Revolut U.S. CFO Max Lapin can sum up the fintech’s ambitions in one line: “Revolut wants to become a bank in the United States.”

A three-year wait finally ended with the London-based fintech securing a banking license in its native United Kingdom last July. Now the company is focusing its attention on growth in the U.S., with CEO and co-founder Nikolay Storonsky highlighting Revolut’s plans to pursue a U.S. banking license in November, Bloomberg reported.

Lapin declined to share a specific timeframe, but stressed Revolut’s aim to provide financial products to U.S. consumers as a fully-fledged institution — with perhaps, one immediate exception.

“We wouldn't be able to offer mortgages and car loans on the spot,” Lapin said in an interview with CFO Dive on the fintech’s U.S. expansion plans. “They are way too capital intensive.”

Bank, take two

This is far from the first time Revolut has announced its intent to become a fully-fledged bank in the U.S. — doing so has been a long-time goal for the company since its founding in 2015.

In 2020, rumors swirled that the company was close to filing an application for a U.S. license, with Revolut announcing plans to do so the following year amid a growing push to digital banking services among U.S. consumers at the time, according to reports.

By 2023, however, such plans had fizzled to a halt amid several financial hiccups for the fintech; an audit of its 2021 financial results led to the delayed filings of its next few annual reports and an overhaul of its leadership structure, among other changes, CFO Dive previously reported. Presently, the company operates in the U.S. through its banking partner and card issuer, Lead Bank, according to its website.

Over the past year, however, the wind has appeared to shift. The approval of its U.K. banking license by the Prudential Regulation Authority — the entity responsible for regulating the market’s banking sector, and which approved Revolut’s license with restrictions — now means the fintech can accept deposits and offer financial products such as credit cards and loans within the market, CFO Dive sister publication Banking Dive reported. In August, just a month after it received its license, Revolut conducted a secondary share sale that brought its valuation to $45 billion — a 36% rise from its 2021 valuation, according to Banking Dive.

“We’ve grown,” Lapin said, when asked what was different about Revolut’s most recent attempt to become a bank in the U.S. “And by grown, I mean not only [in terms of the] size of the company. I'm talking about maturity.”

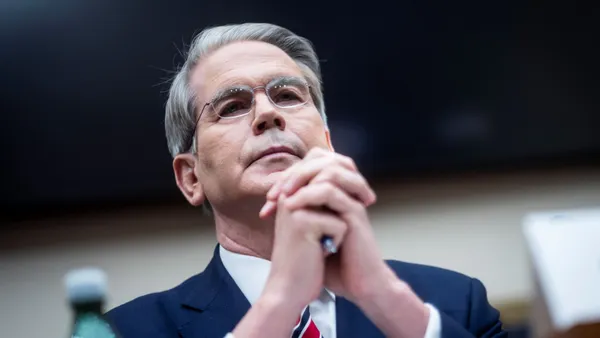

Lapin has served as finance chief for Revolut U.S. since July 2022, according to his LinkedIn profile. His past experience includes serving as interim CFO for Russian classified ads site Avito, as an independent director and audit committee chair for SFI Investment Holdings, and CFO for the Moscow Exchange.

Revolut — like many of its fellow players in the wider fintech ecosystem — has matured since its founding a decade ago, Lapin said, putting more of a focus on compliance as it expands.

“We have upgraded our internal compliance systems, our controls, our reporting in general, our processes” to fall in line with guidelines from the European Central Bank, Lapin said. Revolut has also been put under another “robust test” by the PRA as it seeks to complete what is known as the “mobilization” or “authorization with restrictions,” period in the U.K., he said.

While Lapin cannot comment on when the PRA’s review will be complete, it provides evidence that Revolut has matured, he said — making its goal of becoming a bank in the U.S. a more tangible opportunity.

Staying nimble

As CFO, Lapin is approaching the proposed shift from fintech to fully-fledged bank with care — the goal is to retain some of the nimbleness that makes neobanks or fintechs attractive to customers, while still ensuring the company is meeting compliance standards.

As Revolut pursues its banking ambition, Lapin is proposing the term of “banktech” to help describe the shift; “banktech,” as Lapin defines it, is “a fully regulated bank, but [one] that is keeping [its] agility as a tech company,” he said.

That balance between compliance and agility is “the biggest challenge for the CFO of a regulated company that would like to grow faster than others,” Lapin said. As such, as well as keeping an eye on compliance, Lapin is also taking a close look at Revolut’s talent and hiring practices — a crucial component of its growth, he said.

To have the coveted dexterity needed to launch new products, quickly, while remaining compliant, a number of key roles need to be filled — Lapin, for example, needs to have salespeople, tax, and technical accounts experts on the team.

“There’s got to be boots on the ground with expertise, because eventually it's about responsibility,” he said.