What if you had a trove of fresh valuation data and strategic insights at your fingertips when making decisions about investing in your company’s future? If you’ve completed a goodwill impairment valuation, you are likely sitting on a gold mine of information that may not be realizing its full potential.

With the recent decision by US regulators to abandon plans to scrap mandatory goodwill impairment valuations, goodwill assessments are here to stay. CFOs and their teams that use the process as an input for strategic decision-making can obtain significant competitive value from the exercise.

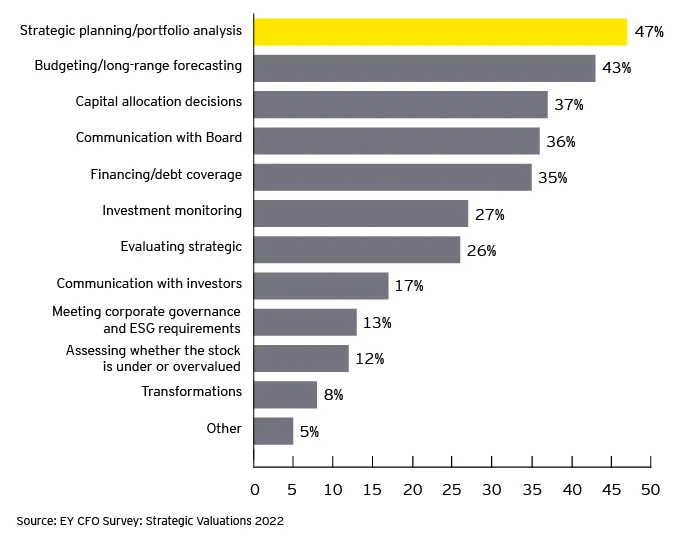

In the EY CFO Survey: Strategic Valuations 2022, 150 CFOs surveyed found that the three most important internal uses for valuations are strategic planning and portfolio analysis (47%), budgeting and long-range forecasting (43%) and capital allocation decisions (37%). [Figure 1]

Figure 1

Q: For which internal purposes do you currently use goodwill impairment valuations? (select up to 4)

Goodwill impairment valuations can help you:

-

Hold strategic conversations about the company’s business portfolio, including deciding which businesses warrant additional investments and which may be candidates for fixing or divesting

-

Use reporting unit valuations, as well as supplementary valuations of segments, divisions and lines of business, to impose and guide governance on investment decisions

-

Communicate the company’s capital allocation strategy internally and externally

-

Obtain insights from the long-range forecast, particularly when involving strategy and financial decision-makers in the review

To get the most from your goodwill valuations, you should commit to the following:

Get strategic: Don’t underestimate or overlook the insights that valuations can provide. Goodwill impairment valuations can help you examine and think critically about your company’s business portfolio, enhance your capital allocation strategy, obtain long-range insights from your forecast, gain a perspective of relative performance to peers and divest when necessary.

Take your time: A common pitfall is to rush through the process, stopping when it’s clear that goodwill isn’t impaired. However, some additional work could deliver significant value by unlocking insights and learnings that would otherwise be overlooked.

Seek objective technical help: The EY survey shows that CFOs who use third-party valuation providers find significant value in their technical expertise (58%), market data and perspectives (49%) and the objectivity of an outside provider (38%). The survey also finds the biggest challenges in preparing valuations internally are the subjectivity of key assumptions (65%), lack of people (58%) and availability of consistent data (56%).

A third-party valuation can help address the skills-and-resources gap as well as provide an independent perspective that can help eliminate influence from internal biases in a full portfolio review process. Multidisciplinary advisors can also leverage the analysis to help determine the impact of entry into new businesses and markets, working capital efficiencies and a wide range of operational and restructuring considerations.

The following EY case studies demonstrate where CFOs have leveraged goodwill valuations beyond a compliance exercise:

Biotech: forecasting to understand growth drivers

A biotech company acquired a non-core technology business that had a software platform designed to improve brand loyalty. Management struggled to understand its performance drivers compared to their core business. As the software business was a separate reporting unit, the company used the forecast and insights developed for goodwill impairment testing to monitor their acquisition’s performance and built accountability within the organization. The free cash flow detail also enabled the CFO to communicate important capital needs and ROI information to the board.

Software: gaining visibility for capital allocation

The CFO of a leading technology client leverages the goodwill impairment process to support strategic planning and portfolio analysis across the enterprise. The company brings business unit leaders together with functional leaders in strategy, finance, accounting and the C-suite for value-based discussions that help inform strategic and capital planning decisions. This example is a leading practice. Often, too few senior leaders in organizations understand the relative value distribution of the enterprise across businesses. By leveraging goodwill impairment procedures, companies can align leaders on which businesses drive value for the enterprise and enable them to use this lens when making decisions.

Summary

By taking your time and bringing in objective help, you can help ensure that your organization will reap the myriad benefits of a thorough goodwill impairment valuation. Valuation analysis can help management with strategic planning, long-range forecasting, capital allocation and communication with investors and the board. When you combine strategic insights with quality data and analytics, you will position yourself to unlock long-term value by enabling critical thinking about capital structure, share buybacks, capital allocation and other essential finance functions.

For more resources and guidance on corporate finance strategy, visit EY Corporate finance consulting.

Daniel Burkly, Ryan Citro and Jessica Shaw are principals in Strategy and Transactions at Ernst & Young LLP.

The views reflected in this article are those of the authors and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.