Dive Brief:

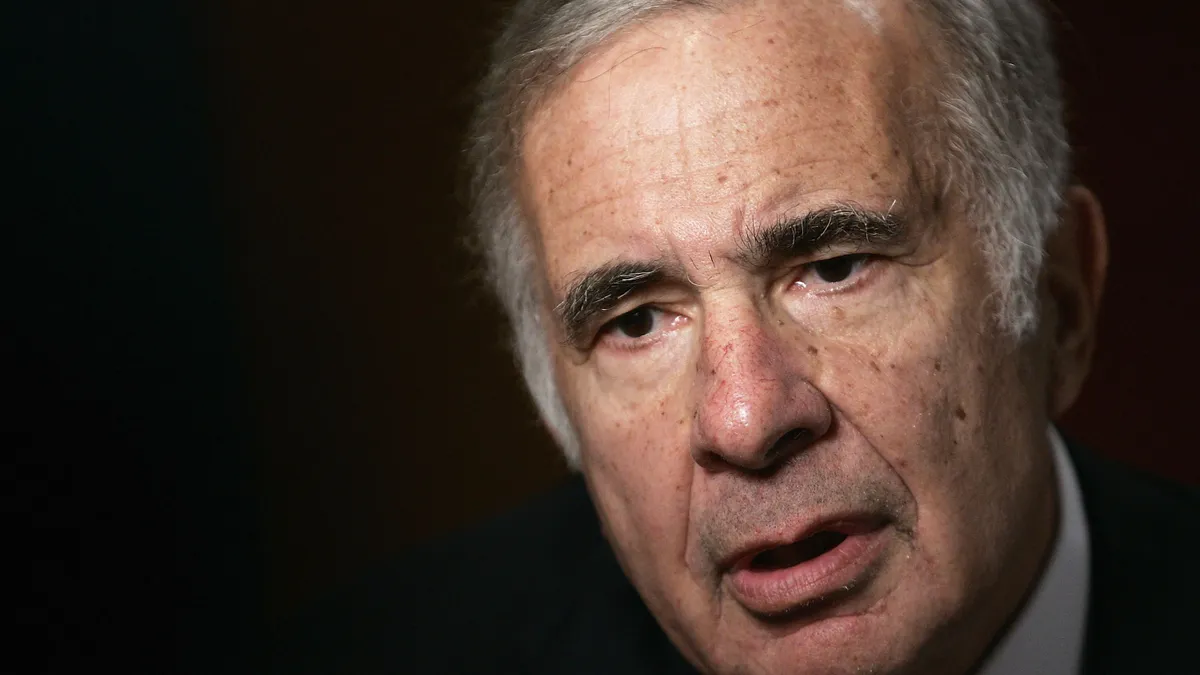

- Billionaire investor Carl Icahn’s Icahn Partners LP and Icahn Partners Master Fund filed suit Wednesday against Rialto Capital Advisors, alleging breach of contract and fraud and seeking $15 million in damages related to the loan servicer’s handling of a $73 million loan on a 376,000 square foot Primm, Nevada, mall contained in a commercial mortgage backed securities (CMBS) trust.

-

The suit alleges that Rialto failed in its duties as the debt’s servicer to maximize the recoveries for the trust’s investors, instead “running Prizm Outlets into the proverbial ground” and delaying the sale until April 30, 2021, when it was sold for $400,000, effectively resulting in a loss on the loan as well as $12.85 million in fees advances and expenses incurred by the trust. It marks the largest loss on a CMBS conduit loan since the 2008 financial crisis, according to a release from the law firm of Kasowitz Benson Torres, attorneys for the Icahn entities.

-

In a sweeping statement, the suit asserts that the case is part of a broader problem in the securitized commercial real estate lending market, stating that “Rialto’s actions — and analogous actions by Rialto and other CMBS market participants — are undermining the basic integrity of the trillion-dollar CMBS market.”

Dive Insight:

The suit, filed in Clark County, Nevada, District Court, comes as financial executives have been grappling with rising uncertainty around commercial real estate appraisals and underwriting as the pandemic accelerated changes in shopping and work habits that drive how retail and offices are used.

Market volatility and stresses early in the pandemic also increased scrutiny of lender underwriting practices and led to some litigation. Wells Fargo recently beat back a suit that alleged the bank routinely made risky commercial real estate loans using improperly inflated underwriting metrics that left the company and its shareholders vulnerable to losses. A judge last month dismissed the proposed class-action suit that had named the bank’s former CEO Timothy Sloan and former CFO John Shrewsberry as defendants.

The suit against Rialto states that the mall, previously named Fashion Outlets and located near the California-Nevada border, “exemplifies the death of the American mall in under-serviced areas: rising vacancies as retailers reduce their physical presence, falling foot traffic as consumers move to online shopping and crumbling properties not worth the investment to maintain, let alone upgrade,” the suit states. While almost fully occupied when the loan was originated in 2012, the property declined after 2016 and was half vacant by late 2017, when Rialto appointed a receiver to stabilize it, the filing asserts.

The Icahn funds are owners of $16.2 million or 84% of the current balance of the Class E slice of the CMBS pool of loans that included the Prizm loan. At origination in 2012 the trust held 48 fixed rate mortgage loans secured by first lien mortgages on 152 commercial and multifamily loans.

It’s not unusual for investors to hold both long and short positions in CMBS and related indexes. But Icahn is one of the bigger and best known investors on the the short side of the mall trade, having bet against brick and mortar stores by shorting an index which contains retail-heavy CMBS trusts. The suit is partly notable because it reveals that Icahn funds invested in mall debt.

Icahn profited from betting against retail in what some have called “Big Short 2.0,” according to an April 24, 2020 report by The New York Times. Early in the pandemic he told CNBC he was shorting the commercial mortgage bond market and that it was his “biggest position by far,” according to a March 13 2020 CNBC report. Icahn made $1.3 billion betting against brick-and-mortar stores using short positions on CMBS, according to an August 11, 2020 Bloomberg report.

A spokesperson for Icahn could not immediately be reached and Rialto did not immediately respond to requests for comment.