Clene Inc. subsidiary Clene Nanomedicine's new CFO Morgan Brown said he will consider a shelf registration, fresh debt or potential licensing agreements outside the U.S. to give the biopharma company a longer financial runway.

“Right now the market is very challenging,” Brown said in an interview, noting that smaller biotech companies have been out of favor for many quarters. “The key is to be prepared for when there is opportunity and to have enough arrows in your quiver.”

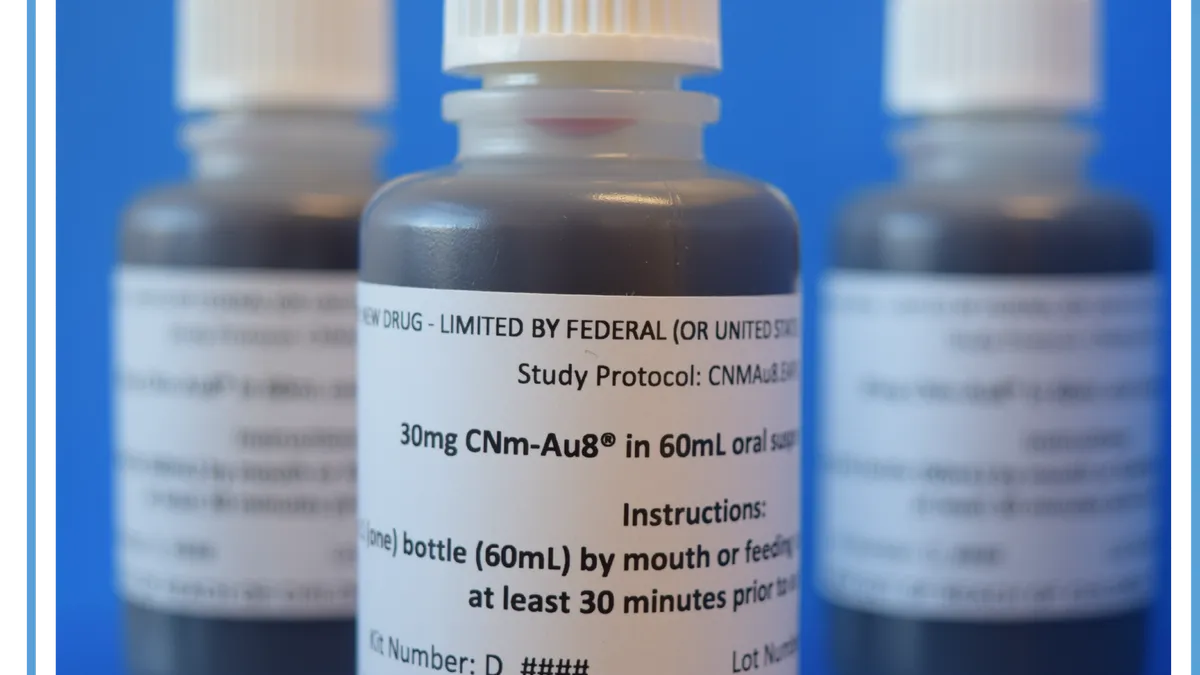

The company, whose shares are trading near a 52-week low of $2.36 from the $16 area a year ago, is developing treatments for a range of neurodegenerative diseases including amyotrophic lateral sclerosis (ALS). One of its leading drug candidates, which involves gold nanocrystals in an oral solution, is part of clinical trials at the Healey Center for ALS at Massachusetts General Hospital in Boston.

ALS, also known as Lou Gehrig’s disease, has largely thwarted attempts to develop effective medicines and few medicines have been approved by the Food and Drug Administration to date. But the cutting edge nature of its business is partly what drew Brown to join Clene. "Some of these patients are struggling with very few treatment options," he said.

Brown will need to find a way get a fresh slug of financing in the near future to give it a path forward. The company had over $60 million in cash as of the end of the third quarter but is burning through roughly $10-$11 million per quarter, he said.

“We’ll have enough cash to get through 2022 but beyond that we’ll have to raise some additional capital,” he said. Even though the current stock price makes a stock offering unattractive now, the company will file an S-3 shelf registration and Brown is hopeful that ultimately positive news on any of several trials will boost stock price and make an equity offering a viable financing option.

Significantly undervalued

The company might also consider term or convertible debt though he expects that rates will likely rise. The company has a 9.85% rate on $20 million in debt that it obtained from a venture fund, according to its third quarter earnings report. It could also raise capital by selling licensing in areas like Asia or Latin America that would not limit its potential in the future. As for partnering somehow with Big Pharma, he said he would consider anything but at the company’s current valuation it might not be the right time.

"We think the company is significantly undervalued and we believe with successful data the market value will more closely approximate the true opportunity," he said.

Clene announced its hire of the veteran biopharma and healthcare executive Brown this month, citing his experience with four publicly traded life sciences and experience with out-licensing of commercial stage assets and equity and debt financing.

“His expertise in these areas will be critical to Clene as we look ahead to potential commercialization of our lead drug candidate, CNM-Au8, in ALS next year,” Clene’s CEO Rob Etherington said in a statement. Brown will receive an annual base salary of $375,000 and will be eligible for an annual bonus targeted at 40% of the base salary, according to an SEC filing.

Brown, 53, was most recently CFO and executive vice president of Lipocine Inc.