Financial Reporting: Page 46

-

Deep Dive

Avoiding ASC 470 debt modification mistakes

Many companies restructured debt during the pandemic; accounting for that can be fraught with risk if you misapply the rules, reporting specialists say.

By Ed McCarthy • June 3, 2021 -

Travel rebound currently leisure-driven, but business will follow: Hilton CFO

"We're not a huge believer in a new normal; sorry," Kevin Jacobs said last week. He fully expects business travel to reach pre-pandemic levels within the next two years.

By Jane Thier • June 1, 2021 -

Explore the Trendline➔

Explore the Trendline➔

KanawatTH via Getty Images

KanawatTH via Getty Images Trendline

TrendlineCFO best practices in the evolving generative AI era

As the initial frenzy around the launch of generative artificial intelligence subsides, a new GenAI era appears to be taking shape.

By CFO Dive staff -

Nearly 40% of large companies pose biodiversity threat: Moody's ESG study

A Moody’s study aimed at measuring “biodiversity risks” in investment and lending portfolios found that 38% of 5,300 global companies operate at least one facility causing loss of habitat.

By Jim Tyson • May 28, 2021 -

Gensler pledges tough SEC scrutiny of SPACs, warning of fraud risk

The SEC will “closely look” at each stage of SPAC financing to ensure adequate investor safeguards, Chair Gary Gensler said in congressional testimony.

By Jim Tyson • May 27, 2021 -

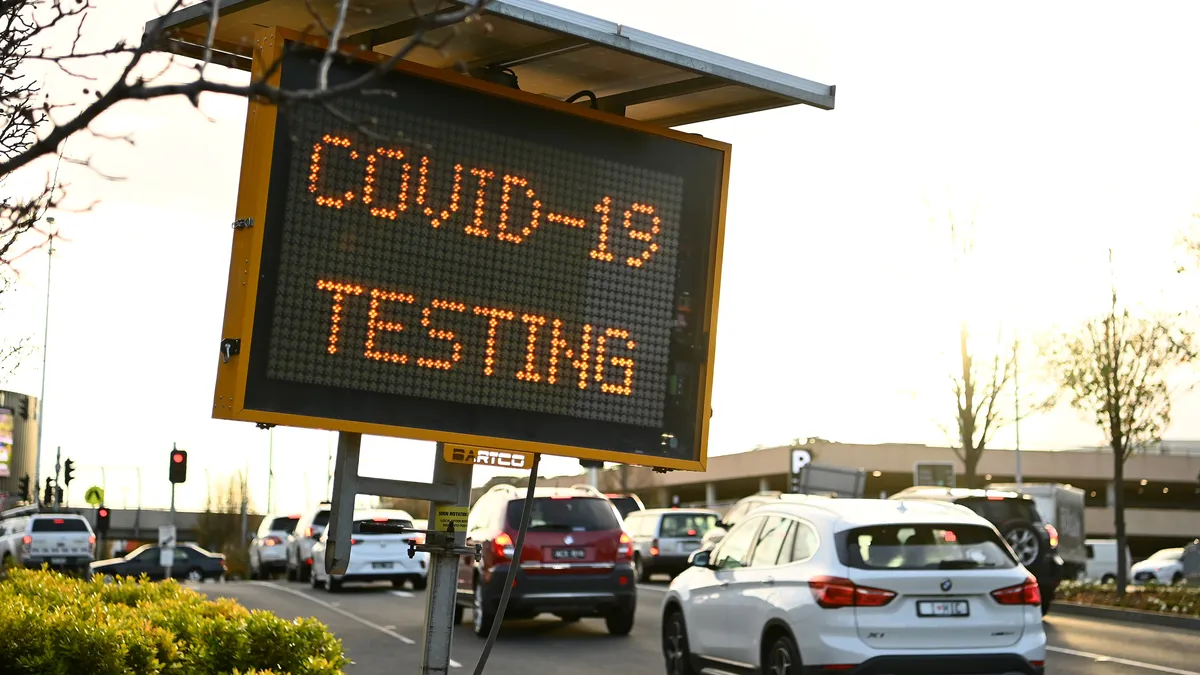

New data analysis may help predict pandemic recovery: AstraZeneca FP&A head

The coronavirus sped up adoption of automation at AstraZeneca and generated datasets that may help forecast recovery, according to the company's FP&A director.

By Jim Tyson • May 25, 2021 -

Target CFO: 'Theme for the quarter is growth on growth'

The retailer's fulfillment services and portfolio of private labels across multiple categories have kept shoppers hooked post-2020.

By Maria Monteros • May 24, 2021 -

Retrieved from Airbnb on September 24, 2020

Retrieved from Airbnb on September 24, 2020

Airbnb CFO 'highly confident a rebound is coming'

"All the early indicators" suggest the online vacation rental marketplace will return to pre-pandemic operating levels within the year, Dave Stephenson said last week.

By Jane Thier • May 19, 2021 -

SPAC warrant resolution said to be in works

Legal and accounting specialists are developing a type of warrant that can be treated as equity, but it’s weeks away and needs SEC approval.

By Robert Freedman • May 17, 2021 -

Most companies increase spending on diversity training: survey

Roughly four in five companies are increasing their budgets for diversity training and for managing their performance in sustainable business practices, a OneStream Software survey found.

By Jim Tyson • May 13, 2021 -

Following first quarter rebound, Applebee's, IHOP parent hires new CFO

On June 14, Vance Chang will replace Dine Brand's corporate controller and interim CFO Allison Hall, who is moving into the chief accounting officer role.

By Jane Thier • May 12, 2021 -

Bill seeks to shine light on companies' global profit shifting

The "Disclosure of Tax Havens and Offshoring Act" would require companies to identify their profits and taxes on a country-by-country basis.

By Robert Freedman • May 12, 2021 -

Lack of automation preventing efficient financial close: CFO survey

Due to ineffective processes and technology, 51% of CFO respondents to Trintech's Global Financial Close Benchmark Report cited meeting deadlines and time pressures as their biggest challenges this year.

By Jane Thier • May 11, 2021 -

Half of companies lack LIBOR phase-out plan: Duff & Phelps

Despite regulatory pressure, more than half of financial services firms have not determined when they will stop using LIBOR in new contracts, according to a Duff & Phelps survey.

By Jim Tyson • May 10, 2021 -

ESG reporting

Companies ignoring ESG may become 'uninvestable,' says investment bank chief

Interest in sustainability goals is growing "enormously" and companies that ignore the trend risk rejection by investors, according to Larry Wieseneck, co-president of investment bank Cowen.

By Jim Tyson • May 7, 2021 -

Corporate tax rate unlikely to rise above 25%

Along with the tax hike, mandatory ESG reporting and the treatment of remote workers are priorities that stand a good chance of congressional passage this year, a lobbyist for the accounting profession says.

By Robert Freedman • May 7, 2021 -

Under Armour hit with $9M fine for undisclosed 'pull forwards'

The company accelerated revenue without disclosing material information to investors about the practice, the Securities and Exchange Commission says.

By Robert Freedman • May 4, 2021 -

SEC hits companies for hiding restatements before seeking filing delays

The agency used data analytics to identify companies that sought a filing delay and then shortly afterward announced a correction to a previous filing.

By Robert Freedman • May 3, 2021 -

Deutsche Bank posts strong quarter, OKs 3-day remote work: CFO

James von Moltke said the bank, going forward, intends to let employees work from home 40-60% of the time.

By Jane Thier • April 29, 2021 -

Multinationals reported $6.16B in negative forex exposure for Q4: study

A decline in negative foreign exchange impact during the fourth quarter was probably "the calm before the storm" that likely occurred during the first quarter of 2021, according to Kyriba.

By Jim Tyson • April 29, 2021 -

SEC said to be weighing SPAC disclosure guidelines

Whether or not guidance is issued, the agency is signaling concerns over "frothy" forward-looking statements in the hot alternative IPO market.

By Robert Freedman • April 29, 2021 -

HSBC CFO: Bank 'very much' wants to shift to hybrid working model

"We've basically baked in about half of the cost of travel going forward," finance chief Ewen Stevenson says.

By Jane Thier • April 27, 2021 -

As probe continues, Trump Organization CFO's past comments emerge

In a recently unearthed deposition from 2010, Trump Organization CFO Allen Weisselberg, who is under investigation, said he steers clear of the “legal side” of the former President's business dealings.

By Jane Thier • April 26, 2021 -

After bombshell quarter, Chipotle's CFO focuses on sustainability

Amid discussions of carbon neutrality, a $15 federal minimum wage and a quickly evolving fast casual landscape, Jack Hartung says the chain remains committed to its employees and agricultural partners.

By Jane Thier • April 23, 2021 -

SPAC market during Q1 showed 'explosive growth': Duff & Phelps

The SPAC market boomed during the first quarter of 2021, Duff & Phelps said, noting that SPAC warrants this month have come under regulatory scrutiny.

By Jim Tyson • April 23, 2021 -

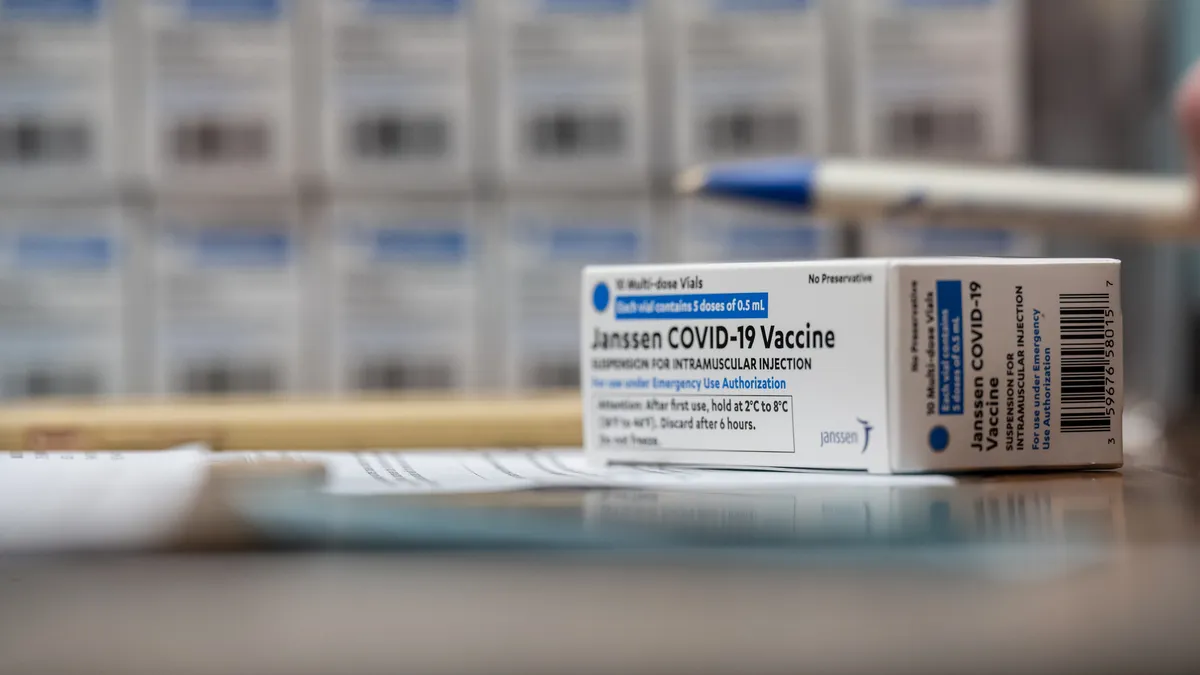

Johnson & Johnson stronger today than pre-pandemic, CFO says

Despite the setback with its COVID-19 vaccine, the company has seen sales across its product lines increase almost 8%, Joseph Wolk said as the biopharma giant shared its first quarter results Tuesday.

By Jane Thier • April 21, 2021