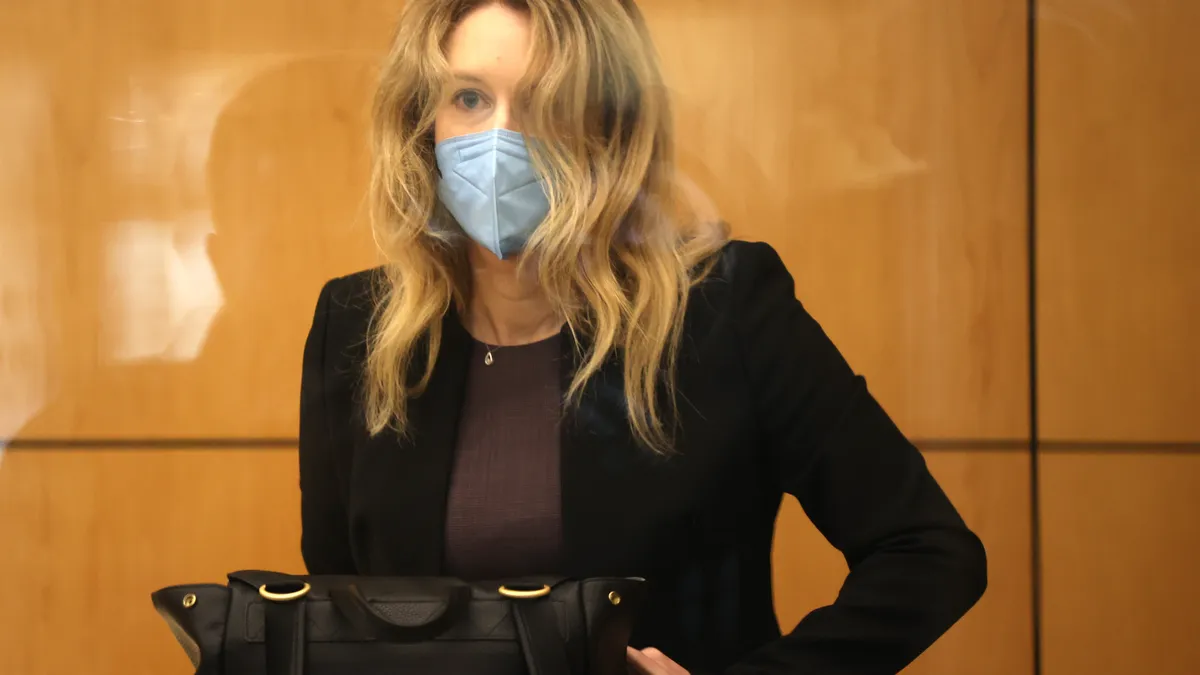

When a jury convicted former Theranos CEO Elizabeth Holmes on January 3 on four counts of fraud, it laid bare what happens when investors gloss over the importance of due diligence in their rush to be part of the next big thing – but it also showcased the importance of the CFO in keeping a company grounded to reality.

Theranos, the blood-testing technology company that was once the darling of Silicon Valley, had one CFO in its 15 years as a business, Henry Mosley, a finance veteran who was fired from the company in 2006 after being in the seat only eight months.

Mosley had gotten his start at Intel and later ran the finance operations at four technology companies, taking two of them public before joining Theranos, according to a 2018 book on the company by former Wall Street Journal reporter John Carreyrou.

Mosley joined Theranos in part because of the high caliber of its executives, many of them technology veterans who had been involved in some of Silicon Valley’s biggest success stories, according to the book, "Bad Blood: Secrets and Lies in a Silicon Valley Startup."

But he didn’t last long. Holmes fired him after he expressed concern that the company, as part of a pattern, had faked test results it had shown to Novartis, the Swiss pharmaceutical giant that was thinking about becoming an investor. “We can’t keep doing that,” he told her, according to Carreyrou.

“Elizabeth’s expression suddenly changed,” Carreyrou said in the book. “Her cheerful demeanor of just moments ago vanished and gave way to a mask of hostility. It was like a switch had been flipped. She leveled a cold stare at her chief financial officer. ‘Henry, you’re not a team player,’ she said in an icy tone. ‘I think you should leave right now.’”

Mosley was never replaced. Besides Holmes, the company’s only other senior executive from that point on was Ramesh Balwani, its president and COO, who faces his own criminal charges.

Guilty verdict

Holmes started Theranos in 2003 when she was a 19-year-old Stanford dropout. In its verdict this week, the jury found her guilty of three counts of wire fraud against individual investment firms, including Lakeshore Capital Management, which gave the company $100 million, and PFM Healthcare Master Fund, which gave it $38 million. She was also convicted on one charge of conspiracy to commit wire fraud against investors.

Both the trial and a 2018 agreement that Theranos entered into with the Securities and Exchange Commission (SEC), to settle earlier fraud charges, suggest investors failed to do the kind of due diligence that would be expected of them in equity deals of Theranos' scale.

Wade Miquelon, CFO of Jo-Ann Stores who was CFO of Walgreens when it entered into a 2013 agreement with Theranos to operate in-store testing sites, said during the trial Walgreens never tested Theranos’ main product, a blood-testing device called Edison, before agreeing to pay the company a $100 million innovation fee and take an ownership interest with a $40 million equity investment.

In the absence of that due diligence, he indicated during the trial, he was surprised to learn the company was using outside technology to do much of its testing.

“My understanding is, the blood would be tested on the Edison device,” he said, according to the Washington Post.

Lack of due diligence

Walgreens wasn’t the only investor that didn’t independently verify company claims.

In a New York Times report, even sophisticated funds putting in tens of millions of dollars did so on faith, in part because of investment agreements giving Holmes the right to decide who would be in, and who would be out, the next time the company raised capital.

“We were very careful not to circumvent things and upset Elizabeth,” said Lisa Peterson, an advisor who managed a $100-million investment in the company by the DeVos family, heirs to the Amway fortune. “If we did too much, we wouldn’t be invited back to invest.”

Black Diamond Ventures, which put some $7 million into the company, reportedly never pushed back when Theranos kept its finances closed to them on the grounds the books contained proprietary information.

A leak could “give competitors a chance to crush the company,” said Christopher Lucas, the head of Black Diamond, who shared in his testimony the company’s rationale for keeping its books closed.

Warning signs

Over its roughly 15 years, the company attracted almost $1.5 billion in capital, much of it from some of the most experienced investors in Silicon Valley, including a $100 million credit line in 2017 from Softbank-funded Fortress Investment Group, which took a 4% equity stake. Softbank is the largest tech investor in the world, with a war chest of more than $100 billion in two capital funds.

Although investors took a risk by not doing the level of due diligence expected of business deals of the scale Theranos represented, the absence of a CFO to help enforce financial, operational and compliance discipline played a role as well, according to a commentary by purchasing platform company Teampay.

“Without a CFO, Theranos’ finances became ever more divorced from the front the company showed to the world,” the commentary says. “This fiction culminated in 2014 when Theranos issued a projection claiming $1 billion in revenue in 2015, a number that was absurdly unreasonable given that its revenue in 2014 was around $100,000 and its contracts were shrinking rather than growing.”

The gap between appearance and reality, which Mosley tried to close before he was fired, is ultimately what brought down the fast-growing company.

“The lack of CFO should have been a warning sign to investors that all was not right,” the commentary says. “The company’s exciting potential was enough to sway investors into contributing a total of $1.4 billion. The vast majority of that money was invested after Holmes fired the company’s one and only CFO.”