Compliance: Page 36

-

Healthcare company and its finance officers fined for misleading accounting

The company didn’t properly account for legal contingencies, inflating its earnings, the Securities and Exchange Commission said.

By Robert Freedman • Aug. 24, 2021 -

Photo by Alexander Suhorucov from Pexels

Most CFOs pushing internal diversity programs: PwC

Financial executives are rethinking their companies’ role in society, with 60% of them planning to advance internal programs to increase diversity, according to a PwC survey.

By Jim Tyson • Aug. 23, 2021 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineTop 5 stories from CFO Dive

The disruption of the rules-based global order means CFOs need to adjust scenario planning to the prospect of higher capital costs and greater foreign exchange risks.

By CFO Dive staff -

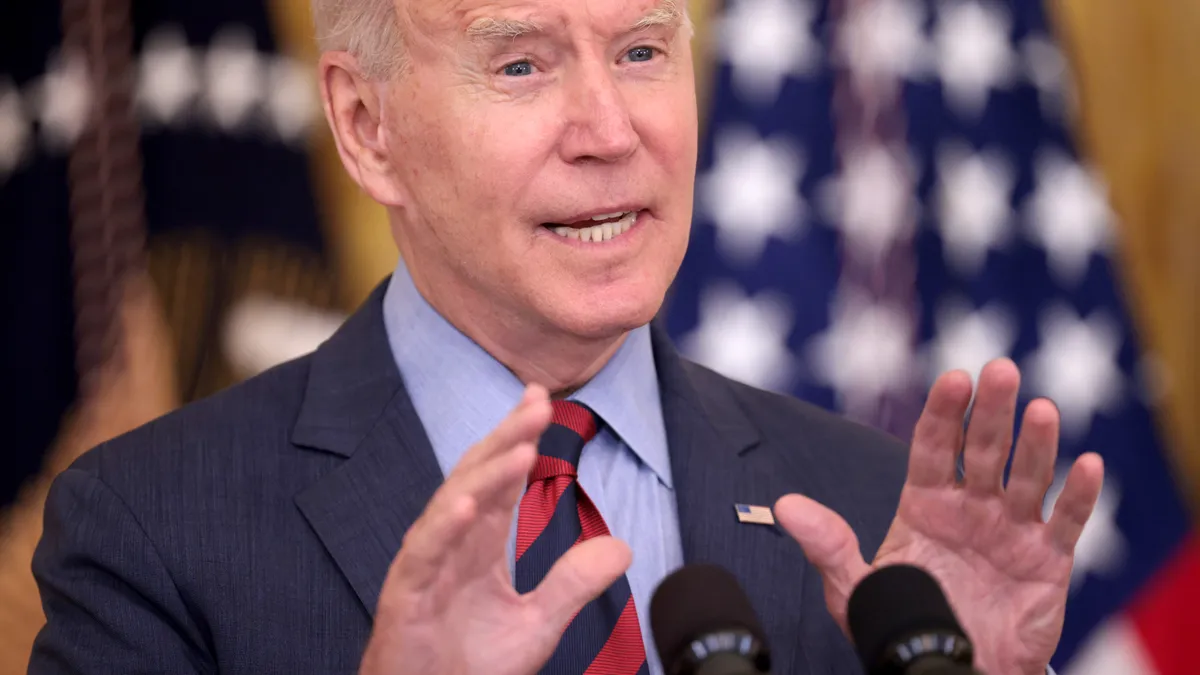

Biden plan would increase taxes on less than 3% of small businesses: Treasury

Most small businesses would not face higher taxes under Biden’s spending proposal, the White House said, citing Treasury analysis in response to Republican criticism.

By Jim Tyson • Aug. 20, 2021 -

Group illegally traded on Netflix subscriber growth, SEC charges

An insider ring is said to have made stock bets on confidential KPI data before it was released in quarterly reports.

By Robert Freedman • Aug. 19, 2021 -

SEC challenged in court over Nasdaq rule requiring board diversity

Affirmative action opponents in a court filing call the Nasdaq board diversity mandate “contrary to law, arbitrary and unconstitutional.”

By Jim Tyson • Aug. 19, 2021 -

Exec hit with insider trading after buying rival stock

A biopharma executive, after learning of plans for his company's acquisition by an industry giant, bought stock in a rival, which he suspected would get a valuation bump from the news.

By Robert Freedman • Aug. 18, 2021 -

Photo by Alexander Suhorucov from Pexels

SEC backs Nasdaq diversity rule over political opposition

The Nasdaq rule seeks to expand race and gender diversity on corporate boards but is met with resistance from Republican senators.

By Jim Tyson • Aug. 9, 2021 -

Shareholder support surges for action on climate change: EY

Investors back proposals for change in corporate environmental and social policies, an EY study found.

By Jim Tyson • Aug. 6, 2021 -

Companies oppose one-size-fits-all SEC climate disclosure rule: survey

The SEC should scale its coming rules for climate risk disclosure based on a company’s size, according to companies surveyed by the U.S. Chamber of Commerce.

By Jim Tyson • Aug. 5, 2021 -

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

Carol Highsmith. (2005). "Apex Bldg." [Photo]. Retrieved from Wikimedia Commons.

FTC unable to keep up with 'surge' in merger filings

The Federal Trade Commission said it “has been hit by a tidal wave of merger filings” and can’t complete reviews within the statutory period.

By Jim Tyson • Aug. 4, 2021 -

Former trucking giant CFO convicted of fraud

Peter Armbruster manipulated Roadrunner’s books to make company performance look better than it was.

By Robert Freedman • Aug. 3, 2021 -

Sustainable bond issuance will surge this year to record exceeding $850B

The volume of sustainable bonds issued will grow 59%, fueled by investor enthusiasm and increased regulatory clarity, Moody’s Investor Service said.

By Jim Tyson • Aug. 2, 2021 -

Almost 90% of SPACs have had to restate financials

Concerns by the Securities and Exchange Commission over the accounting of warrants spurred a compliance rush, both by operating companies and SPAC sponsors.

By Robert Freedman • Aug. 2, 2021 -

CFOs called key to setting comparables in SPAC warrant valuations

The goal is to find comparables that accurately reflect the lowest possible volatility level of the target company’s warranty valuation.

By Robert Freedman • July 30, 2021 -

SEC may require climate risk disclosures in expanded 10-Ks: Gensler

SEC Chair Gary Gensler says a company, when filing mandatory climate risk disclosures, may need to measure carbon emissions across its “value chain.”

By Jim Tyson • July 28, 2021 -

Global regulators unite to intensify scrutiny of SPACs

A group of securities market regulators from several countries launched a joint network to monitor SPAC deal-making.

By Jim Tyson • July 27, 2021 -

Loan performance could worsen under new lease accounting standards

For executives whose pay is tied in part to company performance, debt troubles from the reporting changes could impact compensation.

By Ed McCarthy • July 26, 2021 -

Tax complexity rising for global companies, survey finds

Global companies face increasingly complex taxation in dozens of countries, especially in calculating transfer pricing and when challenging tax assessments, according to a survey.

By Jim Tyson • July 26, 2021 -

Retailer, former CEO charged with accounting failures

The SEC charged Tandy Leather Factory and its former CEO with knowingly maintaining a flawed inventory system that led to errors in its financial statements.

By Jim Tyson • July 22, 2021 -

ESG reporting

Corporate 'greenwashing' poses growing threat to ESG goals: report

Sustainable financing has surged since 2015 but false corporate claims jeopardize carbon reduction efforts, Generation Investment Management said in a report.

By Jim Tyson • July 21, 2021 -

CEO, CFO charged with faking revenue, bond documents

The Securities and Exchange Commission alleges the former executives of FTE, a network infrastructure company, used phony paperwork to hide the financial health of the company while spending lavishly on themselves.

By Robert Freedman • July 20, 2021 -

SPAC sponsor, merger target charged with misleading statements

Under a settlement for making inaccurate claims about the target company's technology, the sponsor must give up any founder shares it would have received from the merger, and private investment in public equity (PIPE) investors can terminate their subscription agreements before the merger.

By Robert Freedman • July 14, 2021 -

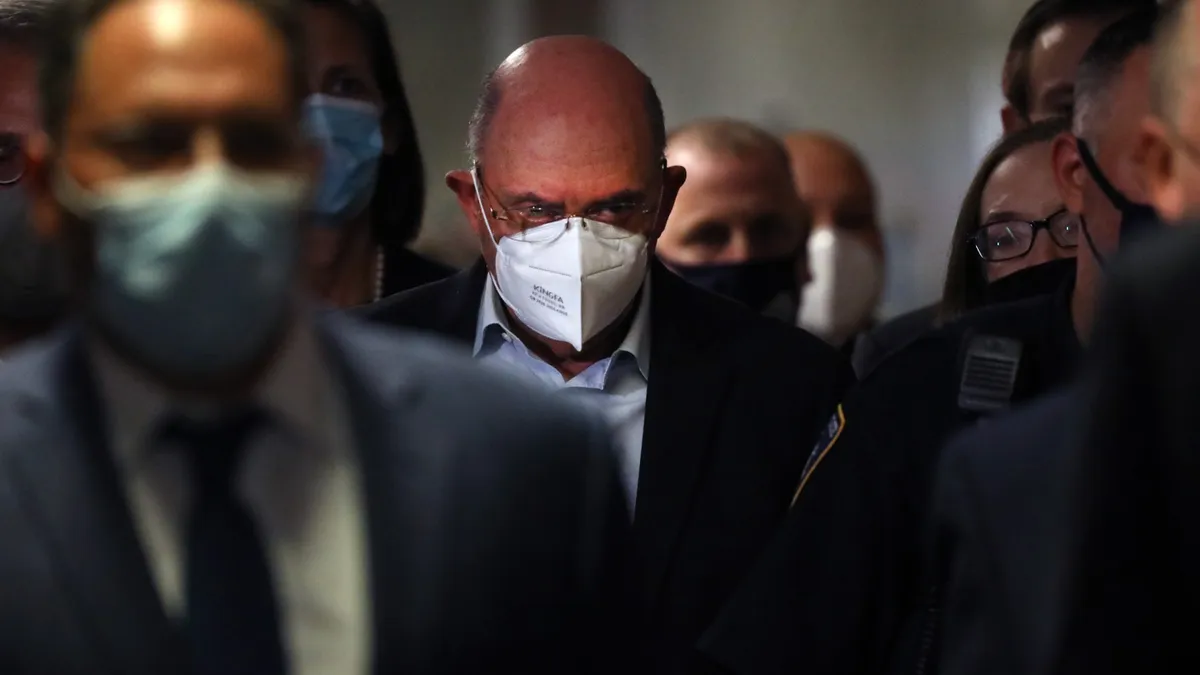

Weisselberg removed as officer of Trump Org. subsidiaries

Since Trump Organization CFO Allen Weisselberg was accused of 15 counts of tax fraud on July 1, his name has been wiped from the filings of several company subsidiaries.

By Jane Thier • July 13, 2021 -

Double set of books could prove Trump Organization's undoing

An internal spreadsheet the company kept treated expenses in one way while the expenses were treated another way in the general ledger.

By Robert Freedman • July 13, 2021 -

Finance employee charged with insider trading

The bank employee used coded words to tip off a friend about upcoming private-equity acquisitions.

By Robert Freedman • July 9, 2021