When Betsy Ward reflects back on her first days as MassMutual’s CFO in 2016, she acknowledges the gravitas that came with being the first woman to take the life insurer’s finance reins likely bolstered one of her key initiatives — modernizing the 173-year-old company’s finance processes.

Despite initial skepticism from some staff, she worked to convince them that change was possible. To foster buy-in she set up “go-and-see visits” to show what changes were possible and held meetings in which she pulled no punches about the need for the new processes and the potential benefits they could realize by reinvesting savings in the group.

“I do believe the big difference that I represented and that I was bringing to the table made a difference, though I don’t want to say a male couldn’t do it,” Ward said in an interview last month, noting that “it was a combination of how I was looking to bring people along as well as how I had proven my ability in the space, and the team was willing to follow me.”

Ward, 60, is preparing to retire at the end of this month after 30 years with the Springfield, Massachusetts-based insurance giant. The company last year saw the total value of its life insurance coverage issued to policy holders pass $1 trillion for the first time in its history, while its total assets grew by over 4% to $335 billion in 2023 from the year earlier, according to its 2023 annual report. Ward, who has an easy laugh and isn’t afraid to wear a leather jacket to a business conference full of suits, is quick to note the people behind her company’s numbers: MassMutual’s oldest policy holder is 103 years old, she says.

She believes now is a logical time for her to step down from her post as it gives her successor the opportunity to put her own stamp on the second phase of the modernization process. “We’re about to start this next phase so it’s a good time for the person who is going to be there to kick it off and own those decisions,” she said. Mary Jane Fortin, formerly the president and chief commercial officer for Thrivent Financial, will take MassMutual’s CFO seat on Jan. 1.

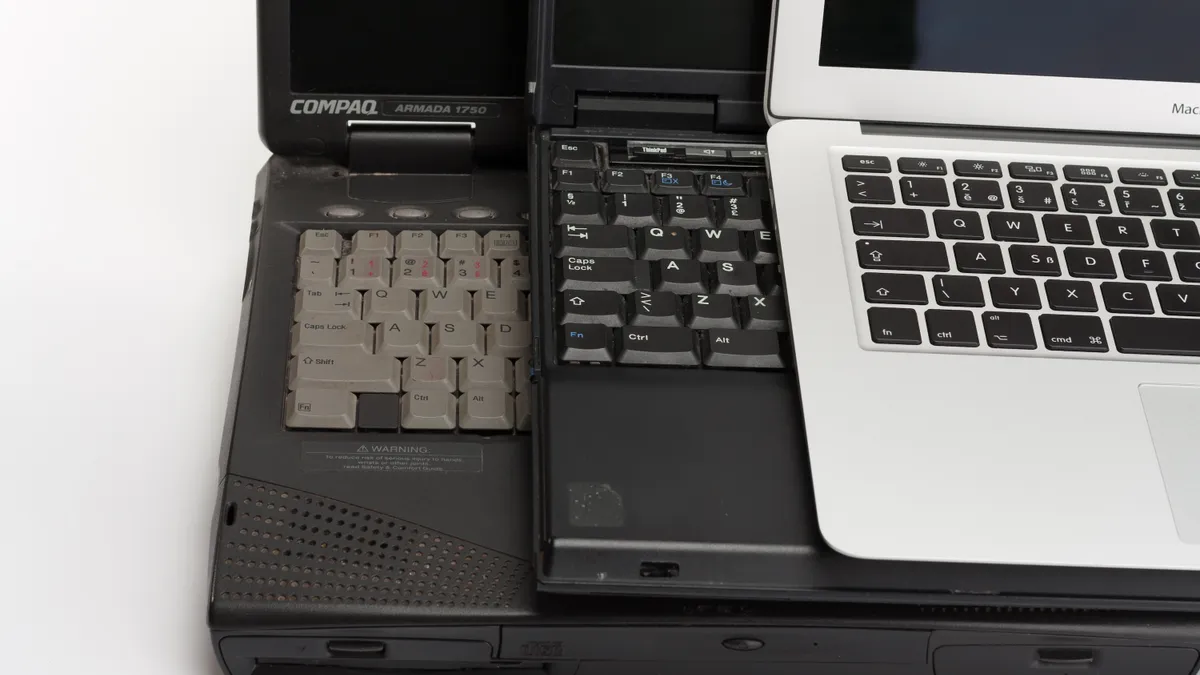

Trading microfiche for dashboards

The financial team’s modernization hasn’t taken place overnight. In 2016, the year she was appointed finance chief, Ward assessed the company’s financial processes and came to see that her department’s ways were antiquated and manual — her roughly 300-person financial team still stored data on microfiche, and the FP&A team used spreadsheets for forecasting.

But early on, she drew some initial shock with her proposed changes. At one meeting she recalls starting out by empathizing with her staff, saying she knew it was said that it was difficult to be in finance because “your numbers need to be perfect and on time.” But she didn’t stop there. “I said, ‘I’m here to tell you that’s not enough,’” Ward recalled in the interview. “The point I was making back then was, ‘you need to tell me what the numbers say, you’re so close to them if they’re coming in too late we’re not going to get the details we need.’”

After a woman raised her hand to tell her there was no time to do more, she told them that she’d watch them go through the quarter end to see how it worked. Ward found that they were right: the process was too slow and manual and needed to be updated by bringing automation into the system so accountants and others could be freed up to analyze the data.

By 2018, she was executing the transformation. The first phase of the modernization effort has included adding bots, creating dashboards to provide information, changing the way the company is storing data so it doesn’t need microfiche anymore, moving off some databases and consolidating some actuarial reserve systems.

A non-traditional CFO path

Ward didn’t take the typical path to become CFO: She isn’t a CPA. As a college student at University of Rochester in New York, she majored in economics and Spanish and then followed in the steps of her father to become an actuary, according to Ward and her LinkedIn profile.

Early in her career working her way up in Aetna Life & Casualty’s actuarial program, Ward was tasked with describing asset liabilities so that investment managers could invest against them. When she found that she effectively wasn’t speaking the same language as the investment side, she asked her boss if she could learn how to trade. They went on to trade corporate bonds in the utility sector, enabling Ward to gain investing experience and paving the way for her to work in a number of subsequent roles as a portfolio manager.

In November of 2007, she took the role of chief enterprise risk officer at MassMutual just as the Great Financial Crisis was unfolding. The insurance sector was wrestling with whether to use mark to market accounting or risk management assessment to value assets correctly. “What we found is we should look at both so that you understand what your risk would be if every depositor were to leave today,” she said.

Her predecessor in the MassMutual CFO seat was Michael Rollings, who left to become CFO at the U.S. fund manager Vanguard in 2016. Because she reported to him, Rollings got to know and recommend Ward as a potential successor, at one point asking her if she’d be interested in being CFO. She had her doubts. “I said, ‘I’m not an accountant,’” she recalled. His retort, “Neither am I.” She came to understand that there was much more to being a strategic CFO at a company like MassMutual than keeping the books.

Getting loud

Ward is stepping down as some inroads have been made by women finance leaders this year: the number of female CFOs appointed globally reached a five-year high in the first half of this year, according to a recent report by leadership advisory firm Russell Reynolds Associates. Among them: Google parent Alphabet in June named Eli Lilly veteran Anat Ashkenazi to become its new CFO. Still, just 17.8% of sitting CFOs at Fortune 500 and S&P 500 companies are currently female, down from 18.5% in 2023, according to a 2024 study by the executive search firm Crist Kolder Associates.

Ward has some advice for women coming up behind her. She suggests younger women be mindful about picking mentors: choose people that are senior to you who are doing things that you want to do, she said. This can be particularly hard for women who often think they need to pick a perfect mentor and who sometimes also aim too low when searching out sponsors, she said. “Just pick a whole bunch,” Ward said.

She has also noticed that there is a certain power that three women can hold in a group. When she became chief risk officer, a named officer position, she said she benefited from having two other women at the meetings, the head of human resources and the head of the retirement business area. “They say there’s something magical about three,” she said, noting that when there is a trio the same two women don’t always have to team up to support one another.

Then too, in meetings, she’s also learned the importance of standing her ground. She has never been intimidated by the financial subject matters being discussed, but there were times when she has needed to force herself to speak up — sometimes loudly.

“They get loud and I just have to get louder and keep talking until I can hardly hear what I’m saying but I just have to keep going,” Ward said. “I had something important they needed to hear. Especially as a risk officer, you have to be able to speak up.”