Business leaders who were anticipating that their enterprises would have to pay less interest on debt this year may have to rethink their company finances amid falling rate-cut expectations.

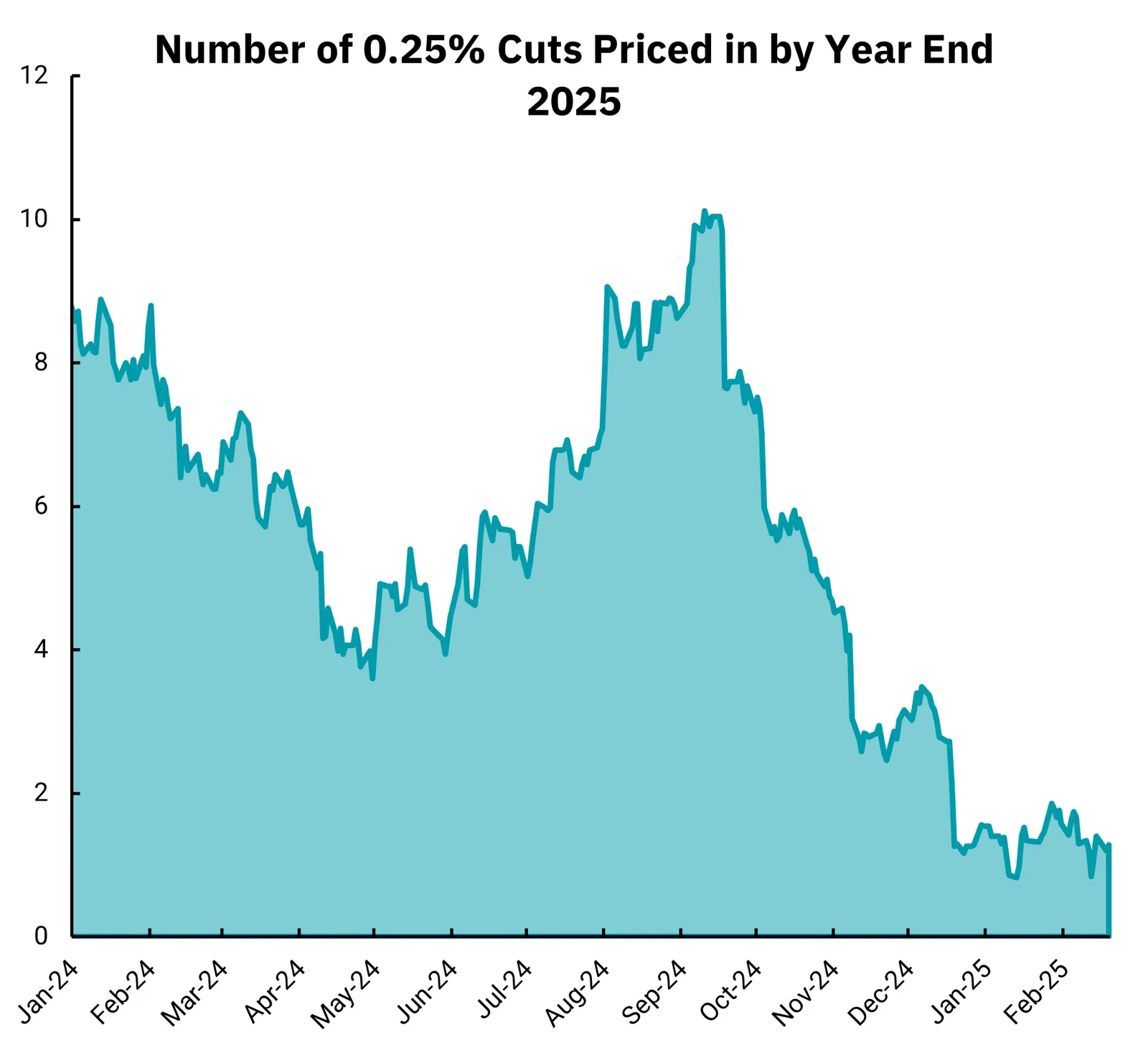

That’s as there has been a clear decline in the number of rate cuts expected out of the Federal Reserve by the end of this year. In September 2024, markets were pricing in as many as 10 rate cuts in 2025, with a rate cut defined as a drop of 0.25%, or 25 basis points. In February 2025, expectations had dropped to as few as one or two cuts by year-end. This projected decline in rate cuts can dramatically affect businesses that are carrying shorter-term debt, as opposed to large corporations that were able to take out 30-year corporate bonds when interest rates were low.

“It’s the smaller companies without access to capital markets that may be paying more interest on debt now because they likely had to take out floating-rate loans,” said David Anderson, corporate banking manager for BOK Financial®.

Is it time to redefine a ‘neutral’ rate?

However, that’s not to say that debt-laden businesses have not gotten any relief. The Fed has already reduced rates by 1%, or four cuts of 0.25% each. In fact, their first move to start lowering rates in September 2024 amounted to two rate cuts, as they lowered rates by 0.5%, or 50 basis points, at that meeting. They followed that action with additional rate cuts of 25 basis points at their November and December meetings.

Looking forward, experts predict the total number of expected rate cuts by considering how many times the Fed has lowered rates already and the ultimate rate at which they think the Fed will stop lowering rates.

“The fact that we are now expecting only between one and two more rate cuts means there has been a significant shift in the projected terminal rate—that is, the interest rate where the Fed is neither restrictive nor stimulative in monetary policy,” Anderson said. “It is also called the ‘neutral rate.’”

However, the jury is still out on what that neutral rate actually is, especially given how resilient the U.S. economy—particularly the U.S. job market—remained during the Fed’s rate-hiking cycle, experts said. This strong economic data might indicate that the Fed’s current monetary policy may not be as restrictive as once thought, so they might not need to cut rates nearly as much to be ‘neutral.’

What this means for businesses

If the Fed is not going to lower rates as much as what was once anticipated, then borrowing costs will remain higher for companies. However, this does not mean that business leaders’ hands are tied. Instead, building a multifaceted relationship with their financial services firm and fostering a close relationship with their bankers can help build trust on both sides of the relationship.

“If there’s an issue, you have to be confident that you and your banker are going to work through it together,” Anderson said.

BOK Financial® is a trademark of BOKF, NA. Member FDIC. Equal Housing Lender . © 2025 BOKF, NA.