Financial Reporting: Page 53

-

Wall Street goes remote as NYC becomes COVID-19 epicenter

While many companies shift to remote work, Wall Street has two large roadblocks: compliance and security.

By Jane Thier • March 23, 2020 -

Coronavirus impact limited to timing issues so far, LED company CFO says

The company has taken steps to keep manufacturing on track by disinfecting its facility, but employees uncomfortable with working on site can stay home.

By Robert Freedman • March 19, 2020 -

Explore the Trendline➔

Explore the Trendline➔

KanawatTH via Getty Images

KanawatTH via Getty Images Trendline

TrendlineCFO best practices in the evolving generative AI era

As the initial frenzy around the launch of generative artificial intelligence subsides, a new GenAI era appears to be taking shape.

By CFO Dive staff -

Slack, Zoom CFOs stay realistic as coronavirus spotlights remote work

With most of the country transitioning to remote work, video conferencing tool Zoom and instant messenger Slack are exploding in popularity. But their CFOs aren't quick to assume that it will have long-term benefits.

By Jane Thier • March 16, 2020 -

PCAOB chair: focus is on preventing bad audits

The regulator is making a push for audit reviews to include a meeting with company audit committees, agency chair William Duhnke said.

By Ted Knutson • March 11, 2020 -

10-K filings to reflect uncertainty of new accounting rules

New ways to account for leases and expected credit losses may pose a reporting test for companies.

By Robert Freedman • March 7, 2020 -

SEC gives companies extra 45 days for reporting amid coronavirus uncertainty

By the end of April, companies must summarize why the outbreak is keeping them from filing public disclosures.

By Robert Freedman • March 5, 2020 -

SEC hits Cardinal Health with accounting violations

The company didn't have controls in place to detect improper payments by a former Chinese subsidiary, the SEC says.

By Robert Freedman • March 3, 2020 -

Will more CFOs switch to mark-to-market pension accounting?

With the Federal Reserve signaling an interest-rate response to the coronavirus, continuing low interest rates could drive CFOs to move away from amortization of pension losses.

By Robert Freedman • March 2, 2020 -

Deep Dive

As XBRL in financial reporting matures, focus is on accuracy

The ability to increase financial transparency with machine-readable tags is improving, but few means are in place to ensure data quality.

By Ted Knutson • Feb. 25, 2020 -

Can a CFO restore his reputation after SEC fraud allegation?

After a long legal battle, the SEC dropped fraud charges against former Osiris Therapeutics CFO Gregory Law, but his professional standing may never recover.

By Robert Freedman • Feb. 24, 2020 -

Extreme optimism on earnings calls OK, study finds

Conveying expected performance on earnings calls with extreme language tends to correlate with future positive results, a study shows.

By Robert Freedman • Feb. 19, 2020 -

Proposal to fold audit watchdog into SEC sparks pushback

The independent board overseeing the quality of audits of publicly traded companies would become a function of the SEC in the FY21 federal budget request.

By Robert Freedman • Feb. 18, 2020 -

The problem with planning: Knowing when to turn down new tech

The influx of innovative tech designed to modernize the finance function has made it harder than ever to discern what's best for your company. How can CFOs make the distinction?

By Jane Thier • Feb. 13, 2020 -

Under Armour forecasts up to $60M revenue hit from coronavirus disruptions

The outbreak also puts at risk supply chain improvements that CFO Dave Bergman talked about on the company's fourth quarter earnings call.

By Emma Cosgrove • Feb. 12, 2020 -

Wyndham Hotels CFO moves to XPO Logistics

David Wyshner, who will start as finance chief on March 2, joins the supply chain provider amid its exploration of a potential sale or spinoff of its business units.

By Jane Thier • Feb. 11, 2020 -

A consultancy CFO's No. 1 KPI

According to Halloran Consulting's Tania Zieja, there is one KPI that is vital for finance, accounting and HR.

By Jane Thier • Feb. 6, 2020 -

Deep Dive

Making the most of new rules on goodwill impairment

New FASB rules for SEC-regulated companies only require one test to be met, but begin impairment calculations early to ensure accurate reporting.

By Suzanne Northington • Feb. 3, 2020 -

Deep Dive

New credit loss accounting standard expected to pummel retail income

FASB's CECL standard took effect for public banks at the beginning of this year. Analysts at Morgan Stanley say it's going to hit some retailers hard.

By Robert Freedman • Jan. 27, 2020 -

Job-hopping finance execs attract double-digit pay gains

Compensation packages also include flexible hours and other perks, as competition for talent intensifies.

By Jane Thier • Jan. 16, 2020 -

Metrics, management reporting are top CFO priorities in 2020

CFOs' perceived shortcomings tend to fall beyond the scope of the typical responsibilities, veering into operations, IT and management.

By Jane Thier • Jan. 2, 2020 -

Regulators eye accounting, audit changes for 2020

FASB, the SEC and PCAOB all have changes in the works that could affect both your reporting and your auditors.

By Robert Freedman • Jan. 1, 2020 -

Ernst & Young chief accountant tapped to lead FASB

The organization has faced criticism for the way it has rolled out recent changes in standards.

By Robert Freedman • Dec. 22, 2019 -

Clawbacks appear to cause more harm than good, study finds

Executives are more likely to engage in aggressive tax strategies than managing accruals if they face potential loss of their bonuses, researchers say.

By Robert Freedman • Dec. 16, 2019 -

Transformation of GE's closing process aims to improve finance jobs, CFO says

The company created a data lake to help organize a system that includes thousands of legal entities, many of which use their own ERP software.

By Robert Freedman • Dec. 9, 2019 -

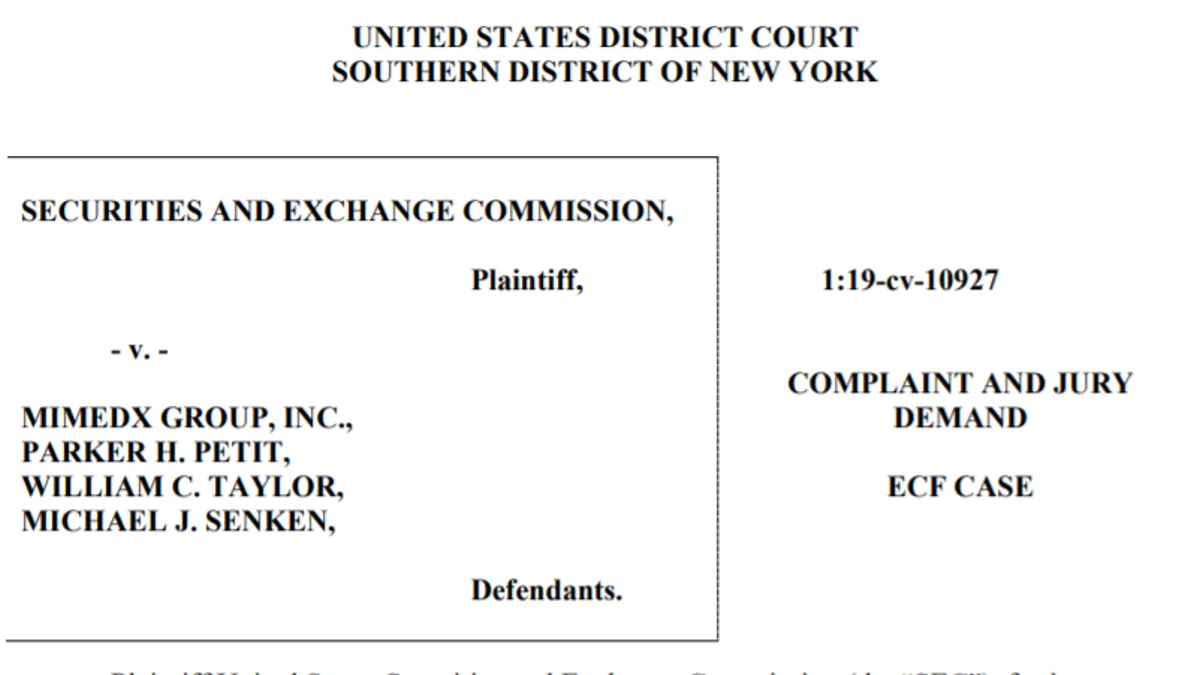

Ex-CFO, others charged in biotech accounting scheme

The CFO is accused of ignoring concerns raised by the company's controller over payment arrangements made with some suppliers.

By Robert Freedman • Dec. 2, 2019