Dive Brief:

-

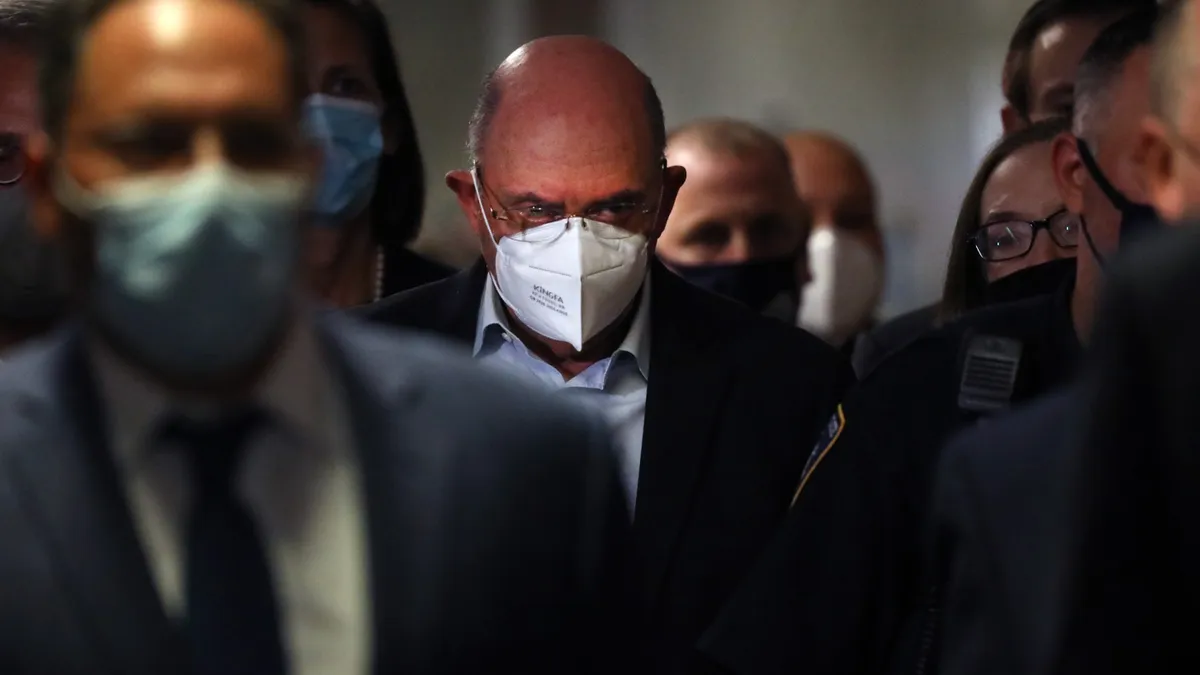

Following his indictment earlier this month on tax fraud, Trump Organization CFO Allen Weisselberg has been removed by the company from the leadership team at a number of its subsidiaries.

-

Weisselberg’s removal follows discussions of removing him from each of his duties, responsibilities and possibly his CFO title, sources told the Wall Street Journal.

-

State business records show one of the companies charged in Weisselberg’s criminal case, Trump Payroll Corporation, originally listed him as its treasurer, director, vice president and secretary. Now, former President Trump’s son, Donald Trump Jr. , is listed as executive vice president, director, secretary, treasurer and vice president, and Eric Trump is listed as president, director and chairman.

Dive Insight:

Since Weisselberg’s grand jury indictment earlier this month, among dozens of other roles, he has lost his director position at Trump International Golf Club Scotland Limited. Annual reports for two other Florida-based Trump Organization entities, DJT Holdings and DT Marks Jupiter, were amended Friday to remove Weisselberg as vice president, treasurer and secretary, the Journal found.

Weisselberg and the Trump Organization were accused of running a tax-fraud scheme since at least 2005 that used off-the-books payments and bonuses to reduce payroll and income tax liability. Both Weisselberg and the Trump Organization pleaded not guilty and their lawyers have said they plan to fight the charges.

The case brought the first criminal charges of the New York District Attorney’s probe of former President Trump’s business affairs, which has been underway since 2018.

Daniel Zelenko, a former federal prosecutor, told the Journal that keeping Weisselberg in his roles at the subsidiaries after being indicted is a generally unrealistic approach. “How are insurers and lenders going to rely on what the CFO tells them?” he said. “It creates a lot of challenges for a company continuing to do business.”

Alan Futerfas, a lawyer for Trump’s company, called the charges against the company and Weisselberg “unprecedented,” adding that civil tax authorities typically revolve such compensation cases without turning to criminal prosecution. Futerfas said the investigation is “not appropriate and is unjustified,” and “if the name of the company was something else [besides Trump], I don’t think these charges would’ve been brought. In fact, I’m fairly certain.”

During last week’s trial, New York District Attorney General Counsel Carey Dunne said the case involved a “sweeping and audacious illegal payments scheme,” in which Weisselberg demanded company records “be deleted to conceal his participation in this scheme, with the knowledge of the company, yet he remains to this day [its] most senior financial fiduciary.”

If convicted of his top charge, second-degree grand larceny, Weisselberg, a long-time Trump family confidant, faces a prison sentence of up to 15 years.