Compliance: Page 28

-

Workers gain clout during pandemic: Gallup

CFOs face pressure to raise wages as the number of job vacancies far exceeds the number of unemployed people looking for work.

By Jim Tyson • Aug. 31, 2022 -

How adopting OKRs can help CFOs through a recession

When it comes to setting a company’s objectives, less is more, advises Gtmhub Vice President Jenny Herald.

By Elizabeth Flood • Aug. 29, 2022 -

Trendline

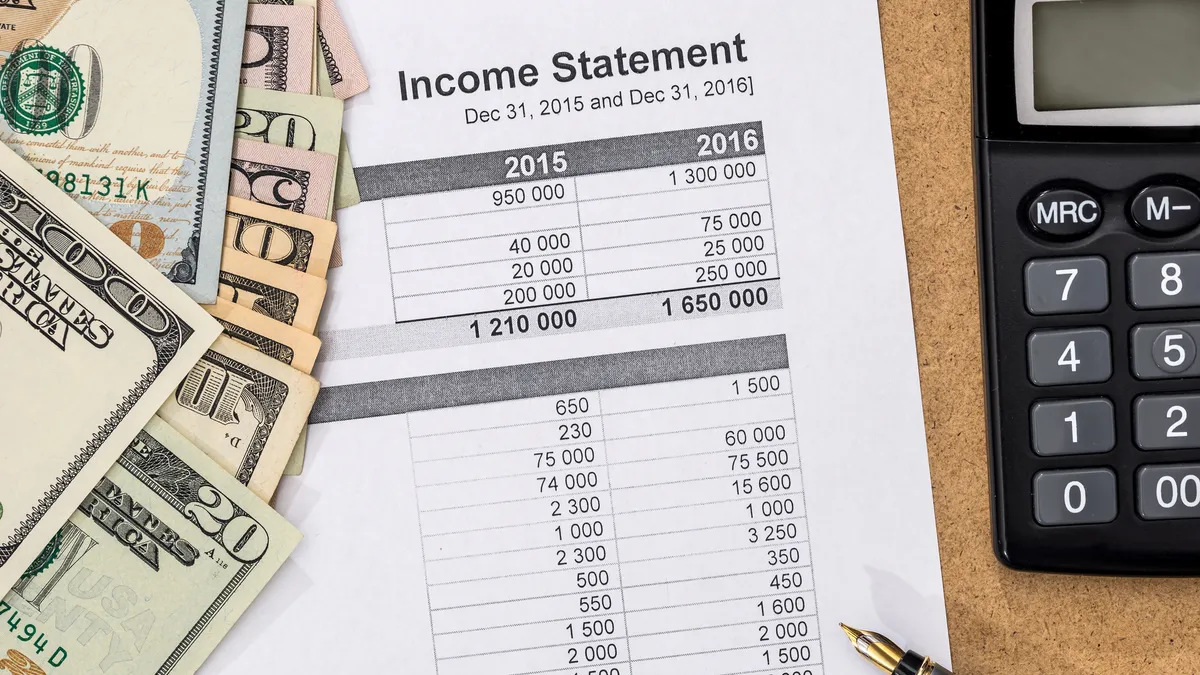

Financial reporting enters a new age

Finance leaders are increasingly relying on metrics including churn, net promoter score and customer growth to reveal company performance in a way traditional GAAP measures cannot.

By CFO Dive staff -

SEC boosts incentives for whistleblowers

The SEC awarded a record $564 million to 108 whistleblowers last year and receives dozens of tips of wrongdoing each day.

By Jim Tyson • Aug. 29, 2022 -

PCAOB, Chinese authorities reach deal as delisting threat looms

SEC Chair Gary Gensler cautioned that foreign issuers that want access to U.S. public capital markets must be on a level playing field with U.S. firms.

By Maura Webber Sadovi • Aug. 26, 2022 -

SEC adopts pay-versus-performance disclosure rules

The rule, revived from a 2015 proposal, requires companies to include a table tracking both executive compensation and financial performance indicators for a five-year period.

By Grace Noto • Aug. 26, 2022 -

Fitch sees ‘modest’ tax headwind from Inflation Reduction Act

Fitch’s assessment comes as CFOs, accountants and tax-preparers are just beginning to grapple with the Inflation Reduction Act’s tax implications.

By Maura Webber Sadovi • Aug. 24, 2022 -

M&A sparked by ESG surges 111% in H1 2022

Pressure for sustainability disclosure is fueling dealmaking targeted at providers of ESG software and services, Hampleton Partners said.

By Jim Tyson • Aug. 24, 2022 -

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "The Apex Building" [Photo]. Retrieved from Wikimedia Commons.

Twitter whistleblower claims may bolster federal privacy push

Bipartisan efforts to protect consumer information may gain momentum following allegations that Twitter failed to safeguard private data.

By Jim Tyson • Aug. 23, 2022 -

FASB calls for comments on tax credit change

The move marks another step toward simplifying accounting rules related to Renewable Energy Tax Credits and several other credit programs.

By Maura Webber Sadovi • Aug. 22, 2022 -

CFOs-turned-CEOs have ‘worse outcome’

CFOs turned CEOs must “let go” of finance so they can become stronger in other areas like investments and innovation, experts say.

By Elizabeth Flood • Aug. 18, 2022 -

Former Trump CFO pleads guilty in tax scheme

At the core of the charges that Trump Organization executive Allen Weisselberg pleaded guilty to Thursday is a scheme to evade income taxes by hiding compensation.

By Maura Webber Sadovi • Aug. 18, 2022 -

SEC backs tougher rules for audits involving multiple firms

SEC Chair Gary Gensler hailed efforts to avert significant errors in audits by multiple firms, including mistakes in the calculation of revenue and measurement of fair value.

By Jim Tyson • Aug. 16, 2022 -

AICPA warning on 15% tax timeline goes unheeded

CFOs at companies on the threshold of being subject to the new tax will also need to familiarize themselves with the complex rules.

By Maura Webber Sadovi • Aug. 15, 2022 -

Bankrupt Celsius pulls bid to hire ex-CFO

Cryptocurrency firm Celsius pulls motion to tap its former CFO as a bankruptcy advisor following legal objections filed from investors.

By Grace Noto • Aug. 8, 2022 -

Just 9% of finance departments have primary ESG oversight: survey

Evidence of loose internal controls related to environmental, social and governance (ESG) data comes as the potential cost of companies getting ESG reporting wrong are rising.

By Maura Webber Sadovi • Aug. 5, 2022 -

SEC should require global tax disclosure: transparency group

Spotty public disclosure by U.S. companies on foreign tax risk may erode investor confidence and increase the odds of financial market instability, according to the FACT Coalition.

By Jim Tyson • Aug. 4, 2022 -

Bankrupt Celsius, investors clash over former CFO advisory role, allege double dipping

Investors are taking steps to block Celsius from tapping former CFO Rod Bolger as a bankruptcy advisor, a bid that comes with a costly $92,000 monthly price tag for the insolvent company.

By Grace Noto • Aug. 4, 2022 -

FTC widens federal crackdown on COVID-19 scams

The Federal Trade Commission triumphed in lawsuits against companies that in early 2020 exploited the rush to combat the coronavirus.

By Jim Tyson • Aug. 2, 2022 -

PCAOB, SEC double down on full access to audits in China

The Public Company Accounting Oversight Board (PCAOB) doesn’t have the authority to remove foreign companies from U.S. exchanges but a 2020 law gives the Securities and Exchange Commission authority to do that if the PCAOB isn’t getting cooperation.

By Maura Webber Sadovi • Aug. 2, 2022 -

CFOs look for consistency, transparency in emerging sustainability requirements

CFOs globally are asking for added transparency and more consistency as regulatory bodies gear up to publish sustainability reporting standards later this year.

By Grace Noto • Aug. 1, 2022 -

Sponsored by T-Mobile for Business

Leveraging the right kinds of technology to handle communications more effectively

As companies continue to face challenges in mobile communications — from both an administrative and budget perspective — better solutions are sorely needed.

Aug. 1, 2022 -

SEC may take ‘fresh look’ at auditor conflicts of interest: Gensler

Decades after the Enron accounting scandal led Congress to direct the SEC to create stronger barriers between auditors and other parts of their firms, auditor conflicts of interest persist.

By Maura Webber Sadovi • July 28, 2022 -

Insurer Aspen switches to E&Y after accounting weaknesses surface

Aspen’s hiring of Ernst & Young follows the resignation of KPMG after the insurer identified “material weaknesses” in internal controls related to its financial reporting.

By Maura Webber Sadovi • July 27, 2022 -

Crypto firm Celsius to tap former CFO to advise on bankruptcy proceedings

Cryptocurrency firm Celsius filed a motion Monday to bring in former CFO Rod Bolger, who served in the position for five months, as an advisor as it continues through Chapter 11 bankruptcy proceedings.

By Grace Noto • July 27, 2022 -

Q&A

Unpacking crypto and FASB’s new priorities with Richard Jones

The Financial Accounting Standards Board Chair Richard Jones discussed the organization’s agenda, a possible quick fix and the accounting topic that finally trended on social media.

By Maura Webber Sadovi • July 18, 2022