Dive Brief:

-

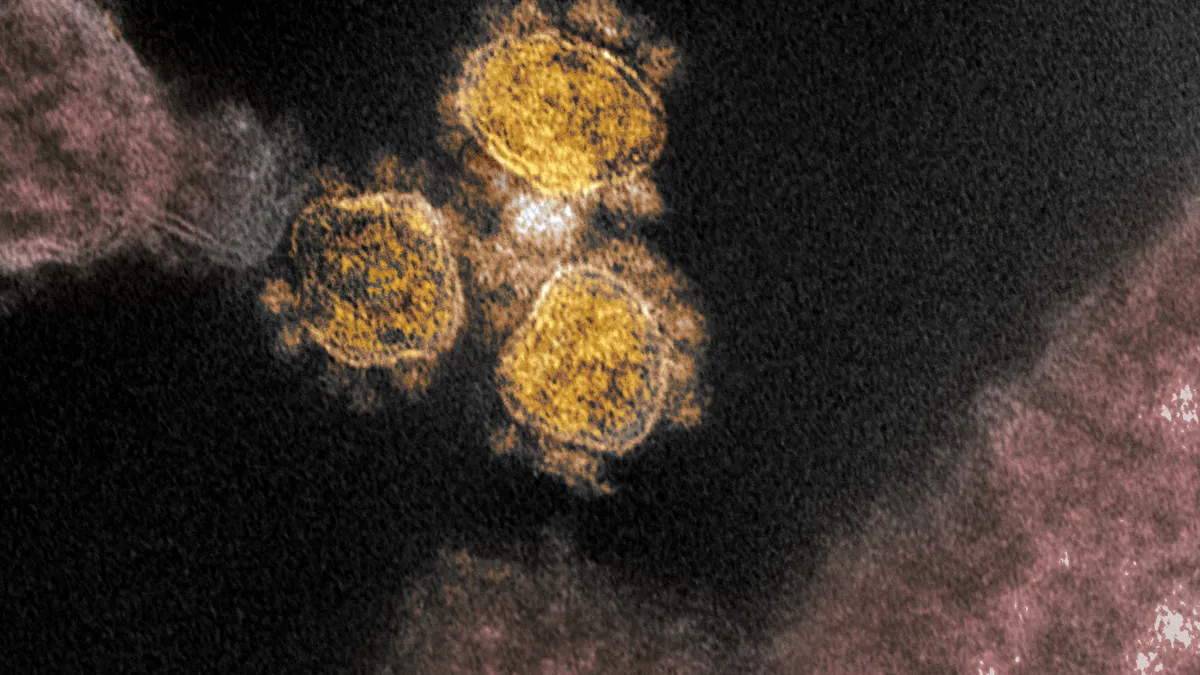

With the United States now reporting 129 confirmed cases of coronavirus, CFOs are put in the position of predicting how the developing outbreak could stand to affect their companies’ future performance.

-

The spread of the virus has proved chaotic for many companies’ supply chain operations, and for many companies, The Wall Street Journal reported, the outbreak "has coincided with deadlines for filing annual reports due in March, and decisions about filing paperwork for initial public offerings."

-

As a result, finance chiefs are rushing to prepare explanations of how the rapidly changing coronavirus situation could affect their future bottom lines.

Dive Insight:

As of last week, references to coronavirus have been made over 8,000 times across over 1,000 companies on earnings call transcripts, natural language processing company Amenity Analytics found,

Apple led the pack as the first corporate giant to state that it wouldn’t meet its Q1 revenue projections due to the virus, which originated late last year in Wuhan, China. iPhones, which are manufactured in China, have experienced limited production and reduced domestic demand, Apple announced on February 17.

Microsoft soon after followed suit. "Although we see strong demand ... the supply chain is returning to normal operations at a slower pace than anticipated at the time of our Q2 earnings call," the company said last week. "As a result, for the third quarter of fiscal year 2020, we do not expect to meet our More Personal Computing segment guidance as Windows OEM and Surface are more negatively impacted than previously anticipated."

As with many other large public companies, Microsoft’s statement included several clauses affirming that the health and safety of its employees is its first priority.

MasterCard announced it was reducing its forecasts for the quarter and for 2020, citing travel and e-commerce-related complications, expecting revenue growth to slow by 2 to 3%, "if the outbreak spreads at its current pace."

Hotel giant Marriott International expects coronavirus fears to cause a $25 million hit to its monthly fee revenue. On the airline front, Fortune reported that United Airlines officially withdrew 2020 revenue guidance due to uncertainty over how the virus will impact demand. In its annual report, United said its performance will depend on the parameters of the outbreak, including future travel advisories, WSJ reported.

As a result of supply chain disruption, Coca-Cola Co. followed with an announcement of a 1 cent to 2 cents knock on its Q1 earnings per share, Fortune reported.

Some companies such as Best Buy, Macy’s and JCPenney have yet to express any certain financial struggles, instead claiming on earnings calls that it’s "too soon to tell," although they might update their outlook given liability risks if they're seen as hedging too much.

"Companies could face lawsuits from investors if they aren’t sufficiently forthcoming about their financial ties to infected regions, or if they describe the virus as a hypothetical risk when it has in fact affected operations," sources told The Journal.

In a joint statement, the heads of the SEC and the Public Company Accounting Oversight Board (PCAOB) urged public companies to collaborate with their auditors "to ensure that financial reporting, auditing and review processes are as robust as practicable in light of the circumstances," WSJ reported.