Dive Brief:

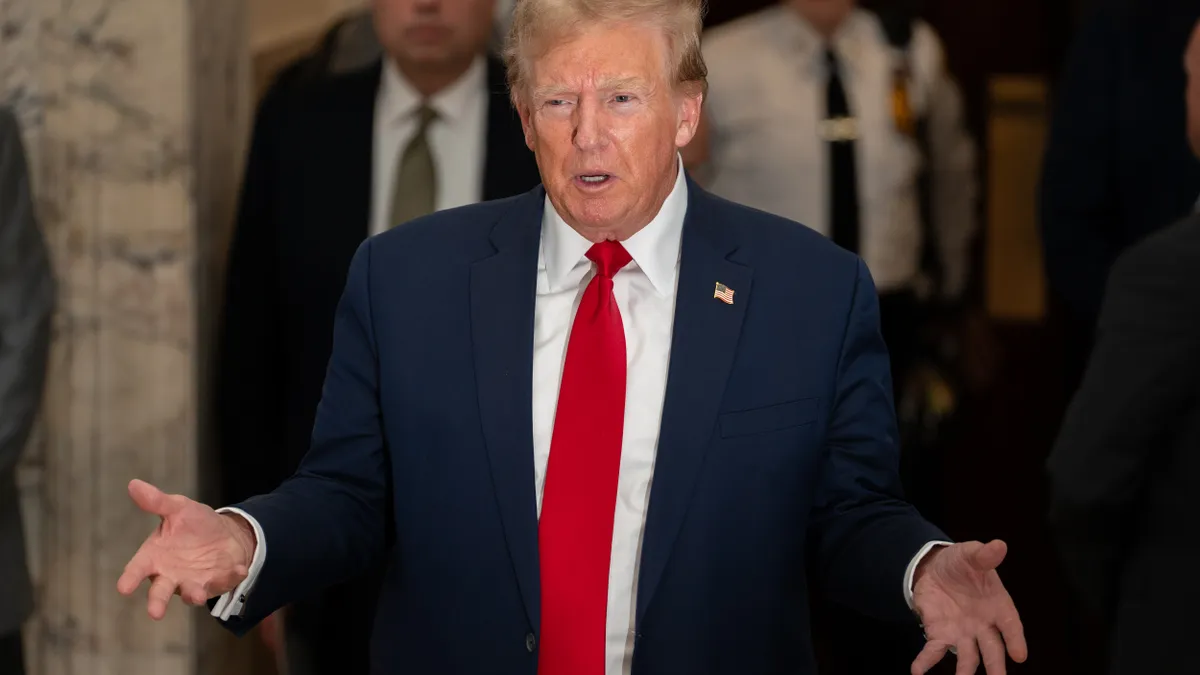

- The New York Attorney General’s Office moved to peek under the hood of generally accepted accounting principles in court Tuesday as the $250 million civil fraud case against former President Donald Trump winds down.

- During cross examination of defense expert witness Eli Bartov, a professor of accounting at New York University’s Stern School of Business, state attorneys sought to shine a final light on key accounting questions which have lingered throughout the trial — including the definition of materiality, how to calculate the valuation of a real estate asset under GAAP, and the differences between fair and current value — to prove their assertion that the former president and key figures in the Trump Organization had violated GAAP principles.

- In response to cross-examination, Bartov largely stuck to conclusions he asserted last week, noting that he found no evidence of fraud in his review of the Trump Organization’s financial statements and that the NY AG’s complaint contained no reference to a particular provision of GAAP that was violated — a claim that appears to be directly contradicted by the complaint, CFO Dive previously reported.

Dive Insight:

The NY AG’s $250 million civil fraud case alleges the former President and other members of the Trump Organization fraudulently inflated his net worth to obtain bank loans at more favorable rates than would otherwise have been available. The court has already ruled the organization is liable for fraud; at issue during the trial is the extent of damages to be paid and whether the Trump Organization will be barred from conducting business in New York.

GAAP has emerged in the spotlight as the case comes to its close; highlighted Tuesday were the particular standards that should be used to calculate the valuations of real estate assets. The NY AG’s office has asserted that the values of certain properties including Trump’s Mar-a-Lago estate were inflated on the organization’s statements of financial conditions and therefore constitute fraud.

State attorney Louis Solomon pressed Bartov on previous testimony surrounding the calculations of such valuations; he had previously testified that discrepancies in valuation by the Trump Organization and by banks such as Deutsche Bank, for example, can be simply explained with the fact that the two entities used different ways to calculate value.

Solomon questioned Bartov on the method for calculating estimated current value for assets under Accounting Standards Codification 274, which Trump’s attorneys have stated is the standard used to determine valuations for such assets on the organization’s SOFCs.

Solomon cited GAAP guidance under 274-55-1. It states in part that “recent transactions involving similar assets and liabilities in similar circumstances ordinarily provide a satisfactory basis for determining the estimated current value of an asset” and provides alternative methods in the event sales information is unavailable, according to the codification document that contains GAAP guidance on the Financial Accounting Standards Board’s website.

This section, however, would not be applied to real estate — there is a particular provision for calculating estimated current value for real estate, 274-55-6, which would be used instead by any reasonable accounting expert, Bartov said.

“Hypothetically, people can use whatever they want, but in reality, I can’t believe that a reasonable expert would rely on 55.1 versus 55.6,” Bartov said in response to questions.

ASC 274 concerns the preparation of personal financial statements and contains guidance on methods to calculate estimated current value for assets including real estate, according to the FASB; compliance with this standard shows there was no fraud or misstatements in the Trump Organization’s SOFCs, Trump attorney Chris Kise has previously stated, noting current value is distinct from fair or market value.

Bartov will be the final witness called by the defense in a trial that has stretched over months. The former president decided not to testify for what would have been the second time Monday, citing the limited gag order put in place by presiding Judge Arthur Engoron as the reason behind his decision.

Bartov testified Friday that the Trump Organization and the Save America PAC was paying him about $877,500 for his testimony. His hourly rate is $1,350 and he has spent approximately 650 hours in preparation for the case, he said.

Collectively, Trump has paid expert witnesses approximately $2.5 million over the course of his defense during the ongoing civil fraud trial, according to a report by ABC News.

The politically-charged case has sought to determine not only the presence of fraud but upon whom the burden of providing accurate and compliant financial information should rest with; witnesses including Trump’s two eldest sons, Donald Trump Jr. and Eric Trump, have pointed to parties including ex-CFO Allen Weisselberg, controller Jeff McConney, and external accountants Mazars as those responsible for drafting the organization’s SOFCs.

Attorneys for the former president — who has denied any wrongdoing — have asserted that there is no fraud present in the SOFCs and, moreover, that the onus is on the state to prove that the organization violated GAAP; objecting Tuesday to testimony to be included by rebuttal witness tapped by the state, Trump attorney Chris Kise argued the state has not done so.

He argued that the calling of these witnesses in rebuttal meant that the state was “essentially acknowledging there’s a hole in their case.”

“They clearly had the burden to establish if there were GAAP or ASC 274 violations…the failure [to prove GAAP violations] does not mean they can bring in evidence now,” Kise stated. “It’s not a rebuttal, it’s classic back filing.”

State attorneys asserted they were not relying specifically on ASC 274 in their case.