Strategy & Operations: Page 92

-

M&A: Integration is in, holding companies are out

Setting up a holding company for an acquisition that expands the scope of a company's business might make sense temporarily, but integration can make a better long-term solution.

By Ted Knutson • Feb. 11, 2020 -

Wyndham Hotels CFO moves to XPO Logistics

David Wyshner, who will start as finance chief on March 2, joins the supply chain provider amid its exploration of a potential sale or spinoff of its business units.

By Jane Thier • Feb. 11, 2020 -

Explore the Trendline➔

Explore the Trendline➔

iStock / Getty Images Plus via Getty Images

iStock / Getty Images Plus via Getty Images Trendline

TrendlineDigital transformation, one smart step at a time

As pricing pressures tighten margins and technologies like artificial intelligence evolve, finance chiefs are more closely scrutinizing the cost and returns of the tech tools they implement.

By CFO Dive staff -

Machine learning is nearly ubiquitous in finance, even if you don't know it

Many cloud-based finance and accounting functions already use AI that helps produce more accurate numbers than you otherwise could.

By Robert Freedman • Feb. 11, 2020 -

Deep Dive

CFO in the Know: Getting acquired in a 'snack-eat-snack' market

Small food companies often form in hopes of acquisition by giants like Hershey or Mondelez. How can CFOs best help their companies prepare for such large-scale acquisitions?

By Jane Thier • Feb. 11, 2020 -

CFO embeds team members outside finance to improve analysis, morale

The organization of your finance team can help you separate the noise from the signal, Eventbrite CFO Lanny Baker says.

By Robert Freedman • Feb. 10, 2020 -

Opinion

You've set the budget and it's Q1. Now what?

Monthly forecasting exercises offer CFOs 12 chances to perfect their plan. Here's how to get the most out of them.

By Jason Lin • Feb. 9, 2020 -

UBS global wealth management CAO replaces CFO

Amid a strategy overhaul announced last month, UBS is expected to cut the jobs of 500 senior wealth management employees.

By Jane Thier • Feb. 9, 2020 -

Survey: 60% of procurement leaders site risk from lack of financial transparency

Respondents in a Basware survey reported a direct correlation between their level of transparency and the success of their business.

By Morgan Forde • Feb. 7, 2020 -

Pods enable CFO to keep drug manufacturing costs down

AVROBIO hopes to offer drug therapy for a disorder that can cost $14M over a lifetime to treat. CFO Erik Ostrowski is doing his part by raising capital and practicing frugality.

By Robert Freedman • Feb. 6, 2020 -

A consultancy CFO's No. 1 KPI

According to Halloran Consulting's Tania Zieja, there is one KPI that is vital for finance, accounting and HR.

By Jane Thier • Feb. 6, 2020 -

Reimbursement plans seen as cost-saving alternative to group insurance

Federal rules allowing companies to give employees money to buy their health insurance in the individual market just took effect.

By Robert Freedman • Feb. 5, 2020 -

Merck joins peers in spinning off lower growth drugs

Merck expects to receive up to $9 billion through a tax-free dividend and realize more than $1.5 billion in operating efficiencies by spinning out women's health and legacy drugs into a new company.

By Jacob Bell • Feb. 5, 2020 -

Financial automation a must-have, CFO says

To stay competitive, companies must begin deploying technologies that can help them scale operations as their business grows, a survey shows.

By Robert Freedman • Feb. 4, 2020 -

2020 Trends: Middle market CFOs ready to spend on growth

Few CFOs think the economy will become an issue requiring them to take a defensive posture, a BDO survey finds.

By Robert Freedman • Feb. 2, 2020 -

Opinion

2020 Trends: What future-ready CFOs are thinking about

Qualitative analyses, sustainable investment, inclusive hiring, shortened supply chains and business response plans are among the priorities forward-looking CFOs will put in place in 2020.

By Anthony Coletta • Jan. 30, 2020 -

82% of workers want financial updates from CFOs

Across industries, sharing financial performance information with employees results in more trust, loyalty and better workplace culture, a Robert Half survey finds.

By Jane Thier • Jan. 30, 2020 -

Making early-pay access a thing

Scot Parnell is deploying his financial services experience to help a startup evangelize a radical idea: let employees access their earned income as needed.

By Robert Freedman • Jan. 30, 2020 -

How Lush ditched manual invoicing for automated accounts payable

Before 2017, the skincare company printed hundreds of thousands of supplier invoices annually. Now 92% of invoices are touchless.

By Deborah Abrams Kaplan • Jan. 30, 2020 -

2020 M&A trends: ‘Scope’ deals to take center stage

Deals that move companies into new business areas have a spotty record of success, but companies aren't deterred from making them the centerpiece of their M&A strategy this year.

By Robert Freedman • Jan. 29, 2020 -

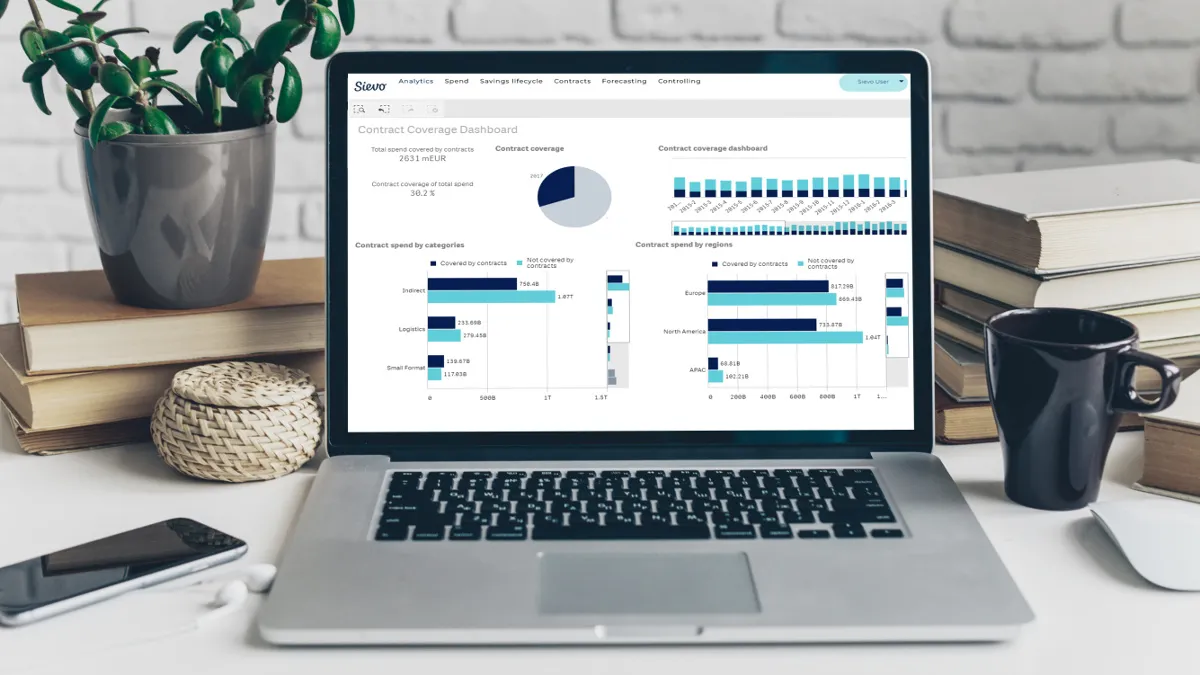

When forecasts are misaligned

Coordinating plans across finance, operations, procurement and logistics can be a challenge, especially at large businesses. A central forecasting team can help.

By Deborah Abrams Kaplan • Jan. 28, 2020 -

What's the right forecasting method? It depends on your data.

Time-series forecasting is a method that goes back decades, but as new computational power provides new options, what's the best way to go?

By Matt Leonard • Jan. 28, 2020 -

Deep Dive

New credit loss accounting standard expected to pummel retail income

FASB's CECL standard took effect for public banks at the beginning of this year. Analysts at Morgan Stanley say it's going to hit some retailers hard.

By Robert Freedman • Jan. 27, 2020 -

2020 Trends: Rise of the CFO-COO

The combined role is gaining popularity across industries. But is it really that much of a change?

By Jane Thier • Jan. 26, 2020 -

How to combine external data with AI to improve forecasting

Understanding the external factors that affect business can mean the difference between revenue gains and value destruction.

By Robert Freedman • Jan. 26, 2020 -

Opinion

Rolling forecasts support your enterprise risk management

This kind of projection can provide an incentive for long-term, value-maximizing behavior over short-term, bonus/target-based decisions rooted in the current fiscal year, writes Bryan Lapidus of the Association for Financial Professionals.

By Bryan Lapidus • Jan. 25, 2020