Dive Brief:

- The proceeds from U.S. initial public offerings (IPOs) plummeted 94% this year compared with 2021, hammered by inflation, geopolitical tensions, stock market volatility and the most aggressive monetary policy tightening since the 1980s, EY said.

- The number of U.S. IPOs sank 78% to just 90, according to EY. Worldwide, IPOs during 2022 fell to 1,333 — a 45% decline compared with last year — and generated just $180 billion, or 61% less than in 2021. The global IPO market may begin to recover during the second half of next year, EY predicted.

- “2022 will be remembered for the perfect storm of well-documented headwinds,” according to Rachel Gerring, IPO leader in EY Americas. “Market volatility needs to subside and investor confidence to return for the IPO market to recover.”

Dive Insight:

CFOs considering an IPO confront warnings of recession and the prospect that a whipsaw in equity prices will persist. The Cboe VIX Index — a gauge of expected volatility in the Standard & Poor’s 500 index — has gyrated this year, surging 33% as of Tuesday.

“As pipeline continues to build, many companies are waiting for the right time to review their IPO plan,” EY Global IPO Leader Paul Go said in a statement. “Still, with tightening market liquidity, investors are more risk averse and favor companies that can demonstrate resilient business models in profitability and cash flow.”

Liquidity has fallen as the Federal Reserve has sought to throttle the highest inflation in nearly four decades by raising the federal funds rate 4.25 percentage points this year.

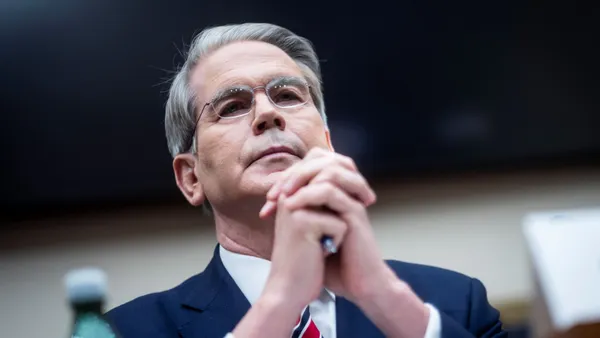

Fed Chair Jerome Powell on Dec. 14 told a press conference that the policymakers will probably raise the federal funds rate next year as well, albeit at a slower pace.

“We have more work to do,” Powell said after Fed officials pushed up the benchmark interest rate by a half point. “Reducing inflation is likely to require a sustained period of below trend growth and some softening of labor market conditions.”

Policymakers including Powell have acknowledged the risk that excessive tightening may tip the economy into recession, hurting businesses and pushing up unemployment.

“I just don't think anyone knows whether we're going to have a recession or not and if we do, whether it's going to be a deep one or not,” Powell said. “It's not knowable.”

After the slowest fourth quarter in a decade, the global market in IPOs may bounce back next year, EY said.

“As the global market has started showing signs of lower volatility and — together with the general expectation that the interest rate hikes should slow down and end during 2023 — more favorable conditions seem to be set in place for the global IPO activities to regain greater momentum by the second half of 2023,” EY said.

IPOs in the U.S. involving special purpose acquisition companies (SPACs) also plummeted in 2022, falling to 83 from 613 last year, EY said. It noted that “a glut of SPACs” face a deadline to consummate a deal within the next six months or liquidate.

“An increase in redemption, regulatory scrutiny and tightened market liquidity coupled with poor stock price performance have dampened investors’ appetite and momentum during most of 2022,” EY said, referring to the SPAC market.

The EY data refers to IPOs from Jan. 1 until Dec. 5, plus expected transactions by Dec. 31, 2022.