Can a CFO take a “don’t ask, don’t tell” attitude towards the company’s legal matters?

The Trump Organization CFO Allen Weisselberg put the issue under the spotlight last month when he said the legal side of the business was “not my thing” in a 2015 deposition on the now-defunct Trump University, according to The New York Daily News.

“I was only concerned about the economic side of it,” he said when asked about the company’s plan to open up a fictitious office outside of New York. “They were handling the legal side of it.”

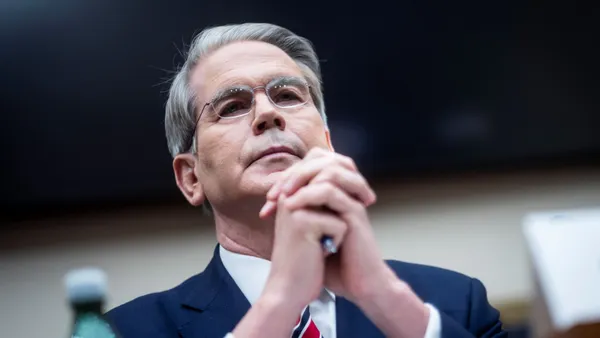

Wrong answer, according to Harvey Pitt, former chair of the Securities and Exchange Commission. “The legal side of the business” most assuredly is the CFO’s "thing,” Pitt told CFO Dive in an email. “This is highly unusual, the dangers are enormous, and it’s never appropriate.”

Conscious avoidance

Although they aren’t expected to be lawyers, CFOs must know if something they’re asked to execute on is illegal, said Pitt, now CEO of global advisory firm Kalorama Partners.

The concept of “don’t ask, don’t tell” under securities laws is called “conscious avoidance” and has led to enormous civil and criminal penalties for those who practice it, he said.

General counsel role

For CFOs faced with a complex legal issue, the prudent approach is not to act until the general counsel has weighed in, said Yelena Dunaevsky, an attorney who serves as managing editor of the American Bar Association’s Business Law Today.

“People who are experts in their specific field should stick to that field as far as comments go, and not assume expertise in someone else’s area," Dunaevsky said.

By commenting, or working, on legal matters outside of their expertise, CFOs run the risk of causing stock price fluctuations and invite lawsuits and investigations, she said.

Intertwined issues

Broadly, CFOs are not responsible for legal matters, but in a complex organization, “financial and legal issues are totally intertwined,” said Damon Silvers, director of policy and a special counsel at the AFL-CIO.

The CFO will know whether the company is basically obeying the law or evading it because of the executive’s knowledge of where the hot spots are in accounting, disclosure, and sensitive areas like dealing with banks, said Silvers, who has also served as a member of the SEC Investor Advisory Committee and vice chair of the Troubled Asset Relief Program (TARP) Commission.

“If the company is playing fast and loose with its finances the CFO is almost certainly a participant in the questionable conduct,” he said.

The CFO’s role in legal matters is also considerable because they’re the one who has to sign the financial statements, not the general counsel, Silvers said.

Bottom line: Although CFOs aren’t expected to make legal decisions, they don’t have the luxury of taking a “don’t ask, don’t tell” approach, because the financial and legal sides of complex issues are intertwined, and they risk becoming a participant in the questionable conduct.