Financial Reporting: Page 50

-

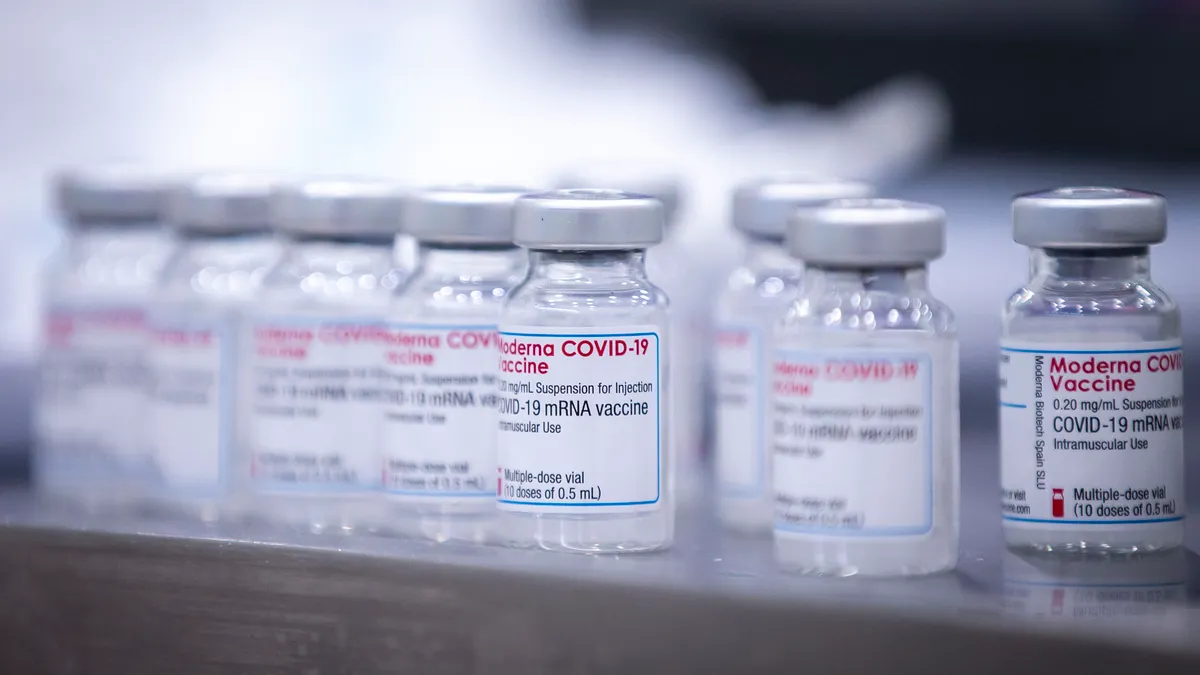

Moderna may seek to claw back payments to ex-CFO

The vaccine-maker Moderna said it has the right to recoup any and all payments to ex-CFO Jorge Gomez if the company determines he engaged in any wrongdoing, according to an amended SEC filing Friday. An earlier filing said he would be provided a 12-month salary totaling $700,000 under a severance agreement.

By Maura Webber Sadovi • May 17, 2022 -

FASB shifts to prioritize 'rapidly evolving' crypto assets

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

By Maura Webber Sadovi • May 12, 2022 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineCFO best practices in the evolving generative AI era

As the initial frenzy around the launch of generative artificial intelligence subsides, a new GenAI era appears to be taking shape.

By CFO Dive staff -

SEC fines NVIDIA $5.5M for failing to disclose cryptomining impact

NVIDIA rode the rush into crypto assets as customers used its gaming devices for cryptomining. The SEC penalized the company for allegedly not disclosing how it gained from the crypto boom.

By Jim Tyson • May 11, 2022 -

Moderna CFO exits abruptly amid probe at former company

Jorge Gomez's departure came just one day after he took the reins as CFO of Moderna, which has become a household name due to the rapid development and success of its coronavirus vaccine.

By Maura Webber Sadovi • May 11, 2022 -

Chipotle CFO doesn't rule out more food inflation despite pause

Finance chief Jack Hartung said the restaurant chain has raised prices by a total of about 10% for the 12 months through the first quarter compared to 2% in a typical year.

By Maura Webber Sadovi • May 10, 2022 -

Judge dismisses class action against Wells Fargo, former CEO, ex-CFO

Investors led by a retirement fund for Hawaii state employees failed to prove the bank unjustifiably inflated loans, understated loss reserves or misstated its practices, a judge ruled Friday.

By Robin Bradley • May 9, 2022 -

FASB homes in on cryptocurrency

FASB has generally been cautious about moving to standardize accounting for bitcoin and other digital asset investments but its stance appears to be shifting.

By Maura Webber Sadovi • May 6, 2022 -

Skanska posts 21% dip in Q1 profits as CFO cites inflation

Skanska CFO Magnus Persson, while citing a drag from inflation, identifies infrastructure spending as a future bright spot.

By Zachary Phillips • May 6, 2022 -

Grayscale CFO's crypto guidance wishlist includes FASB stopgap

The recently intensifying focus of regulators on cryptocurrencies comes amid dramatic growth in markets for digital assets.

By Maura Webber Sadovi • May 4, 2022 -

Global ESG standard-setting gains speed

CFOs seeking to provide shareholders with more sustainability data must choose from a patchwork of inconsistent measurement frameworks. Regulators and other standard setters worldwide are now building a consensus behind uniform rules for gauging sustainability.

By Jim Tyson • May 4, 2022 -

Halliburton picks company veteran for CFO spot

The oil field services giant is "appropriately viewed as a major beneficiary" of rising fossil fuel prices and oil field activity, according to a report from Cowen analysts.

By Maura Webber Sadovi • May 3, 2022 -

Global minimum tax compliance to take 'significant' company resources

Forty percent of businesses surveyed by EY have considered adding headcount, outsourcing tax department operations and investing in new technology to meet BEPS 2.0 requirements.

By Maura Webber Sadovi • May 2, 2022 -

SEC sues Brazilian mining firm, alleging false ESG claims

The agency that supervises Wall Street, seeking to ensure accurate sustainability disclosures, sued a Brazilian company for allegedly misleading investors about safety before a dam collapse killed scores of nearby residents.

By Jim Tyson • April 28, 2022 -

Most executives admit to ESG 'greenwashing': survey

Companies overstate their commitment to sustainability as investors, regulators, lawmakers and other stakeholders push for adherence to environmental, social and governance best practices.

By Jim Tyson • April 27, 2022 -

SEC penalizes pizza accountant $2M for alleged insider trading

The agency tasked with keeping an eye on Wall Street is increasingly using data analytics to uncover accounting fraud and other wrongdoing.

By Jim Tyson • April 26, 2022 -

Deep Dive

Furniture retailers adapt to supply chain chaos

As some retailers extend lead times and amass inventory to manage delays, they're also building sourcing relationships beyond China and Vietnam.

By Ben Unglesbee • April 25, 2022 -

Diversity hiring gains speed in accounting: AICPA

Companies hiring for jobs in accounting and finance increasingly value recent graduates with technological skills, AICPA said.

By Jim Tyson • April 22, 2022 -

IRS 'outgunned' by non-compliant businesses, Rettig says

The IRS lacks the enforcement clout needed to audit many big companies that may dodge their tax obligations.

By Jim Tyson • April 21, 2022 -

FASB steps closer to LIBOR accounting relief extension

The U.S. accounting standards setter will likely affirm the proposed two-year extension of LIBOR-related accounting relief unless it gets new feedback during the public comment period, according to a FASB spokesperson.

By Maura Webber Sadovi • April 21, 2022 -

SEC alleges Brazilian ex-CFO planted false Berkshire Hathaway story

Fernando Passos used a fabricated shareholder list and a fake email as part of a scheme to bolster his false Berkshire Hathaway claim and pump up IRB's flagging stock, according to the complaint.

By Maura Webber Sadovi • April 20, 2022 -

SEC swats pest control company with $8M penalty for accounting flaws

Rollins Inc., a global exterminator company, adjusted its accounting reserves in order to increase its EPS by 1 cent and meet quarterly forecasts.

By Jim Tyson • April 19, 2022 -

Republican lawmakers slam SEC climate-risk disclosure proposal

SEC Chair Gary Gensler says that a new regime of disclosure standards would answer the demand from investors for detailed information about climate risks faced by publicly traded companies.

By Jim Tyson • April 13, 2022 -

SEC issues guidance on crypto-asset accounting, disclosure

As theft of crypto-assets rises, the SEC is pushing companies to publicly report on the potential costs from such crimes and efforts to curb hacking risks.

By Jim Tyson • April 11, 2022 -

IRS's Rettig appeals for 'consistent, timely' funding to streamline agency

The Biden administration has proposed an 18% increase in funding for the IRS budget to help the agency improve performance after years of tight funding.

By Jim Tyson • April 7, 2022 -

New Sigyn CFO maps Nasdaq uplist, shelf registration strategy

Sigyn's Jeremy Farrell is preparing to issue more shares even as some companies are shying away from tapping equity amid rising stock market volatility.

By Maura Webber Sadovi • April 7, 2022