The current expected credit loss (CECL) standard that went into effect for the country’s largest banks in mid-December will face scrutiny in Congress in the coming months if lawmakers heighten oversight of the accounting and auditing professions.

The private nonprofit organization overseeing accounting standards in the United States, the Financial Accounting Standards Board (FASB), raised concerns on Capitol Hill last year when it revamped CECL, which governs how banks account for new loans, despite opposition from the country’s banks and credit unions.

Under the change, banks are to account for expected losses over the lifetime of the loan upfront rather than wait until they see how the loan is doing as is done under the more established incurred-loss method. The accounting change takes effect for other banks and credit unions next year.

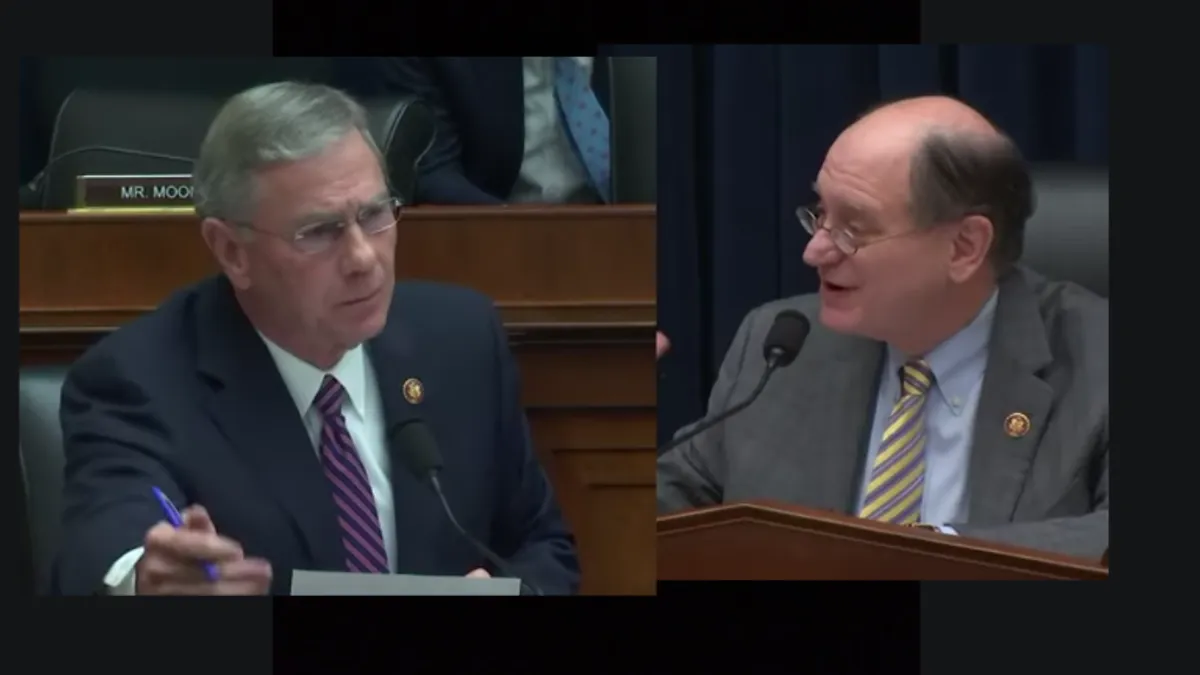

The move so rankled Rep. Blaine Luetkemeyer, R-MO, ranking minority member of the House Financial Services subcommittee on financial institutions, that he introduced a bill to subject FASB to the same rulemaking process as federal agencies.

That process requires agencies to conduct an impact analysis, take public comment, and let Congress weigh in before a rule can take effect.

"This bill will not take away FASB's independence, but it will force them to perform the due diligence they have proven unwilling to do," Luetkemeyer said last year.

The legislation is unlikely to gain traction in Congress this term, but it shows lawmakers are concerned about FASB's potential impact on banks.

Consumer impact

At a House Financial Services subcommittee hearing on investor protection last month, entrepreneurship and capital markets, lawmakers asked why FASB’s analysis of the rule’s potential impact didn’t go beyond banks to look at consumers and the broader economy.

"We are setting ourselves up for an even larger problem going forward, caused by accounting," said Rep. Trey Hollingsworth, R-IN, The Wall Street Journal reported.

The new rule could particularly impact retail consumers. A Morgan Stanley analysis last year found banks are likely to make less credit available to retailers for their in-house credit cards, and also charge higher rates for the cards, because of the new standards, and that will make it harder for consumers to make purchases at the retailers.

Macy’s was cited as a retailer that could be particularly affected because it relies heavily on its in-house card for sales. The retailer has struggled recently and last week announced its closure of 125 stores.

At the hearing, FASB Chair Russell Golden said the organization considers a range of views as it sets standards, but broader economic impacts fall to the Treasury Department.

In CECL's case, he said, FASB intends to revisit the impact on banks once the standards have been in place for a while. And when it does that, banks, lawmakers and other interested parties can weigh in. All stakeholders, said Golden, “have a seat at the table.”

In a separate statement, FASB said it looks forward to input. "The [Financial Accounting Foundation (FAF)] and FASB are committed to continue meeting with stakeholders on Capitol Hill and elsewhere to answer their questions, hear their concerns and discuss the time-tested benefits of the integrity of the standard-setting process," a FASB spokesperson said. FAF is the parent board of FASB.

Audits under scrutiny, too

FASB isn’t the only accounting organization facing scrutiny. The Public Company Accounting Oversight Board (PCAOB), which Congress created in 2002 to oversee the quality of audits of public companies after a series of high-profile accounting scandals, is in the crosshairs, too, as critics question its effectiveness.

The Trump administration has proposed folding the agency into the Securities and Exchange Commission. "SEC is already charged with investigating federal securities law violations and has the authority to impose disciplinary action, including for public accounting firms that are also overseen by PCAOB," the administration said in its fiscal year 2021 budget request.

PCAOB has long been seen as a weak regulator. A review of its actions released late last year by the Project on Government Oversight found that, out of more than 800 incidences in which the board found audit problems, fewer than 20 of them resulted in enforcement actions, and audit firms were fined only about $8 million. What's more, only a fraction of those fines were imposed on the big-four accounting firms that dominate the business: KPMG, PricewaterhouseCoopers, Ernst & Young and Deloitte.

Like the bill to subject FASB to the federal rule-writing process, the proposal to hand PCAOB’s duties to the SEC faces an uphill battle in a divided Congress. But more scrutiny of its effectiveness is likely in store for it as well.

Rep. Brad Sherman, D-CA, chair of the House Financial Services investor protection subcommittee, is an accountant by profession and has said he wants to make accounting and audit standards a priority of the subcommittee. At last month's hearing, in addition to having Golden testify on behalf of FASB, he had William Duhnke, chair of PCAOB, testify as well.

At that hearing, Sherman said he has more scrutiny of the organizations planned, starting with FASB. He wants to bring in academics to weigh in on whether CECL was a good idea.

"Every other entity that exercises anything close to the incredible government power of FASB is here in Washington," Sherman said in an interview with The Wall Street Journal. "They’re geographically subject to oversight by the press, the public and the Congress." FASB, by contrast, he said, is in a "separate cloister" that is "as far away from democracy as they can possibly get."