Until recently, the skincare company Lush printed out the 120,000 invoices it received each year for its North America division. Someone put the invoice in a paper folder and routed it to the correct person to approve. The invoice might sit at the person's desk for a day — or three months. Or maybe it got lost in the shuffle, and the process started over again when a vendor inquired about its status.

"Lush was struggling with the volume of paper coming in, and being able to keep track of those documents," Blanca McGrory, Lush’s accounts payable (AP) manager, said.

The company, now at 250 stores in North America, grew so quickly that its processes could not catch up, said McGrory. Poised to continue adding stores, Lush needed to rework its internal processes like accounts payable.

In mid-2017, Lush implemented a Medius invoice automation system. Now when an invoice is sent via email, it’s routed electronically. An audit trail helps AP track where the invoice is in the process and any levels of approval.

The company knows if someone is sitting on the invoice, who changes an invoice cost code (and what it was changed from or to), and it can run a report at any time to determine what invoices still need approvals — helpful especially at the end of the month.

What automation tells you

Like at Lush, Johnson & Johnson's mail room was overrun with paper invoices and phone inquiries to track the unpaid bills before implementing automation. Judy Bicking, now an Institute of Finance & Management (IOFM) consultant and trainer, formerly was the global director of shared services at J&J.

"We looked like we didn’t know what we were doing," Bicking said. "Anything people asked us, our response was 'send me another copy.'"

J&J automated AP more than two decades ago. As Bicking got her feet wet in accounts payable, she realized there was no way to get accurate AP information without automation. She had a hard time diagnosing problems in the invoice process, finding out what the company was paying for items, determining the payment cycle time, whether invoices were paid on time and whether the company reaped discounting benefits.

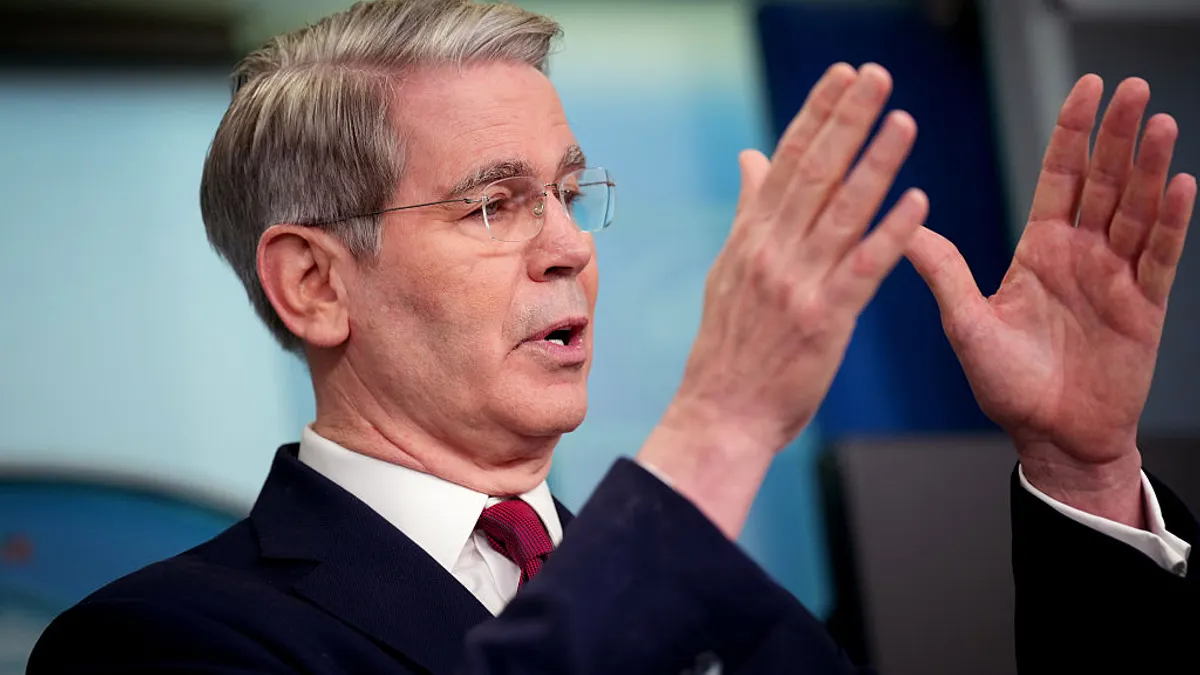

"Giving up paper is harder than quitting smoking."

Judy Bicking

Former Global Director of Shared Services, Johnson & Johnson

Bicking transitioned all of J&J’s shared service center's AP department, which handled approximately 1.3 million invoices annually for 104 business units, ranging from small companies to larger manufacturing sites.

When she began automating J&J’s AP system, she saw the biggest bottleneck was the company often had a purchase order but no documented receiver. Those suppliers were not paid on time. "The data helped break down the silo," she said, and J&J brought in the requisitioners and receiving department to help solve the problem.

When procurement and AP operate in silos, they may not be working together, she said, and that can cost the company money.

Managing the paper to automation transition

At J&J, changing over to automation wasn’t easy. "Giving up paper is harder than quitting smoking. In order to gain control, you have to give up paper," Bicking said.

Giving up paper was one of the benefits McGrory cited, as one of Lush’s values is decreasing its environmental impact. Lush’s invoices come via email. Some are in PDF format, which is most desirable for the optical character recognition (OCR) scanner. Some are in Excel or Word files, which have to be converted. And some are a manually completed form.

The Medius system is cloud-based, and therefore accessible to Lush employees who need access. Most manual approvals are completed within one or two hours, and 92% of the invoices are touchless, meaning they’re automated. When McGrory started at Lush in fall 2017, the company was at 67% touchless processing. The current goal is 95%.

Companies have different touchless goals, Tanja Kannisto, Medius’ North American vice president of marketing, said. If the invoice can be matched with a purchase requisition form, the automation levels are higher.

Lush uses machine learning and logic to teach the Medius system how to route the invoices. It sometimes needs manual intervention to add a cost center code for new suppliers. The validation process allows the system to learn how to process invoices going to specific vendors and to increase the system’s confidence levels and speed the touchless processing rate.

Savings: It’s not about layoffs

Bicking learned a lesson when automating AP at J&J. "In the past we all focused on headcount reduction," she said. But basing the anticipated return on investment (ROI) for automation on headcount is the wrong move, because a company can lose institutional knowledge, she found. "Hire for the ultimate job, not for the job you’re giving them today," she said. That includes hiring for discounting, procurement and spend management roles. While there may be some AP roles that are no longer needed after automation, those positions can be redeployed to save the company money in other ways.

Most companies recoup their automation costs in six to 12 months, said Kannisto.

The first stage in AP automation might be getting a handle on invoices and making the process smoother, adding visibility. Bicking recommends departments iron out and optimize bill cycle time. Procurement can then use the information to gain insights into what it's paying, and how quickly, and use that to improve discounts and get better pricing.

"Most people in a paper environment have no idea what that discount number could be," Bicking said. Using a tiered approach, the company should first take advantage of discounts suppliers offer each other for paying early or on time. The procurement department can then ask other vendors for payment discount rates as well, even if not initially offered.

"Most people in a paper environment have no idea what that discount number could be."

Judy Bicking

Former Global Director of Shared Services, Johnson & Johnson

Bicking said after working at J&J, she owned a small retail gift shop and tested this approach with her suppliers. She asked for a 2% discount to pay the vendors two weeks earlier, and no one turned her down. "Taking 2% off the invoice will get an executive’s attention," she said.

Companies can also transition to more preferred suppliers offering better negotiated rates, which helps bring costs down further.

Automation brought other benefits to Lush, said McGrory. Auditors have limited access to the system, so they can review invoices themselves rather than Lush pulling paper copies of the requested invoices.

To be sure, some staff people find automation threatening, but they should find other companies' experience reassuring. The Lush staff has been happier since the change, said McGrory. Staff members are using the time saved for personal development and other business improvements. They’re having conversations about creating meaningful work for people, rather than staff complaining about doing the same thing repetitively, doing a job anyone could do.

"With Millennials in the workforce, they’re expecting a level of automation," said Kannisto.

Deciding if and when to convert

There are different philosophies of when it makes sense to convert from manual to automated AP. Kannisto said it makes more business sense if the organization processes 30,000 to 40,000 invoices a year. However, smaller companies processing fewer invoices may still want to automate if they are poised for growth and want to optimize their systems before growth happens.

Bicking, though, said it doesn’t matter how many invoices a company processes, because automation will positively affect the bottom line. "My retail store was proof of that," she said, even though she received only 10 invoices a week. She outsourced her invoice scanning automation and payment process, and found it helpful to have the information available at her fingertips.

"With Millennials in the workforce, they’re expecting a level of automation."

Tanja Kannisto

Vice President, Marketing North America, Medius

Before converting, though, Bicking said it’s important to know what a company wants to achieve and to consider what key metrics to monitor. That might include invoices paid on time, invoices paid with purchase order versus non-purchase order and cost per invoice. She’s seen statistics for medium size companies where processing manual invoices cost the company $7.50 per invoice when automation can reduce that to $1.25. "It’s not that people are working faster and harder. It’s the automation," she said.

This story was first published in the weekly newsletter, Supply Chain Dive: Procurement. Sign up here.