Compliance: Page 38

-

CFOs less likely to blow whistle on fraud when under financial pressure

CFOs with accounting backgrounds are more likely to express fraud concerns to external resources than CFOs with banking or finance backgrounds, a study of Italian companies from the Journal of Business Ethics found.

By Jane Thier • Feb. 10, 2020 -

Deep Dive

Making the most of new rules on goodwill impairment

New FASB rules for SEC-regulated companies only require one test to be met, but begin impairment calculations early to ensure accurate reporting.

By Suzanne Northington • Feb. 3, 2020 -

Explore the Trendline➔

Explore the Trendline➔

the-lightwriter via Getty Images

the-lightwriter via Getty Images Trendline

TrendlineTop 5 stories from CFO Dive

The promises and traps of generative AI, revamped modern finance teams and stark geopolitical risks are among the top forces CFOs are grappling with this year.

By CFO Dive staff -

Largest Boeing supplier CFO out amid compliance review

The CFO and the controller at Spirit AeroSystems have resigned and their replacements have been hired, the company says.

By Jane Thier • Feb. 2, 2020 -

Deep Dive

New credit loss accounting standard expected to pummel retail income

FASB's CECL standard took effect for public banks at the beginning of this year. Analysts at Morgan Stanley say it's going to hit some retailers hard.

By Robert Freedman • Jan. 27, 2020 -

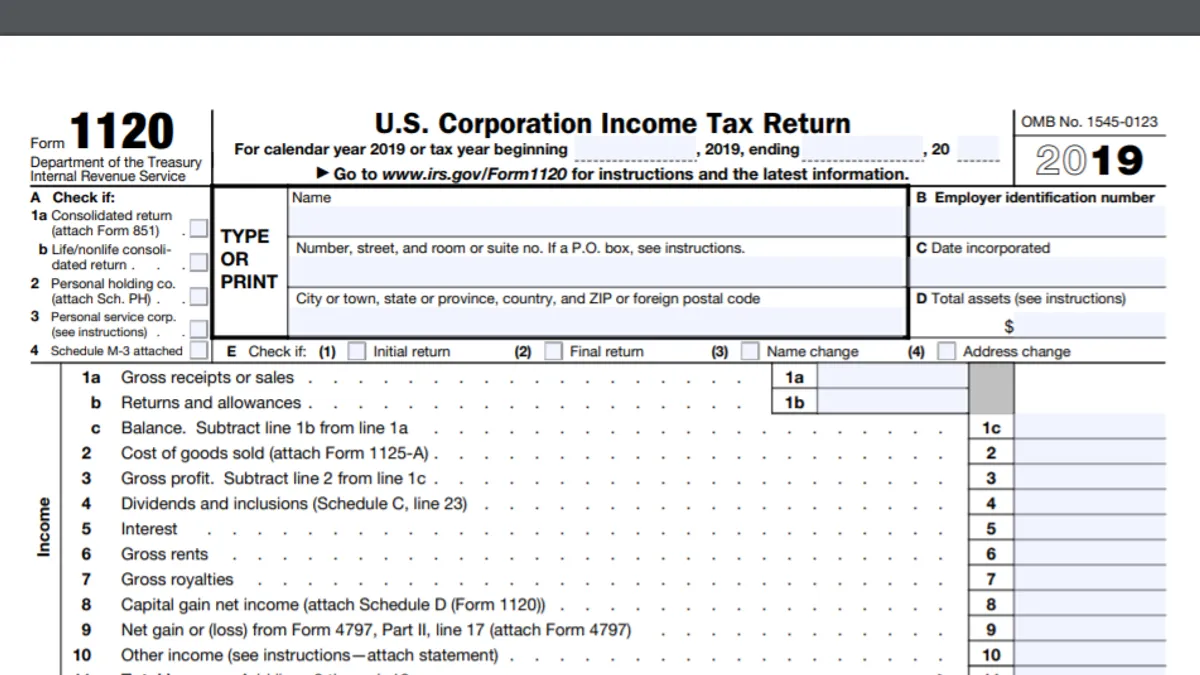

IRS to consider repatriation double taxation relief

The agency is looking for instances in which the same earnings and foreign corporate profits are taxed twice: as dividends and as repatriated income under section 965 of the Tax Code.

By Robert Freedman • Jan. 17, 2020 -

Ex-CFO of 1 Global Capital gets 5-year fraud sentence

Alan Heide pleaded guilty last August to misrepresenting how revenue was being used at the short-term cash advance company.

By Robert Freedman • Jan. 16, 2020 -

SEC can't force Telegram to reveal its bank records, judge rules

The encrypted messaging app won't have to reveal how it spent $1.7 billion, but it must prove by Thursday that it complies with foreign data privacy laws.

By Robert Freedman • Updated Jan. 9, 2020 -

Regulators eye accounting, audit changes for 2020

FASB, the SEC and PCAOB all have changes in the works that could affect both your reporting and your auditors.

By Robert Freedman • Jan. 1, 2020 -

Ernst & Young chief accountant tapped to lead FASB

The organization has faced criticism for the way it has rolled out recent changes in standards.

By Robert Freedman • Dec. 22, 2019 -

SEC hits MetLife with $10M fine for accounting errors

The insurer had a practice of releasing reserves for annuity customers if they didn't respond to two letters which were sent five and a half years apart.

By Robert Freedman • Dec. 18, 2019 -

Clawbacks appear to cause more harm than good, study finds

Executives are more likely to engage in aggressive tax strategies than managing accruals if they face potential loss of their bonuses, researchers say.

By Robert Freedman • Dec. 16, 2019 -

CFO, CEO of solar panel company charged with misusing investor funds

The CFO, Michael Sweaney, identified himself on company communications as Michael Hatton, allegedly to hide a prior securities fraud conviction, the SEC says.

By Robert Freedman • Dec. 12, 2019 -

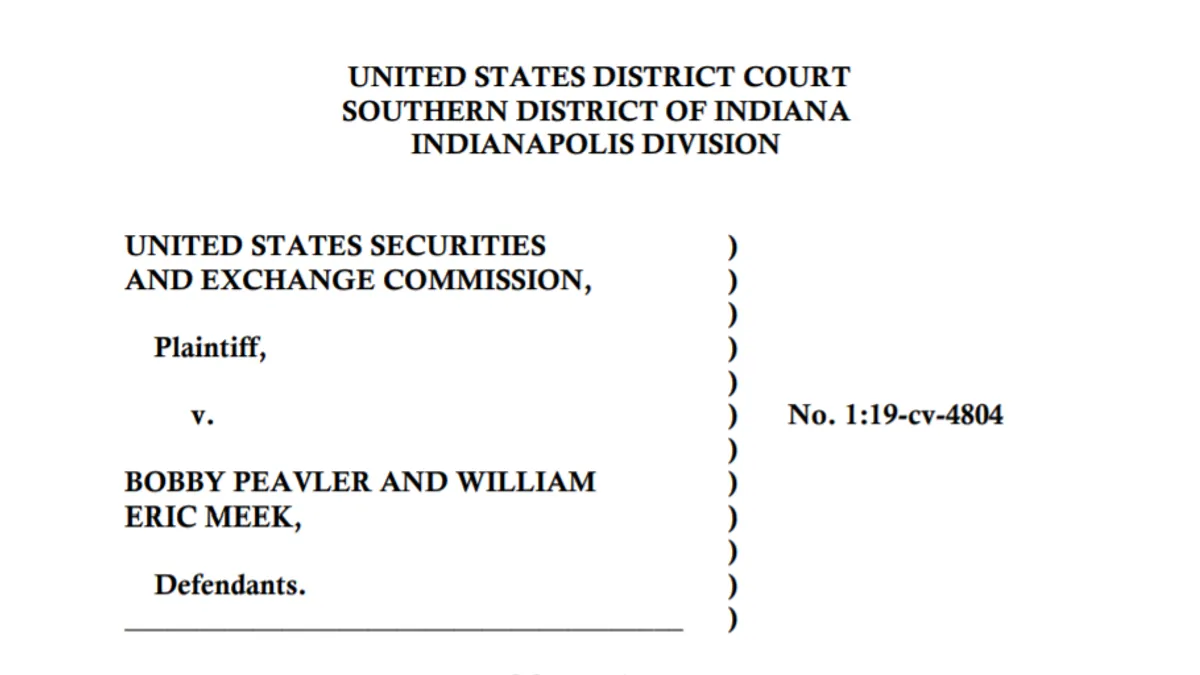

Ex-trucking CFO, CEO charged with accounting fraud

The CFO signed misleading reports on how prices were set on trucks the company bought and sold, the SEC alleges.

By Robert Freedman • Dec. 10, 2019 -

Transformation of GE's closing process aims to improve finance jobs, CFO says

The company created a data lake to help organize a system that includes thousands of legal entities, many of which use their own ERP software.

By Robert Freedman • Dec. 9, 2019 -

SEC charges CFO, other former Iconix executives with fraud

Former CFO Warren Clamen failed to recognize losses from the company's failing licensees, among other violations of reporting laws.

By Robert Freedman • Dec. 8, 2019 -

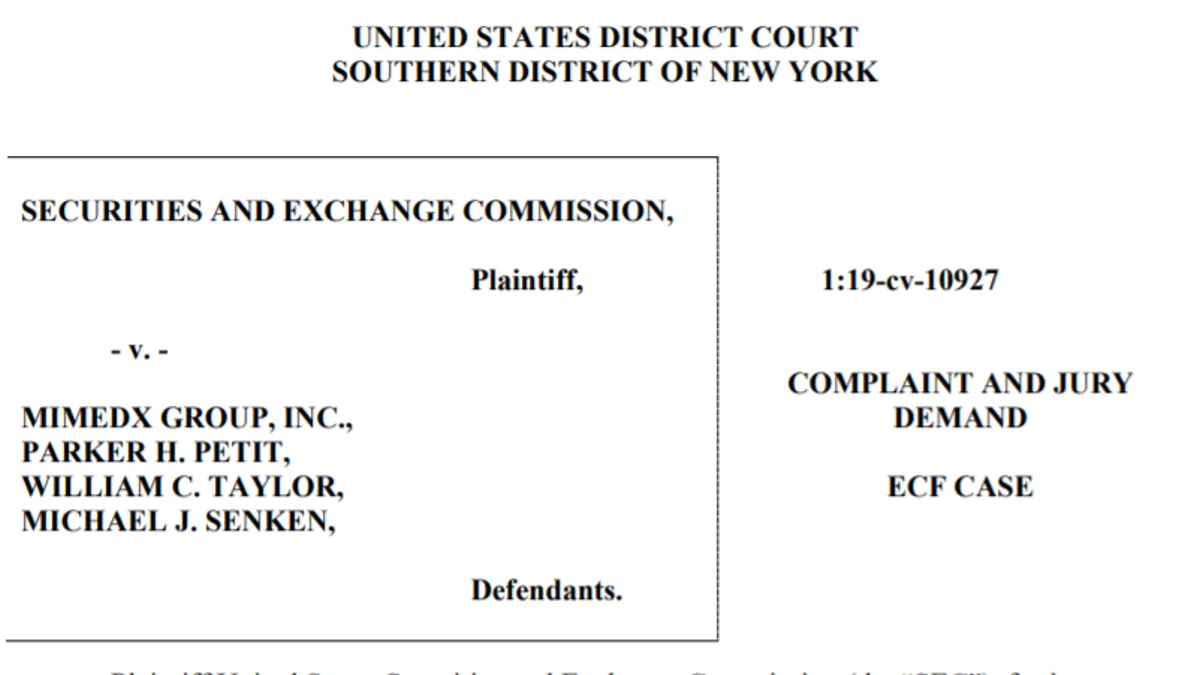

Ex-CFO, others charged in biotech accounting scheme

The CFO is accused of ignoring concerns raised by the company's controller over payment arrangements made with some suppliers.

By Robert Freedman • Dec. 2, 2019 -

Ex-CFO, others at healthcare ad company charged with $487M fraud

Among other offenses, CFO Brad Purdy "did nothing to correct the financial statements before he provided them to investors," the SEC alleges.

By Robert Freedman • Nov. 26, 2019 -

Managing a smooth transition to ASC 606 revenue recognition

Decisions made by legal, sales, and other teams can affect how you recognize money coming in and going out. Collaboration is key to staying on the right side of the 700 pages of guidelines.

By Robert Freedman • Nov. 25, 2019 -

FLSA joint employment, regular rate regs coming in December

The agency also announced plans to fast-track updates to its FMLA regulations.

By Kate Tornone • Nov. 20, 2019 -

Lower awards will mean fewer SEC whistleblowers, critics say

Several people alerting the SEC to public companies' potential violations have been awarded hundreds of millions of dollars over the years. The agency wants to limit those awards.

By Robert Freedman • Nov. 19, 2019 -

Understated income tax expense at center of Mattel accounting error

The company is revising its 2018 10-K and has acknowledged material weakness in its internal controls.

By Robert Freedman • Nov. 6, 2019 -

Shareholder proxy adviser sues SEC for treating it like a solicitor

Institutional Shareholder Services slammed the SEC for changing its policy on proxy advisers in a way it says will hurt investors.

By Robert Freedman • Nov. 4, 2019 -

Under Armour accounting reportedly under SEC scrutiny

Investigators are learning whether the athletic wear giant smoothed out its revenue over quarters to improve its financial appearance, The Wall Street Journal reported.

By Robert Freedman • Nov. 4, 2019 -

Audit quality improves when former partners sit on audit committee

When an affiliated partner serves on the audit committee, its financial reporting quality objectives align with the audit firm, an academic analysis found.

By Robert Freedman • Oct. 31, 2019 -

FASB extends lease accounting standards until January 2021

Private companies and nonprofits get a one-year reprieve on new standards for showing lease obligations in their financials.

By Robert Freedman • Oct. 17, 2019