Compliance: Page 31

-

ESG reporting

Corporate 'greenwashing' poses growing threat to ESG goals: report

Sustainable financing has surged since 2015 but false corporate claims jeopardize carbon reduction efforts, Generation Investment Management said in a report.

By Jim Tyson • July 21, 2021 -

CEO, CFO charged with faking revenue, bond documents

The Securities and Exchange Commission alleges the former executives of FTE, a network infrastructure company, used phony paperwork to hide the financial health of the company while spending lavishly on themselves.

By Robert Freedman • July 20, 2021 -

SPAC sponsor, merger target charged with misleading statements

Under a settlement for making inaccurate claims about the target company's technology, the sponsor must give up any founder shares it would have received from the merger, and private investment in public equity (PIPE) investors can terminate their subscription agreements before the merger.

By Robert Freedman • July 14, 2021 -

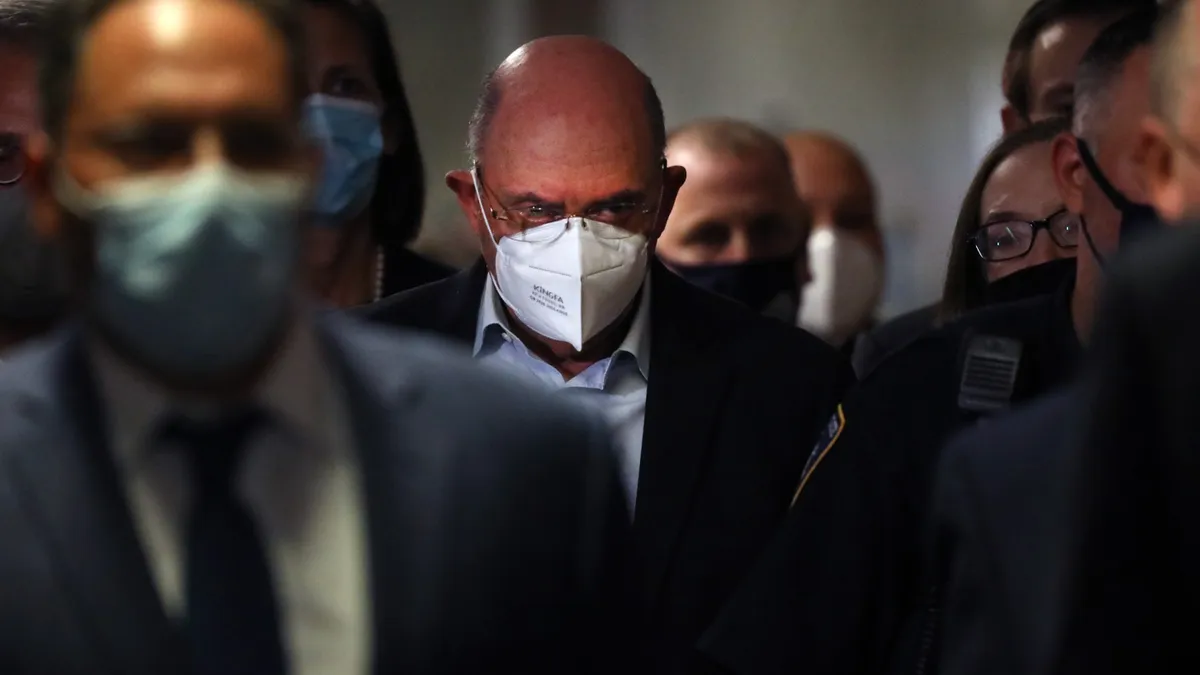

Weisselberg removed as officer of Trump Org. subsidiaries

Since Trump Organization CFO Allen Weisselberg was accused of 15 counts of tax fraud on July 1, his name has been wiped from the filings of several company subsidiaries.

By Jane Thier • July 13, 2021 -

Double set of books could prove Trump Organization's undoing

An internal spreadsheet the company kept treated expenses in one way while the expenses were treated another way in the general ledger.

By Robert Freedman • July 13, 2021 -

Finance employee charged with insider trading

The bank employee used coded words to tip off a friend about upcoming private-equity acquisitions.

By Robert Freedman • July 9, 2021 -

SEC charges Parallax for misleading pandemic disclosures

The company allegedly didn't have a COVID-19 screening test or protective equipment that it claimed to have.

By Robert Freedman • July 7, 2021 -

Business loans 'especially slow' to transition from LIBOR, posing risks: FSB

U.S. securitizations and business loans need to speed the switch to LIBOR alternatives, the Financial Stability Board said, warning of financial instability.

By Jim Tyson • July 7, 2021 -

Trump Organization faces indictment-related credit woes

Lending to the company could dry up, leaving it vulnerable with $1B in loans coming due.

By Robert Freedman • July 6, 2021 -

U.S. gains support for 15% minimum global corporate tax from 130 countries

A 15% minimum global corporate tax will discourage companies from locating headquarters in the lowest-tax nations, according to Treasury Secretary Janet Yellen.

By Jim Tyson • July 2, 2021 -

Trump CFO, company charged with scheme to hide compensation

Among the counts against Allen Weisselberg is grand larceny in the second degree, a felony with a maximum 15-year prison sentence.

By Robert Freedman and Jane Thier • July 1, 2021 -

FASB appears ready to require supplier financing disclosure

The trade payable arrangements, which help companies manage cash, typically aren’t publicly reported despite posing a liquidity risk.

By Robert Freedman • July 1, 2021 -

Market volatility may rise on absence of clear LIBOR alternative: Fitch

A plan to wind down the use of LIBOR at the end of 2021 may lead to market instability because several reference rates are “vying” to become its successor, Fitch Ratings said.

By Jim Tyson • June 30, 2021 -

Trump Organization expected to be indicted on tax treatment for perks

The company could face going-concern issues as a result of the action even if the case goes nowhere, analysts say.

By Robert Freedman • June 29, 2021 -

Deep Dive // ESG reporting

From green to gold: 5 ways CFOs can gain from climate risk disclosure

CFOs confronting growing pressure to disclose climate change risks can find in their analysis opportunities to improve capital allocation and risk management.

By Jim Tyson • June 29, 2021 -

Whistleblowers risk getting nothing from bankrupt companies

Critics in a Wall Street Journal report point to a big flaw in one of the most important tools the Securities and Exchange Commission has to catch fraud.

By Robert Freedman • June 29, 2021 -

Bipartisan infrastructure plan: big beneficiaries, more tax enforcement

No tax hikes are contemplated to help pay for the $1.2 trillion package agreed to by Republicans and Democrats who hashed out the details.

By Robert Freedman • June 25, 2021 -

SPACs will rebound in wake of tougher oversight: Duff & Phelps

Stricter regulation will likely bolster investor confidence and spur a resurgence in SPACs, Duff & Phelps said.

By Jim Tyson • June 25, 2021 -

ESG reporting

Low-quality assurance of ESG reports pose stability risk: IFAC

Companies' attempts to back up their ESG reports with low-quality assurance has put financial stability at risk, a study by the International Federation of Accountants says.

By Jim Tyson • June 24, 2021 -

Gensler says alternative to LIBOR poses risk of manipulation

SEC Chair Gary Gensler warned of risks in replacing LIBOR with the Bloomberg Short Term Bank Yield Index.

By Jim Tyson • June 23, 2021 -

As investigation heats up, Trump CFO appears to remain loyal

Allen Weisselberg, Trump Organization's CFO of over 40 years, has been spotted entering and leaving Trump Tower numerous times in recent weeks, which the Washington Post suggests is a public signal of his loyalty to Trump.

By Jane Thier • June 22, 2021 -

Rev rec manager at hub of fraud ring, SEC says

The Securities and Exchange Commission used data analytics capabilities it launched last year to catch six people benefiting from insider information.

By Robert Freedman • June 21, 2021 -

Whistleblower plan to catch corporate tax cheats gets bipartisan push

Republican and Democratic senators seek to narrow the $630 billion annual tax gap by putting teeth into the IRS whistleblower program.

By Jim Tyson • June 18, 2021 -

Former SEC chief accountant joins real estate investment platform as CFO

Alison Staloch, former chief accountant at the SEC's investment management division, was named CFO at direct-to-investor real estate investment platform Fundrise.

By Jane Thier • June 17, 2021 -

SEC role given to critic of weak corporate governance

SEC Chair Gary Gensler appointed Renee Jones to lead the corporation finance division and tackle high-stakes rulemaking for public disclosure and investor protection.

By Jim Tyson • June 15, 2021