Dive Brief:

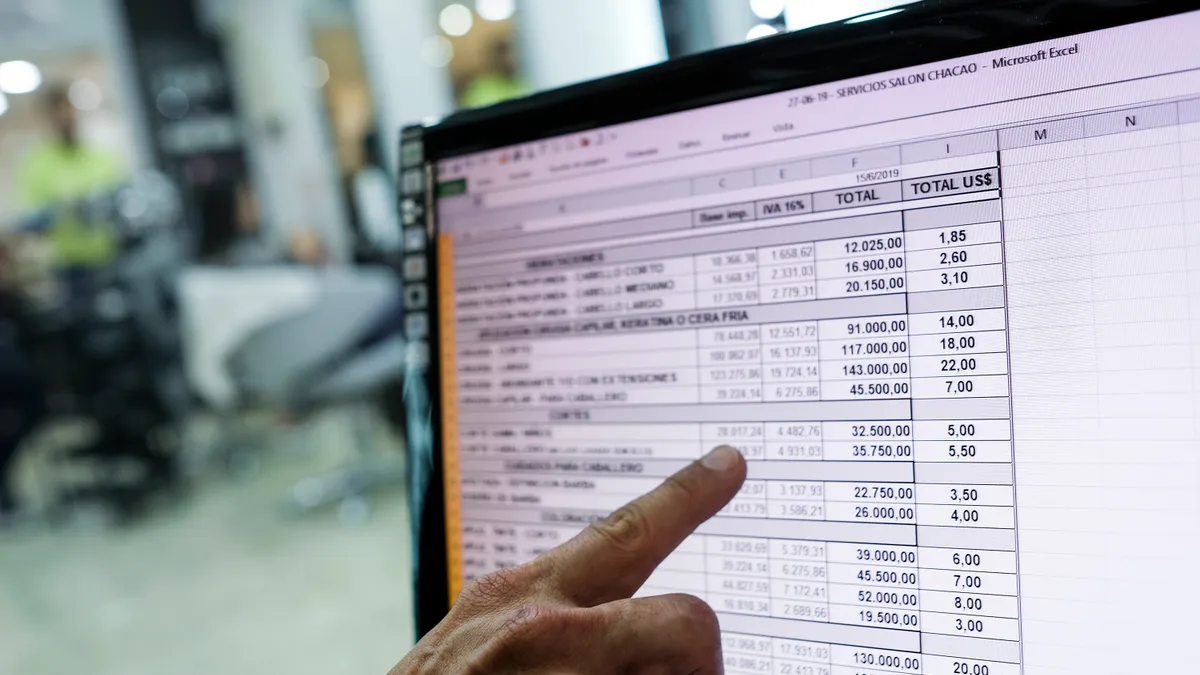

- Over three-quarters of U.S. financial planning and analysis (FP&A) roles in the U.S. still require advanced use of Excel.

- Nine out of 10 top U.S. companies by market cap — which are collectively worth about $12.5 trillion in value — are still seeking out financial analysis candidates who have advanced Excel skills, according to a report by FP&A software service DataRails released Thursday. The report analyzed 500 open FP&A job listings in the U.S. on sites including LinkedIn and Glassdoor from February to June.

- Excel still remains “the canvas that finance teams rely on to create ideas and models,” DataRails CEO and Co-Founder Didi Gurfinkel said in a Thursday press release. “Though we have heard about the so-called death of Excel for a long time, it remains alive and kicking in the biggest companies in the world,” he said.

Dive Insight:

Of the top 10 companies with open positions at the time of the study, only Google parent firm Alphabet Inc. — which operates Excel competing solution Google Sheets — did not list Excel by name as a job requirement for these positions, the report found. Other top companies examined, which did include the software by name in their listings, included Apple and Amazon as well as Berkshire Hathaway, Meta and card network Visa. Microsoft, which owns and operates the Excel program, was also included in the report’s list of top companies.

Excel skills remain table stakes for many companies on the hunt for FP&A associates, with 76% open FP&A roles requiring advanced Excel skills, regardless of industry sector. Thirty percent of companies seeking to fill such positions also required proficiency with PowerPoint, while 15% were seeking skills with software such as NetSuite.

Companies were most likely to include “business acumen” as a requested skill, with this appearing in 95% of listings. The report also found firms are hunting for candidates with notable soft skills in communication and in building relationships. Thirty-five percent of companies are looking for FP&A candidates with proficiency in communication and presentation, while 45% are looking for those who have the necessary skills to build out business relationships.

The report also found 23% of firms are on the hunt for individuals who are “comfortable with speed and uncertainty,” while 7% of companies are interested in FP&A associates with the ability to “challenge the status quo.” Both of these are requirements which could speak to the way FP&A roles are shifting as more companies begin to experiment with new and emerging technologies and solutions which could potentially replace industry standards such as Excel.

CFOs still face significant barriers to executing this type of digital transformation, however. Financial leaders are likely to see notable challenges when integrating automation or artificial intelligence (AI) into their operations, with a June 7 study by Gartner predicting half of current finance AI deployments will either be delayed or outright canceled by 2024.