Compliance: Page 9

-

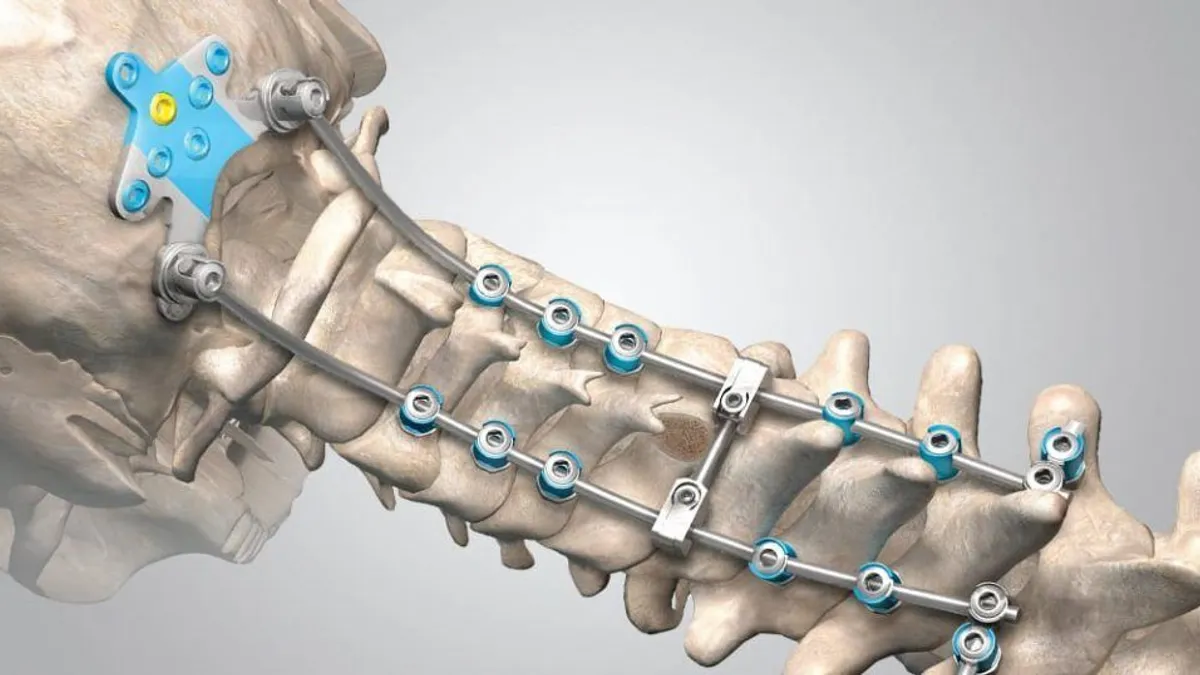

Orthofix replaces fired CLO, grapples with internal control ‘material weakness’

The new chief legal officer is joining the company as it faces a fresh set of headwinds related to its internal control over financial reports.

By Maura Webber Sadovi • April 17, 2024 -

Biden tax negotiator rejoins KPMG as election weighs on Pillar 2 prospects

Although the U.S. has yet to sign on, the OECD’s new Pillar Two tax rules already apply in more than 30 countries, Michael Plowgian said.

By Maura Webber Sadovi • April 16, 2024 -

70% of CEOs feel ready to deliver on responsible GenAI

The intense focus on safe and ethical GenAI use comes as the technology’s rapid rise is prompting scrutiny from governments around the world.

By Alexei Alexis • April 16, 2024 -

Opinion

The CFO’s role in curbing third-party cybersecurity risk

With vendor-related cyber risks spiking rapidly, the stakes are too high for CFOs to treat the issue as merely an IT concern, writes cybersecurity consultant AJ Yawn.

By AJ Yawn • April 16, 2024 -

CFOs mull future benefits for AI in tax: insightsoftware

When it comes to bringing AI into tax, it remains a bit of a “wait and see” for finance chiefs, said insightsoftware’s Josh Schauer.

By Grace Noto • April 11, 2024 -

Suspended ADM CFO’s pay ticked up in 2023 to $4.5M

The majority of Vikram Luthar’s pay package for last year came from $3.4 million in stock awards, according to Archer Daniels Midland’s proxy filing.

By Maura Webber Sadovi • April 11, 2024 -

Lack of uniform standards and disclosures a roadblock to scaling transition finance: report

A lack of standardized definitions, metrics and transition finance instruments endorsed by international organizations threatens broader adoption, the CFA Institute said.

By Suman Bhattacharyya • April 11, 2024 -

PCAOB levies record $25M fine on KPMG Netherlands for exam cheating

The $25 million penalty is the largest fine of any type imposed by the auditor watchdog since it was created in 2002 following the Enron accounting scandal.

By Maura Webber Sadovi • April 10, 2024 -

Nation-state actors drive up cyberthreats

Microsoft and Hewlett Packard Enterprise are among companies that have recently reported high-profile cyber intrusions attributed to nation-state actors.

By Alexei Alexis • April 9, 2024 -

Companies fall short on curbing cybersecurity risks from vendors: Moody’s

Cyberrisks are mounting, with artificial intelligence likely to increase the threat of attack in the short to medium term, Moody’s said.

By Jim Tyson • April 8, 2024 -

Deploying AI in accounting poses 12 audit risks: CAQ study

CFOs see the value of generative artificial intelligence but may not fully grasp its audit risks, according to the Center for Audit Quality.

By Jim Tyson • April 5, 2024 -

FASB to borrow from international rules for government grants

Many businesses and financial report preparers already rely on the IAS government grant accounting rules because GAAP is silent on the subject.

By Maura Webber Sadovi • April 5, 2024 -

NY AG prods for missing email relating to ex-Trump CFO’s perjury plea

Allen Weisselberg’s testimony surrounding the triplex was central to the charges of perjury levied against the former CFO, who is set to begin a five-month jail sentence on April 10.

By Grace Noto • April 5, 2024 -

AT&T hit with proposed class action suit over massive data breach

The breach was a “direct result” of AT&T’s failure to implement adequate cybersecurity procedures, the suit alleges.

By Alexei Alexis • April 2, 2024 -

Tupperware flags accounting strains in late 10-K notice

The late notice comes roughly five months after Tupperware said its former independent auditor PricewaterhouseCoopers declined to be re-appointed.

By Maura Webber Sadovi • April 1, 2024 -

Ex-construction CFO pleads guilty to wire fraud stemming from $890K embezzlement scheme

The former CFO is required to pay restitution of $890,000 in addition to other penalties and may also face time in prison.

By Grace Noto • April 1, 2024 -

FASB fine-tunes proposed expense disclosure rule

The proposed accounting standards update is one of several initiatives that have been a priority for FASB under the general theme of disaggregation.

By Maura Webber Sadovi • March 29, 2024 -

SEC fines Arista Networks founder Bechtolsheim $1M for insider trading

Andreas “Andy” Bechtolsheim, who resigned as Arista chairman in December, allegedly arranged put options contracts for a relative based on non-public information about an imminent deal.

By Jim Tyson • March 26, 2024 -

Tax-free M&A comes in crosshairs of bipartisan Senate legislation

An effort to scuttle deal-making tax exemptions coincides with signs of life in M&A after a severe slump last year.

By Jim Tyson • March 25, 2024 -

SEC busts company behind $300M crypto Ponzi scheme targeting Latinos

Under the leadership of Gary Gensler, the SEC has intensified efforts to protect investors involved in what he calls the “Wild West” of crypto assets.

By Jim Tyson • March 15, 2024 -

EU lawmakers pass sweeping AI rules with global reach, stiff penalties

Penalties include up to €35 million or 7% of a company’s total worldwide annual turnover — whichever is higher — for violations of a ban on “emotion recognition” in the workplace.

By Alexei Alexis • March 13, 2024 -

New SEC cyber rules draw ‘question-begging’ breach disclosures

Filers may be opening the door to investor confusion by reporting breaches that don’t appear to be “material” as described, without explaining why they’re doing so.

By Alexei Alexis • March 12, 2024 -

Minnesota bill with 120-hour CPA path inches forward

The Minnesota bill would allow future certified public accountants to sidestep the need for a fifth year of college. It is controversial.

By Maura Webber Sadovi • March 11, 2024 -

Visa spends ‘billions’ battling cybersecurity threats

“We are all in an arms race to protect this ecosystem, to protect the network,” Visa CEO Ryan McInerney said at an investor conference last week.

By Lynne Marek • March 11, 2024 -

Pillar 2 tax heightens CFO need for quality data

In 2021 more than 130 countries agreed to implement Pillar 2, which seeks to set a global minimum effective tax rate of 15% for certain multinational enterprises.

By Grace Noto • March 6, 2024