Dive Brief:

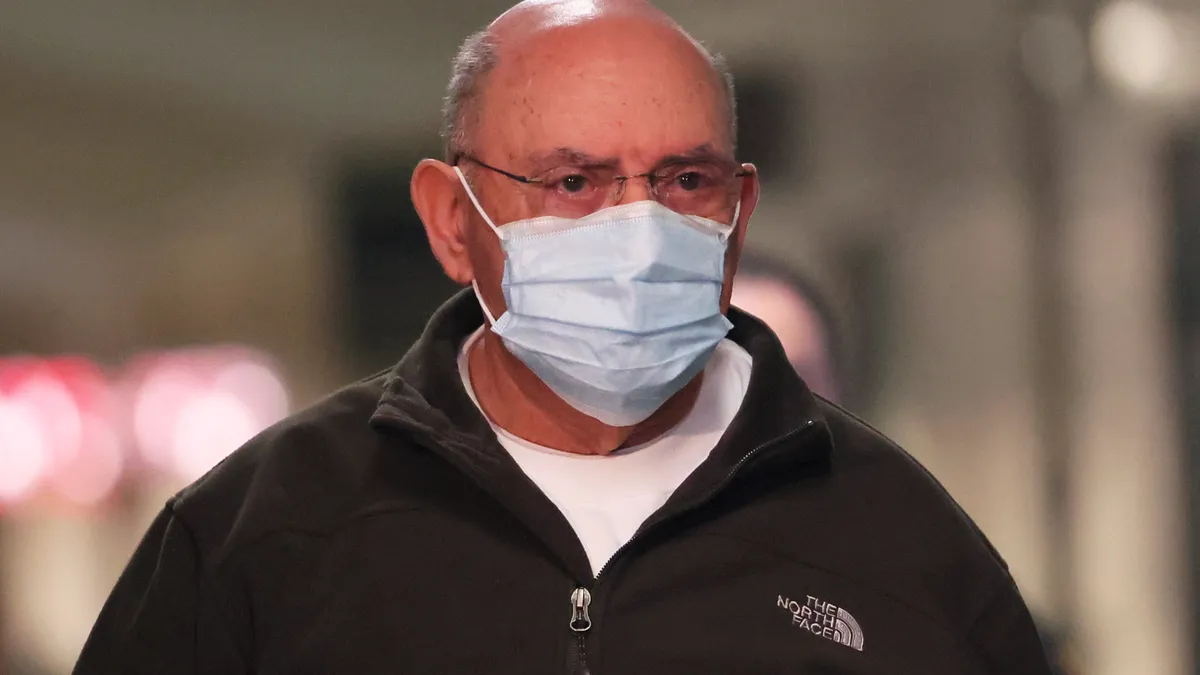

- Allen Weisselberg, the former CFO of the Trump Organization, was sentenced Tuesday by a Manhattan court to five months in jail for tax crimes, according to a release from Manhattan District Attorney Alvin L. Bragg, Jr.’s office. The sentencing is in line with a plea agreement reached by the financial executive and the Manhattan district attorney’s office, according to Weisselberg’s defense attorney Nicholas Gravante Jr.

- The sentencing follows after Weisselberg’s appearance as the Manhattan DA’s star witness during the trial of the Trump Organization, as planned under his plea agreement. Weisselberg is expected to immediately report to Rikers Island in New York City to begin the serving of his sentence.

- Gravante said in a statement on the courthouse steps that the former financial executive entered the court ready to begin his sentence, and that he “deeply regrets the lapse in judgment that resulted in his conviction.” As well as expressing regret for causing pain to members of his family, Weisselberg also regrets “the harm his actions have caused to the Trump Organization and members of the Trump family,” Gravante said.

Dive Insight:

Gravante expects Weisselberg will serve just 100 days in Rikers, approximately 50 days shorter than the agreed upon five month sentence, with the expectation of good behavior, he wrote in response to questions.

“Never had a 75 year-old accountant act up in prison. I promise you it will be 100 days max,” Gravante wrote.

Weisselberg pled guilty in August to 15 charges relating to the design and operation of a scheme by the Trump Organization to defraud New York City and state tax authorities as well as to evading taxes. As part of his plea agreement, Weisselberg agreed to serve the five months at Rikers Island as well as five years of probation, which was contingent upon his truthful testimony in the Trump Organization’s criminal trial.

Two Trump Organization entities were convicted in December of engaging in tax fraud and other crimes for over a decade by a Manhattan jury, according to a report by Bloomberg. The financial cost of the verdict is not expected to be substantial, but the decision could lead to other pitfalls both for the organization and for its owner, former President Donald Trump.

The two Trump Organization entities are set to face sentencing on Friday, with the sentence carrying a maximum fine of $1.6 million.

Weisselberg denied the former president had awareness of the scheme while it was happening during his testimony, but prosecutors argued during closing that this was not the case and that Trump was “explicitly sanctioning tax fraud,” according to a report by the New York Times.

In his August plea allocution, Weisselberg admitted that in his role as CFO he engaged in the scheme — which evaded income tax via the hiding of compensation — for the Trump Organization between 2005 and June 30, 2021, according to an August press release from the Manhattan DA’s office.

“In Manhattan, you have to play by the rules no matter who you are or who you work for,” Bragg said in a statement released by the DA’s office Tuesday regarding Weisselberg’s sentencing. Weisselberg admitted in court that he had carried out a tax scheme for over a decade which had enriched himself and provided benefits for the companies, Bragg said in the statement. “Now, he and two Trump companies have been convicted of felonies and Weisselberg will serve a jail sentence for his crimes. These consequential felony convictions put on full display the inner workings of former President Trump’s companies and its CFO’s actions,” he said.

The Trump Organization failed to withhold income taxes on wages, salaries, bonuses and other compensation paid to both Weisselberg and other employees of the company, according to the DA.

Weisselberg also admitted to failing to report $1.76 million in benefits to tax authorities, unreported benefits which included a Manhattan apartment, cars and private-school tuition for his grandchildren as well as cash and apartment furnishings. As well as his truthful testimony, Weisselberg was also required to repay $1.99 million in taxes, penalties and interest as part of his plea agreement.

The Trump Organization did not respond to requests for comment.

Editor’s note: Maura Webber Sadovi contributed to this story.