Nick Rose is CFO of rebate management software company Enable. Views are the author's own.

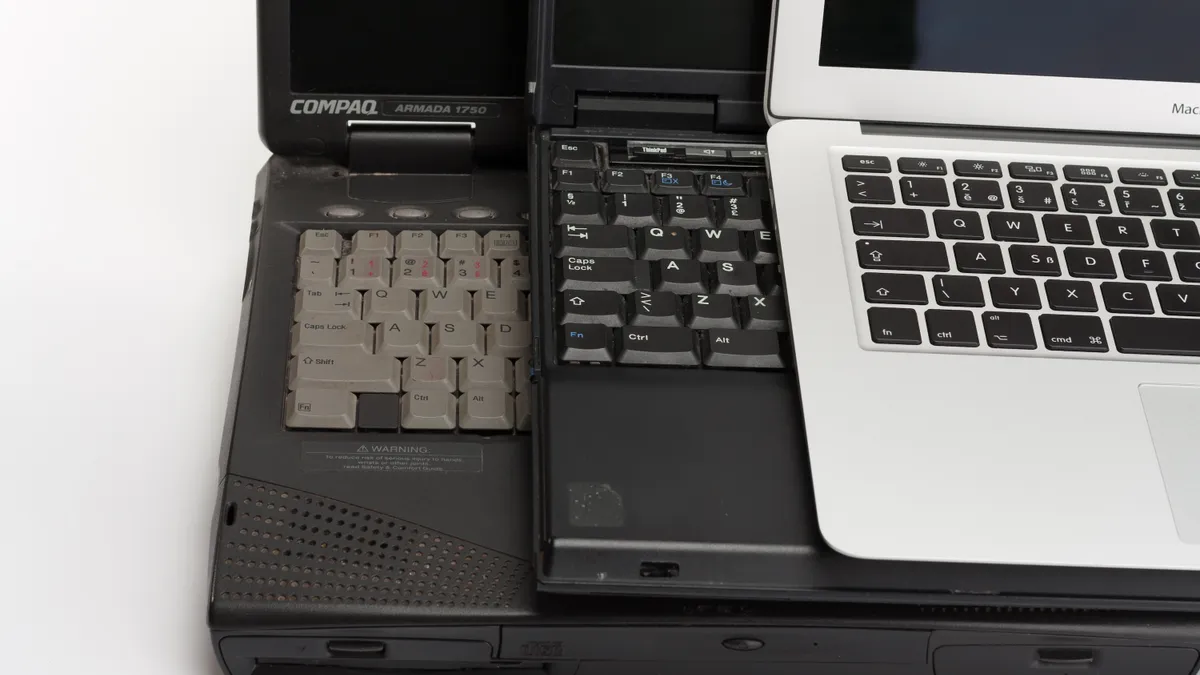

Of all the business functions that stand to benefit from the digitization process, finance is first in line. As finance chiefs, we have to be capable of quickly adapting to changing circumstances, making decisions with multiple timeframes and improving efficiency. But many of us are hobbled by legacy systems that make our jobs more difficult.

These challenges are why finance leaders are making digitization a focus in 2022. Outdated technology and unreliable data processes are major obstacles to improving performance, discovering business opportunities and remaining competitive.

But digitization isn’t just about technology adoption – it also requires companies to make cultural and organizational changes to ensure the right people are in the right places. It falls to CFOs to bring stakeholders together around a data-driven growth agenda. That will help the company scale in an agile and sustainable way.

Leaving manual processes behind

Despite the reliance of finance on data aggregation and analysis, many companies still depend on manual processes to manage their data. According to Ventana Research, 70% of companies use spreadsheets as their “preferred technology supporting a broad range of planning processes.” Ventana found that 88% of spreadsheets in field audits contained errors.

One of Enable’s partners tried to manage trading agreements for more than a thousand suppliers and more than a million products with stacks of paper and hand-written notes, a process that made it extremely difficult to keep track of deals. Meanwhile, the agreements existed in Word documents, digital spreadsheets and emails. This meant finance teams had to synthesize and interpret large quantities of information before duplicating it in their data management systems, many of which lacked the functionality to reliably record all the relevant details. Considering the tight margins and the significant proportion of profit generated by rebates, even small errors could have a dramatic impact.

Our partner isn’t alone. Technology adoption has been sluggish across industries. Gartner reports that fewer than one-third of CFOs are “confident that their technologies are aligned to ensure the future success of the organization.” This problem is even more acute considering how finance has evolved. Datasets have grown exponentially in recent years, and it’s necessary to use this information to help the company make strategic decisions. Finance has moved beyond historical analysis and the preparation of financial statements. It’s now a key element of a company’s growth agenda.

Finance teams are moving away from legacy data management practices and focusing on tech-enabled agility. This allows companies to adapt to changing market and economic conditions, increase the speed of decision-making, identify inefficiencies and opportunities and plan for the future. The companies that make the technology transition will have a competitive edge in the coming years.

Altering your workforce

According to a 2021 PwC survey, 68% of CFOs say they’re increasing investments in digital transformation over the next year. Digital transformation came out as the top “investment plan around the future of work,” a reminder that technology and people are directly related to one another. When our partner adopted a centralized digital ERP, the commercial team was immediately able to identify errors and make corrections. Because all relevant information is accessible via a single system, a significant cultural and organizational shift was necessary to take advantage of the company’s new data management strategy.

Cultural change is crucial to make any digital transformation successful. When companies adopt tools like centralized ERPs, employees and managers need to know how to use them. Our partner, for instance, can now make predictions based on year-over-year changes, ensure that these changes are incorporated into the relevant terms and conditions and analyze how price shifts will affect profits. With the predictive power of data, the finance team is able to avoid sudden changes in costs, delivery schedules and other critical changes that can undermine trust with suppliers and partners. Now the company has increased its rebate income, improved clarity of margin, centralized and streamlined cash collection and increased visibility on deal performance. This means it’s able to negotiate more mutually beneficial deals.

Technology can strengthen your workplace culture by providing employees with digital resources that will help them cooperate and work productively, from cloud-based communication and collaboration platforms to centralized data hubs where everyone has access to the same information. But it’s vital for employees to be capable of deploying these tools effectively. When today’s finance talent is aligned to tomorrow’s technologies, digital transformations will be seamless and sustainable.

Working proactively

CFOs will always be responsible for fiscal discipline and tracking how companies are allocating resources, but they’re also becoming proactive in strategic planning. This has coincided with rising demand for clean, reliable and focused data, which gives companies greater visibility on costs, efficiency and quality of service. McKinsey has found that the most successful finance leaders focus on “value-added activities, such as financial planning and analysis (FP&A), strategic planning, treasury, operational-risk management, and policy setting.”

According to Gartner, 93% of finance leaders say they “expect to see a function that is leaner (with fewer employees), digital and data-driven” by 2025. CFOs are making digital transformation a priority because it will help them identify and respond to trends, build resilience by targeting enterprise risk, evaluate interventions in terms of concrete performance indicators like ROI, consolidate data and make sure key stakeholders have access to it, and offer data-driven predictive insights. Companies often struggle to aggregate, format and harness the power of data, but the right technology can help them do so.

Effective CFOs use data to help companies diagnose problems and determine what can be done to address them. We have never had access to more information about the company’s operations and outputs, and they clearly recognize that this information is indispensable to the development of a more agile and evidence-based finance function. The immediate challenge will be overseeing digital transformations that allow finance leaders to gather and analyze large quantities of data, move beyond inefficient and outdated tools like spreadsheets, and build cultures capable of fully leveraging technology.