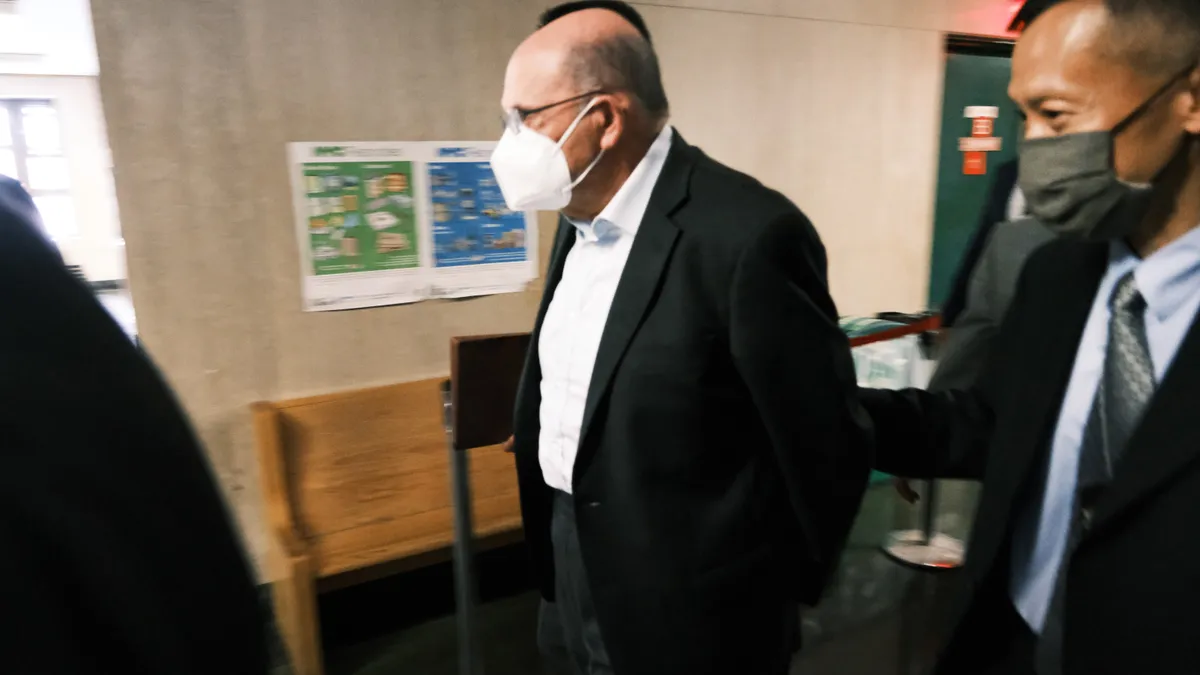

A scheme to evade income taxes by hiding compensation is at the core of state prosecutors’ charges against Trump Organization CFO Allen Weisselberg and the Trump Corporation, an indictment released late Thursday shows.

Weisselberg, who reported $940,000 in annual compensation for much of the period in question, worked through the Trump Corporation to hide $1.76 million in compensation starting from 2005. That enabled the company’s long-time finance chief to evade approximately $560,000 in federal taxes, $107,000 in New York State taxes and $238,000 in New York City taxes. He also received tax refunds of about $95,000 from the federal government and $38,000 from the state over that period.

“The purpose of the scheme was to compensate Weisselberg and other Trump Organization executives in a manner that was “off the books,” Manhattan District Attorney Cyrus Vance, Jr., said in the indictment. “The beneficiaries of the scheme received substantial portions of their income through indirect and disguised means, with compensation that was unreported or misreported by the Trump Corporation or Trump Payroll Corp. to the tax authorities.”

“There’s no clearer example of a company that should be held to account,” Assistant District Attorney Carey Dunne said in court. “It’s not about politics.”

The charges were filed in the Supreme Court of the State of New York County of New York. Both Weisselberg and the Trump Organization have pleaded not guilty.

Treatment of fringe benefits

The accusations largely concern Weisselberg and other executives’ fringe benefits, which should have been reported as income but weren’t, even though the company’s internal records indicated the benefits were part of their income.

To pay for the New York City apartment he used as his principal residence, for example, the company cut rental, utility and other related monthly checks, but instead of booking the payments on its general ledger as employee compensation, the company labeled and deducted them as rent expenses.

“The indirect compensation was not included on Weisselberg’s W-2 forms or otherwise reported to federal, state, or local tax authorities, and no income taxes were withheld by the corporate defendants in connection with the indirect compensation,” the indictment said

Similar arrangements were made for tuition payments for family members, lease payments on a pair of Mercedes Benz cars Weisselberg and his wife used, furnishings he bought for his homes, and cash he handed out at holidays.

Weisselberg, along with other executives, also had bonuses structured as non-employee, contractor payments and reported on 1099 Forms rather than on W-2s.

“This practice, as the defendants knew, was improper,” the indictment said. “The end-of-year bonus compensation received by the executives was employee compensation and should have been reported as such.”

Additional arrangements were made to cover some or all rental apartment costs for Weisselberg’s family members over a period of time and neither the family members nor the company accounted for the payments as compensation.

Weisselberg also failed to disclose his New York City apartment as his main residence, allowing him to avoid city income taxes.

Company charged

Along with charging Weisselberg, the indictment includes charges against the Trump Organization and other Trump-owned entities, including Trump Corporation, which failed to account for the payments on their side, enabling Weisselberg to leave the payments off on his personal returns.

The defendants, the indictment said, altered and erased and otherwise recorded documents, including the company’s general ledger, with the intent to defraud. Fifteen counts in all were filed.

Weisselberg’s top charge is grand larceny in the second degree, a felony with a maximum 15-year prison sentence. He was also charged with scheme to defraud, conspiracy, and four counts of criminal tax fraud.

The indictment is “an important marker in the ongoing criminal investigation of the Trump Organization and its CFO,” said New York Attorney General Letitia James, who has been working with the Manhattan District Attorney on the case. “This investigation will continue, and we will follow the facts and the law.”

Regardless of the outcome, the Trump Organization could be hurt, legal experts say.

“Any kind of indictment against a corporation could be the death knell,” Bradley Simon, a former prosecutor, has said. “It means that customers and vendors are going to stay away and contracts are going to be canceled. From a financial perspective, it’s terrible, because no customer, client or other business will want to go anywhere near a company for fear of being tainted, subpoenaed, questioned by authorities or hauled into a grand jury.”