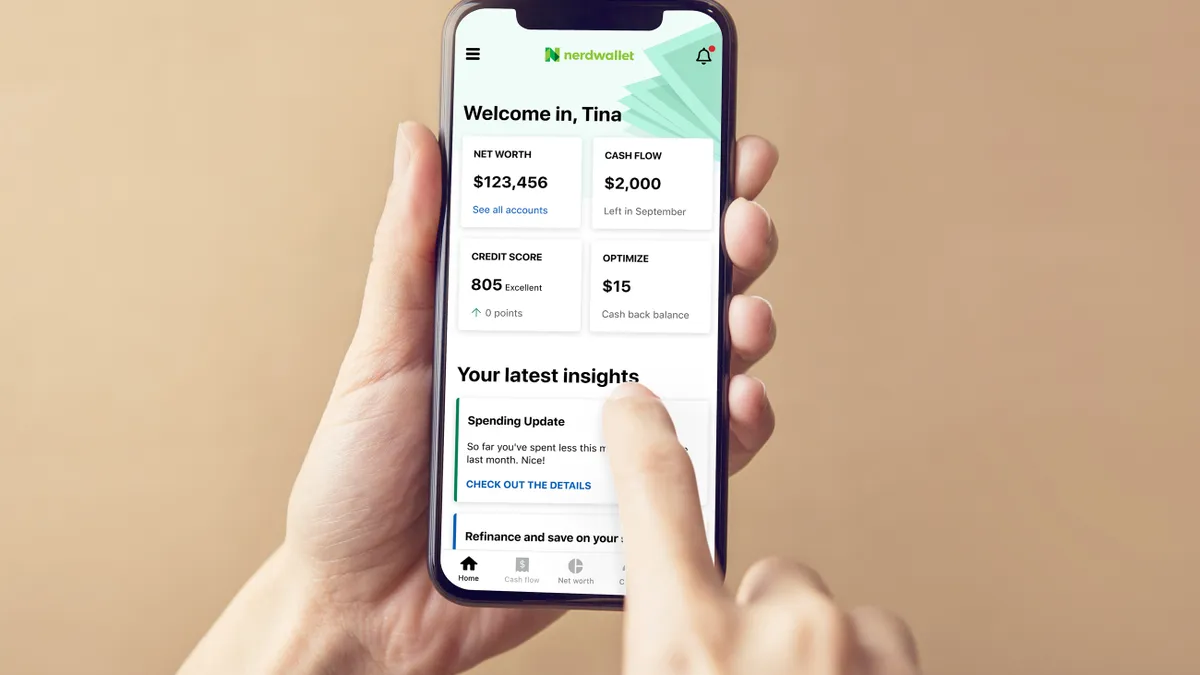

Nerdwallet CFO Lauren StClair is focusing on championing vertical integration, registration and data-driven engagement to create “even better user experiences” on the personal finance platform after seeing a 25% increase in average monthly users for its most recent quarter.

Founded in 2009, Nerdwallet aggregates personal finance products including credit cards and savings accounts for its users. The San Francisco, California-based platform reported record average monthly users of 29 million for the quarter ended March 31, a surge which came as the platform reported a mixed quarter in the face of ongoing macroeconomic pressures.

“We've shown a lot of success in registering users; now we're really focusing on the re-engagement piece,” StClair said in an interview. “How can we create really smart money moves at scale for all of our users, so we incent(ivize) them to come back more regularly?”

Weathering banking, credit uncertainty

Joining Nerdwallet in 2020, StClair previously served as CFO, North America for e-commerce marketplace eBay. She has also held key executive and financial roles at ticket marketplace StubHub, where she served as CFO of StubHub international, as well as payments provider PayPal, according to her LinkedIn profile.

Like many finance chiefs, StClair is focusing on achieving growth in key areas while also being tasked with steering the company through a unique economic environment.

“We were effectively in a zero interest rate environment for a few years, and I think really the pace of interest rate hikes is what has been fairly unprecedented for many of us,” she said of where finance chiefs find themselves. “Even in my career, looking back, I don't think there's been a situation quite like this one.”

While Nerdwallet saw its usership grow and revenue expand in segments such as small to mid-sized business products — where revenue jumped 21% year over year in Q1 to $30.4 million — rising interest rates and other headwinds contributed to revenue declines in other areas on the platform.

Credit card revenue, for example, fell 19% year over year to $50 million in the first quarter, according to the platform’s Q1 results, following skyrocketing credit card delinquency rates in 2023. Total household debt reached $17.5 trillion in the fourth quarter of last year, with credit card balances rising by $50 billion to hit $1.1 trillion, according to February data from the New York Federal Reserve.

“Delinquencies have been rising, but most issuers believe that we've reached a peak and so credit worthiness has been fairly stable,” StClair said. Delinquency rates have eased slightly in recent months, according to reports, while still remaining above pre-pandemic levels. “But the second dynamic is that the bigger balance transfer players and the credit card space are still a bit balance sheet constrained post the (Silicon Valley Bank) crisis.”

The company’s diversification of products has helped to weather headwinds, StClair said, though she is keeping her eye on how changing economic conditions could affect verticals such as banking, for example. The SVB crisis’ impact is still reverberating through the banking space, and as interest rates begin to stabilize, there remains a question for how the sector will be affected and how consumers will continue to respond, she said.

“We're really in unchartered territory right now, and we haven't been around as a company during this type of interest rate environment,” she said. “So…I’m keeping an eye on it, I still think it's a positive for us, even though consumer demand is starting to moderate and would put pressure on growth within banking.”

Forecasting is crucial

With the future of the economy remaining murky — the Federal Reserve is likely to keep interest rates higher for longer, but strength in the labor market and other factors representing encouraging signs — Nerdwallet is keeping its focus on increasing its user engagement and fostering growth, StClair said.

To execute on that strategy, one of the key things from a finance perspective is to continue forecasting, StClair said.

Given the variability in the macro environment, one of the things StClair has done as a best practice is to try to understand all of the risks and opportunities of the issues before her, she said. “So what is the total upside? And what is the downside in a variety of scenarios?” she said. “That way, we at least are going in eyes wide open into, what is the potential outcome, and then we adjust our forecasts accordingly.”

Nerdwallet is also looking to utilize new technologies to execute on its strategy of engaging and retaining new users, including tapping new technologies such as GenAI.

“You'll see that across the site, we're also leveraging our new chat bot, leveraging GenAI to help folks navigate to the right places, but also to give them really good reasons to register and start to share more information with us,” StClair said.