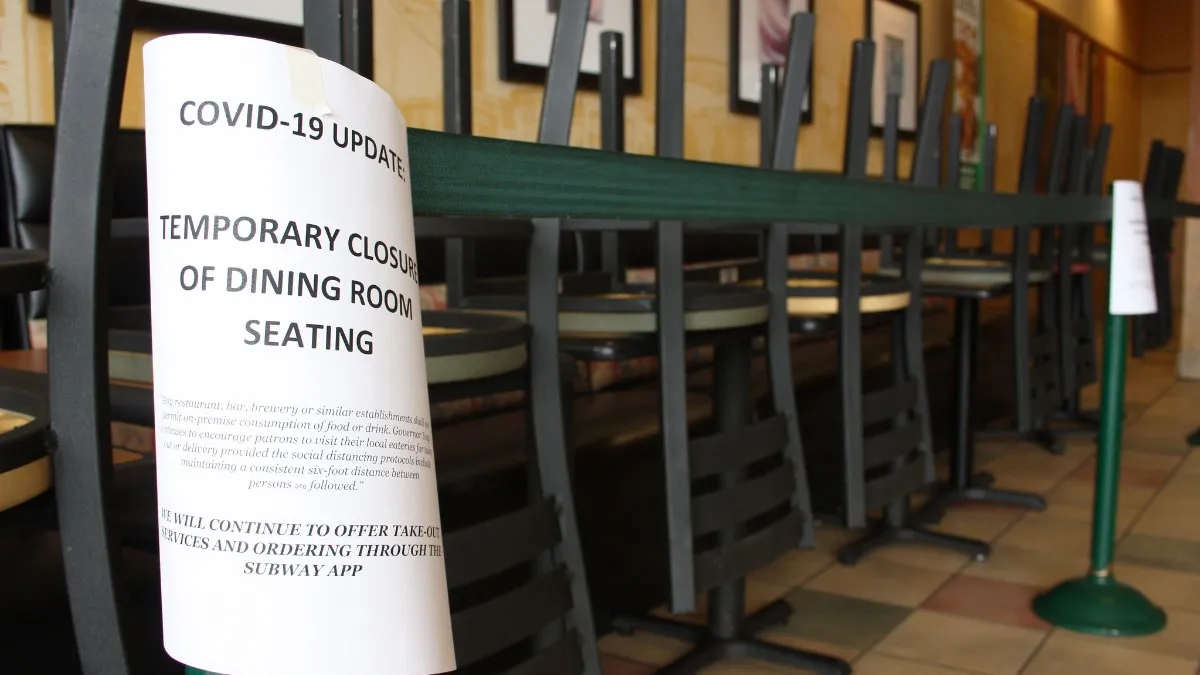

Companies impacted by pandemic-related shutdown orders got a boost in their efforts to get insurers to pay business interruption claims when a federal judge allowed a lawsuit to proceed.

Stephen Bough of the Western District of Missouri gave the go-ahead August 12 to a handful of small businesses in Cincinnati to proceed with their case against property and casualty insurer Cincinnati Insurance Company over its refusal to pay business interruption insurance claims.

The insurer had sought dismissal on grounds its coverage is only for physical damage to a property, not an unseen virus outbreak. But the judge said the case should proceed to discovery because it's not clear the virus hasn't affected the businesses in a physical way.

"Discovery will shed light on the merits of Plaintiffs' allegations, including the nature and extent of COVID19 on their premises," he wrote. "COVID-19 allegedly attached to and deprived Plaintiffs of their property, making it 'unsafe and unusable, resulting in direct physical loss to the premises and property.'"

This is the first case in which the judge refused to accept at face value insurers' assertion the virus doesn't qualify as physical damage to a property; in three previous cases since the pandemic hit, judges dismissed the suits. At least 1,000 cases are pending in courts, according to one estimate.

Pandemics uninsurable

American Property Casualty Insurance Association (APCIA) says business interruption insurance was never intended to cover the impact of a pandemic because a pandemic is not something that can be underwritten against.

"Pandemic outbreaks are uninsured because they are uninsurable," said David Sampson, APCIA president.

Many policies explicitly exclude virus-related business interruption. Some also exclude civil actions, such as the government-mandated shutdown. But many policies include neither of those restrictions and those are the ones at the core of the legal battle.

John Houghtaling, an attorney representing several businesses in COVID-related lawsuits and the head of a coalition of businesses seeking relief, says insurers should pay claims if the policies don’t have these explicit exclusions.

"We are banding together to launch big legal action in every state against insurers who deny ... coverage," he said.

His coalition, Business Interruption Group, is also advocating for a legislative solution. His group wants the federal government to create a fund with which it would reimburse insurers who pay the claims even if they have an exclusion.

The group sees that as a more appropriate solution than some others that have been floated, including one approach that would require insurers to pay regardless of whether the policy has an exclusion or not.

"I don't believe [an approach like that] is constitutional, nor do I believe it's fair," Houghtaling has said.

Insurance advocacy groups and many lawmakers call such a heavy handed approach a non-starter because it would override contractual agreements. Insurers are calling instead for a comprehensive federal solution that would treat the pandemic the same as terrorist attacks, since neither can be realistically underwritten against. After the 9/11 attacks, the government created the Terrorism Risk Insurance Act (TRIA). What's needed now is a pandemic version of that — PRIA.

Any legislative solution, if one comes, is a ways off. In the meantime, the federal court action last week gives businesses some good news as they continue the push for relief.