Compliance: Page 19

-

House Republicans target SEC climate risk rule

Having taken control of the U.S. House, Republicans are redoubling efforts to thwart the Biden administration’s sustainability initiatives.

By Jim Tyson • Feb. 6, 2023 -

Audit committee job creep taking its toll

With internal audit committees biting off more than they can often chew, committee members across businesses are feeling the burnout.

By Elizabeth Flood • Feb. 3, 2023 -

Activision Blizzard to pay SEC $35M for alleged disclosure flaws

The video gaming company has been the target of regulatory scrutiny since allegations of sex discrimination surfaced in 2018.

By Jim Tyson • Feb. 3, 2023 -

Accountants may underestimate impact of Fed tightening: survey

“Further monetary tightening appears inevitable,” the ACCA and IMA said as the Federal Reserve prepared for a two-day policy meeting beginning Tuesday.

By Jim Tyson • Jan. 30, 2023 -

Ex-Pfizer CFO talks tactics for first-timers

Frank D’Amelio, a veteran finance chief, says being ‘a player on the field’ is key for success during unpredictable times.

By Elizabeth Flood • Jan. 30, 2023 -

FASB poised for another crypto vote

The FASB is on track to issue proposed new standards for cryptocurrency by April. The implosion of crypto exchange FTX is likely to sharpen scrutiny of the project.

By Maura Webber Sadovi • Jan. 27, 2023 -

Companies face data privacy maze, skills gap

CFOs could be under increased pressure this year to focus on privacy, as new state laws come into effect.

By Alexei Alexis • Jan. 27, 2023 -

CFO FP&A Close-up: finance function’s ‘octopus’

Between intergenerational differences and specific skillsets, CFOs need to get a handle on how FP&A execs operate.

By Elizabeth Flood • Jan. 27, 2023 -

Auditors dialed back mandated disclosures: study

The study found that auditors pulled back on their disclosures of potentially negative financial matters as companies adjusted to new reporting requirements.

By Maura Webber Sadovi • Jan. 26, 2023 -

Several states cut corporate tax rates for 2023

Many states are competing for businesses by reducing corporate tax rates as of Jan. 1, the Tax Foundation said.

By Jim Tyson • Jan. 25, 2023 -

Twitter headquarters landlord files unpaid rent suit

The suit filed against Twitter comes as a surge of tech firms have announced massive layoffs along with plans to trim real estate costs.

By Maura Webber Sadovi • Jan. 24, 2023 -

Tyson CFO pleads guilty to trespassing, intoxication charges: report

John Randal Tyson pleaded guilty to charges of public intoxication and trespassing. The move marks a change from one month earlier when he pleaded not guilty.

By Elizabeth Flood • Jan. 24, 2023 -

SMEs fall behind on addressing climate change

A readiness gap is emerging between small and large companies in terms of their responses to climate change risks.

By Elizabeth Flood • Jan. 20, 2023 -

How CFOs can come to terms with pay transparency

Pay range disclosure mandates are on the rise. Finance leaders need to understand how these laws can both help and hurt them.

By Elizabeth Flood • Jan. 19, 2023 -

FASB mulls two new software accounting options

The project to improve software accounting standards is a long time coming. At least one element of the current standards has remained largely unchanged since 1985.

By Maura Webber Sadovi • Jan. 19, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

US to jack up fees for big mergers

Filing fees are expected to soar this year and companies will need to prepare for increased regulatory scrutiny of M&A deals.

By Alexei Alexis • Jan. 18, 2023 -

SEC aims to set climate risk, cybersecurity rules before May

The agency, laying out an ambitious agenda, aims in early 2023 to complete several new regulations, many of them focused on increasing disclosures for investors.

By Jim Tyson • Jan. 17, 2023 -

‘Scope creep’ challenging audit committees: CAQ

Audit committees are taking on more responsibilities as the SEC writes several rules requiring more detailed corporate disclosure.

By Jim Tyson • Jan. 13, 2023 -

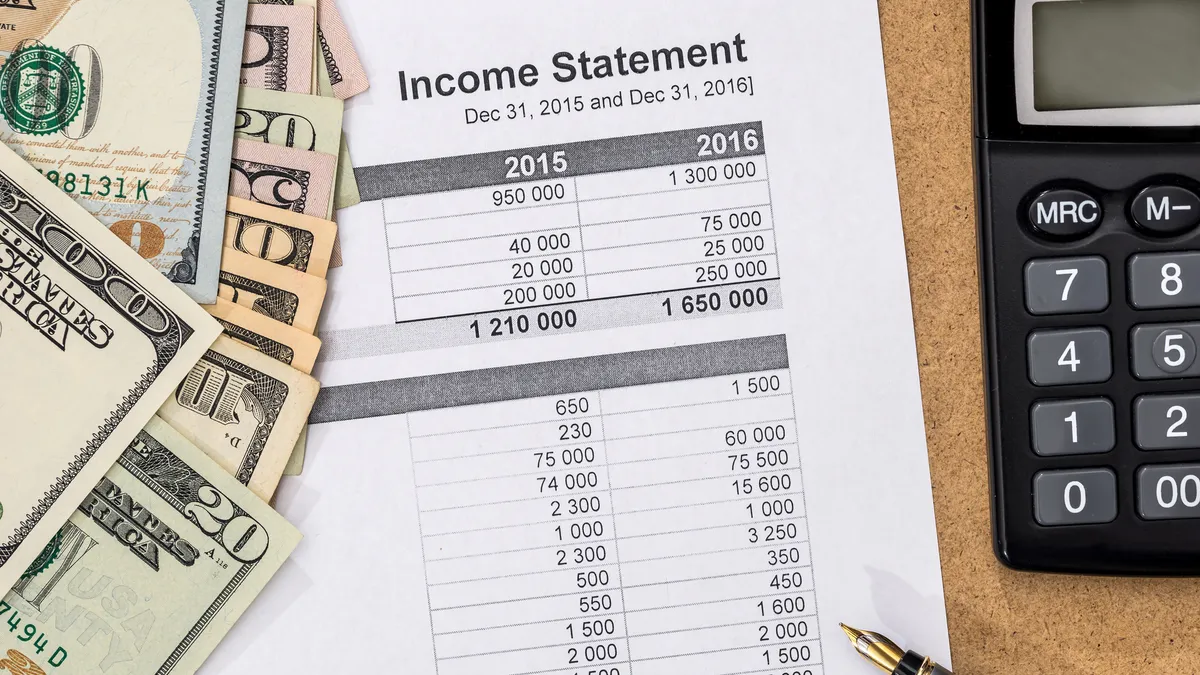

FASB decides to require expense disclosures

For investors, the new income statement disclosure project is the FASB’s most important initiative “by a factor of ten,” one board member said. But it will mean added costs for companies.

By Maura Webber Sadovi • Jan. 11, 2023 -

Trump ex-CFO sentenced to five months for tax fraud

The sentencing comes about one month after a jury convicted two Trump Organization affiliates of tax fraud and other crimes. The company’s former CFO testified for the prosecution during the trial.

By Grace Noto • Jan. 10, 2023 -

FASB continues push for corporate expense disclosures

As the FASB kicks off its first meeting of the new year Wednesday, the U.S. standard setter faces external pressure to step up the pace of its process.

By Maura Webber Sadovi • Jan. 9, 2023 -

Deep Dive

4 CFO trends to watch in 2023

Fed efforts to curb inflation, an imbalance in the demand and supply of workers and clarification of accounting standards are among the CFO trends this year.

By Jim Tyson , Maura Webber Sadovi • Jan. 6, 2023 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Non-competes would be illegal under FTC’s proposed rule

If finalized as written, both new and existing non-competes, along with some non-disclosure agreements, would be banned as unfair practices that harm competition.

By Robert Freedman • Jan. 5, 2023 -

SEC charges ex-CFO at gold mining SPAC with $5M fraud

The embezzlement allegations follow the collapse of the SPAC market in 2022 and sharper SEC scrutiny of the so-called blank check companies.

By Jim Tyson • Jan. 4, 2023 -

IRS delivers ‘crucial guidance’ on 15% minimum tax

The interim guidance gives tax preparers some key directions for interpreting the 15% Corporate Alternative Minimum Tax. But more questions remain, experts say.

By Maura Webber Sadovi • Jan. 3, 2023