Dive Brief:

- Ubisoft executive leadership declined to comment directly on a rumored potential buyout of the video game platform by Tencent Holdings in a Thursday conference call, which largely failed to impress investors looking for clarity regarding the company’s future direction. The call came after the Assassin’s Creed creator also announced on Thursday that it had “appointed leading advisors to review and pursue various transformational strategic and capitalistic options to extract the best value for stakeholders,” Ubisoft said in its Jan. 9 update.

- During the call, a Morgan Stanley representative noted the language in the update was “vague,” and pressed for more details surrounding both the stated goals whether there was a proposal in the works surrounding the company’s reported talks with Tencent.

- Both Ubisoft CEO and co-founder Yves Guillemot along with CFO Frederick Duguet were guarded in their answers on the call. “We are currently actively exploring different options, and we can’t say more,” Guillemot said in response to the question regarding a proposal. “Of course we won’t comment on specific rumors that we’ve seen in the market, but we are convinced there are several potential paths to generate value from Ubisoft assets and franchises. We will inform the market if and when a transaction materializes.”

Dive Insight:

Duguet, a 15-year veteran of the company, stressed the health of Ubisoft’s balance sheet during the call, pointing to its cost reduction plans and new partnership and franchise opportunities. The Paris, France-based company is now expecting to see more than “€200 million in reduction of its fixed cost base by FY2025-26 vs. FY2022-23 on an annualized basis,” it said in its Thursday update.

However, both Duguet and Guillemot skirted multiple queries for clarity about the company’s potential future strategies — when asked for more details surrounding the focus of the strategic advisors appointed by Ubisoft, leadership only commented that the advisors had started work without elaborating further.

Ubisoft declined to comment further in an emailed statement sent to CFO Dive, reiterating their review of “transformational” options and noting “no comment will be made until this review has been completed.”

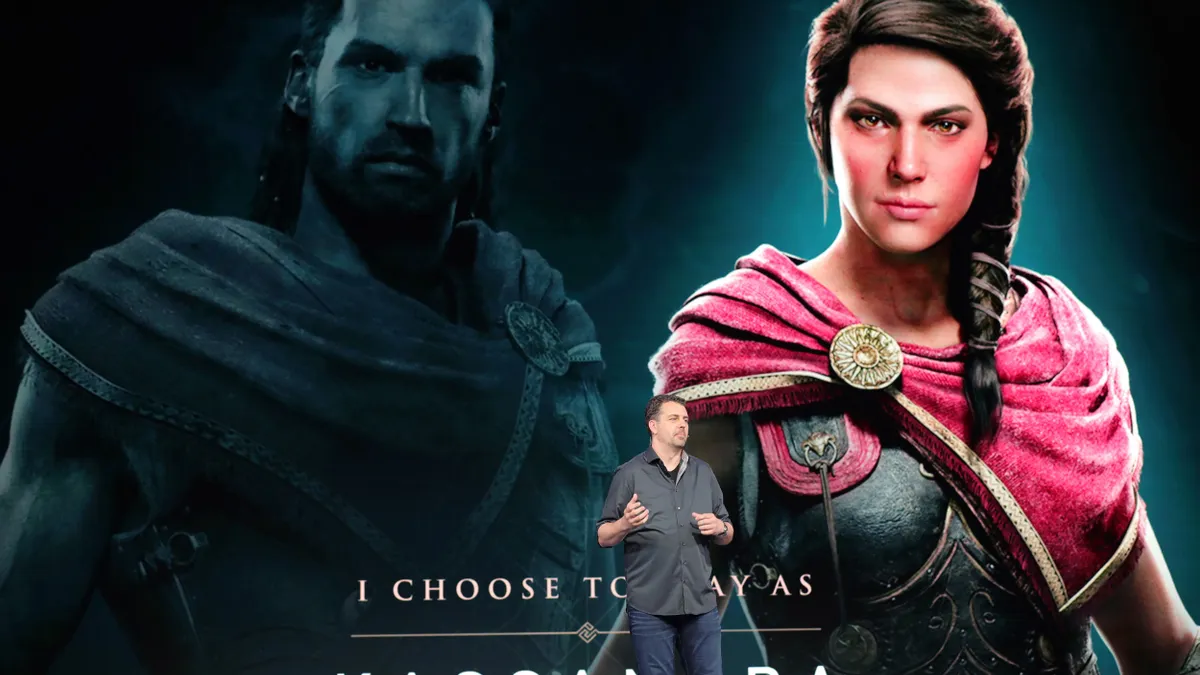

The update follows after Ubisoft shares fell to a 10-year low in 2024 in the face of declining sales and a disappointing roster of new games, with the company also pushing back the release date of key games such as the next installment of its popular Assassin’s Creed franchise last year. Ubisoft once again pushed back the launch of its Assassin’s Creed Shadows game on Jan. 9, with a targeted launch date now of March 20.

The company’s founders, the Guillemot family, have mulled several potential steps in the face of ongoing cost pressure and pushback by both investors and the players of its games, including the potential buyout by Tencent or a bid to take the company private, Bloomberg reported in October, citing people familiar with the matter. Such strategies have also drawn comment from investors — AJ Investments, an activist investor which owns less than 1% of Ubisoft, said it had garnered the support of 10% of the video game maker’s shareholders in favor of a potential sale, according to a September report by Reuters.

In an open letter to Ubisoft at the time, the activist investor urged the board to “consider taking Ubisoft private, with Tencent as a significant partner and shareholder.” However, AJ Investments also lambasted current company leadership in the letter and called for the appointment of a new CEO.

“We believe that Guillemot family and Tencent are discounting [the] potential value of Ubisoft in order to buy more shares” at the lower valuation and to take control of the company, the activist investor said.

A Chinese multimedia company with a market cap over $3 trillion, Tencent owns approximately 9.2% of the net voting rights for Ubisoft, according to its most recent annual report published June 2024. Tencent also maintains a minority stake in Fortnite owner Epic Games and operates a gaming platform of its own known as Riot Games, according to a December Reuters report.