Compliance: Page 40

-

Get to the core of coronavirus impacts in your reporting, AICPA specialist says

Accounting standards provide flexibility to work around coronavirus challenges, AICPA director Bob Durak said.

By Ted Knutson • March 26, 2020 -

FDIC chair asks FASB to waive credit-loss rule

Banks dealing with credit market upheavals as a result of the pandemic shouldn't have to adjust to sweeping changes in loss allowances right now, the regulator says.

By Robert Freedman • March 24, 2020 -

Wall Street goes remote as NYC becomes COVID-19 epicenter

While many companies shift to remote work, Wall Street has two large roadblocks: compliance and security.

By Jane Thier • March 23, 2020 -

Tax Day postponement to July 15 'welcome news' for small business

The U.S. Treasury Secretary announced that, amid the coronavirus' economic impact, Tax Day would be postponed to July 15. But where does that leave small businesses?

By Jane Thier • March 20, 2020 -

PCAOB chair: focus is on preventing bad audits

The regulator is making a push for audit reviews to include a meeting with company audit committees, agency chair William Duhnke said.

By Ted Knutson • March 11, 2020 -

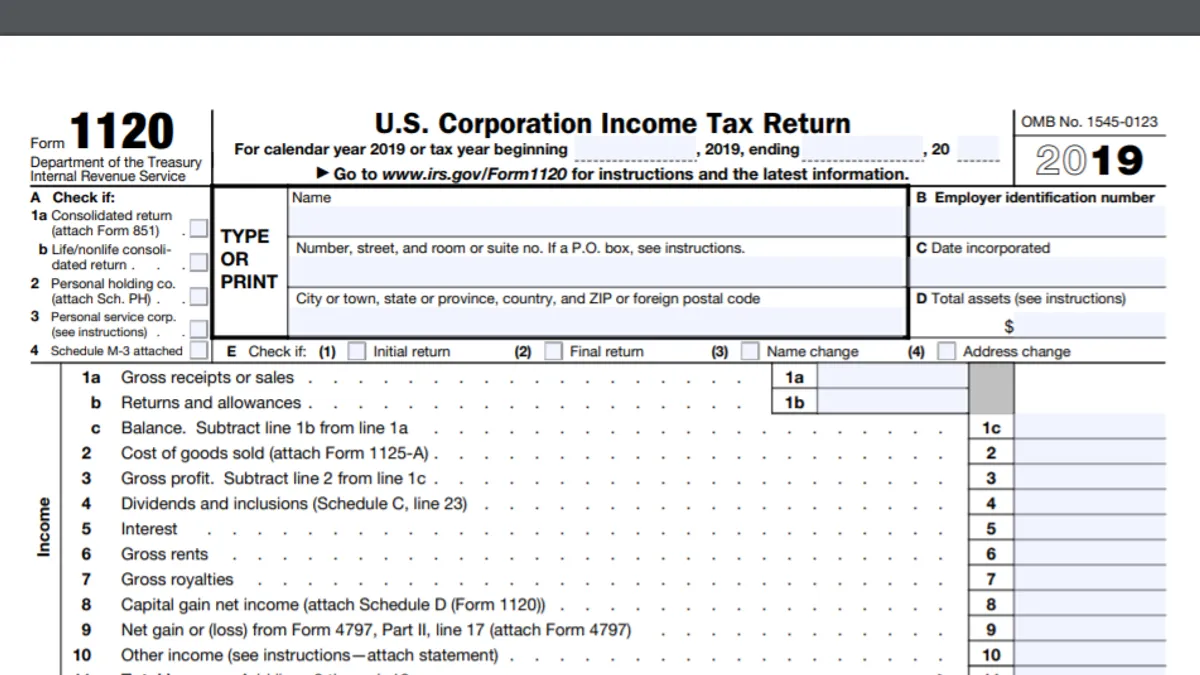

10-K filings to reflect uncertainty of new accounting rules

New ways to account for leases and expected credit losses may pose a reporting test for companies.

By Robert Freedman • March 7, 2020 -

SEC gives companies extra 45 days for reporting amid coronavirus uncertainty

By the end of April, companies must summarize why the outbreak is keeping them from filing public disclosures.

By Robert Freedman • March 5, 2020 -

SEC hits Cardinal Health with accounting violations

The company didn't have controls in place to detect improper payments by a former Chinese subsidiary, the SEC says.

By Robert Freedman • March 3, 2020 -

Former CFO of fabrication company charged with fraud

Joseph Nader allegedly misrepresented financial information to make it appear the company was generating more revenue than it was, a U.S. attorney says.

By Robert Freedman • March 1, 2020 -

How to use external obsolescence to reduce property taxes

Technology and other forms of disruption that have impacted your business model open the door to a property tax appeal, tax specialists say.

By Robert Freedman • March 1, 2020 -

Deep Dive

As XBRL in financial reporting matures, focus is on accuracy

The ability to increase financial transparency with machine-readable tags is improving, but few means are in place to ensure data quality.

By Ted Knutson • Feb. 25, 2020 -

Can a CFO restore his reputation after SEC fraud allegation?

After a long legal battle, the SEC dropped fraud charges against former Osiris Therapeutics CFO Gregory Law, but his professional standing may never recover.

By Robert Freedman • Feb. 24, 2020 -

More scrutiny in store for CECL bank credit-loss standard

Rep. Brad Sherman, D-Calif., the new chair of a House investor protection subcommittee, hopes to shine more light on FASB and PCAOB's roles in accounting and auditing.

By Robert Freedman • Feb. 23, 2020 -

Catching rogue staff before they cost your enterprise a bundle

You can expect a cash leakage of up to 5% of revenue if your security system is built around little more than periodic audits, a security specialist says.

By Robert Freedman • Feb. 20, 2020 -

Proposal to fold audit watchdog into SEC sparks pushback

The independent board overseeing the quality of audits of publicly traded companies would become a function of the SEC in the FY21 federal budget request.

By Robert Freedman • Feb. 18, 2020 -

Global group again warns about splitting up audit firms

Firms that provide both audit and non-audit services develop extensive in-house talent that lets them provide higher quality audits, an international accounting group says.

By Robert Freedman • Feb. 13, 2020 -

CFOs less likely to blow whistle on fraud when under financial pressure

CFOs with accounting backgrounds are more likely to express fraud concerns to external resources than CFOs with banking or finance backgrounds, a study of Italian companies from the Journal of Business Ethics found.

By Jane Thier • Feb. 10, 2020 -

Deep Dive

Making the most of new rules on goodwill impairment

New FASB rules for SEC-regulated companies only require one test to be met, but begin impairment calculations early to ensure accurate reporting.

By Suzanne Northington • Feb. 3, 2020 -

Largest Boeing supplier CFO out amid compliance review

The CFO and the controller at Spirit AeroSystems have resigned and their replacements have been hired, the company says.

By Jane Thier • Feb. 2, 2020 -

Deep Dive

New credit loss accounting standard expected to pummel retail income

FASB's CECL standard took effect for public banks at the beginning of this year. Analysts at Morgan Stanley say it's going to hit some retailers hard.

By Robert Freedman • Jan. 27, 2020 -

IRS to consider repatriation double taxation relief

The agency is looking for instances in which the same earnings and foreign corporate profits are taxed twice: as dividends and as repatriated income under section 965 of the Tax Code.

By Robert Freedman • Jan. 17, 2020 -

Ex-CFO of 1 Global Capital gets 5-year fraud sentence

Alan Heide pleaded guilty last August to misrepresenting how revenue was being used at the short-term cash advance company.

By Robert Freedman • Jan. 16, 2020 -

SEC can't force Telegram to reveal its bank records, judge rules

The encrypted messaging app won't have to reveal how it spent $1.7 billion, but it must prove by Thursday that it complies with foreign data privacy laws.

By Robert Freedman • Updated Jan. 9, 2020 -

Regulators eye accounting, audit changes for 2020

FASB, the SEC and PCAOB all have changes in the works that could affect both your reporting and your auditors.

By Robert Freedman • Jan. 1, 2020 -

Ernst & Young chief accountant tapped to lead FASB

The organization has faced criticism for the way it has rolled out recent changes in standards.

By Robert Freedman • Dec. 22, 2019