Technology: Page 38

-

Citigroup is actively investing to improve automation, says CFO

Citigroup marches forward with technology investments as companies rethink their tech spending.

By Grace Noto • July 18, 2022 -

Twitter suit details CFO, CEO caught in Musk crossfire

Twitter’s complaint paints a picture of senior executives under pressure as they seek to cooperate with and provide information to a mercurial buyer.

By Maura Webber Sadovi • July 13, 2022 -

Explore the Trendline➔

Explore the Trendline➔

iStock / Getty Images Plus via Getty Images

iStock / Getty Images Plus via Getty Images Trendline

TrendlineDigital transformation, one smart step at a time

As pricing pressures tighten margins and technologies like artificial intelligence evolve, finance chiefs are more closely scrutinizing the cost and returns of the tech tools they implement.

By CFO Dive staff -

Cloud computing adds value well beyond agility, efficiency: Deloitte

Companies excelling in the use of cloud computing work with three or four cloud providers rather than only one or two and do not spend much more on cloud platforms and services than their rivals, Deloitte found in a survey.

By Jim Tyson • July 11, 2022 -

Tapping the cloud can help CFOs craft data-driven ESG strategies

CFOs should look to the cloud and other data-driven technologies to help them build out holistic, long-term ESG strategies in the face of changing regulatory and social pressures.

By Grace Noto • July 8, 2022 -

Opinion

Don't abandon stablecoins over Terra, CFO says

Fintechs and financial services players will "be the driver of innovations and regulations that enable stablecoins, crypto and other digital assets to scale," argues Metallicus Chief Financial Officer Irina Berkon.

By Irina Berkon • July 8, 2022 -

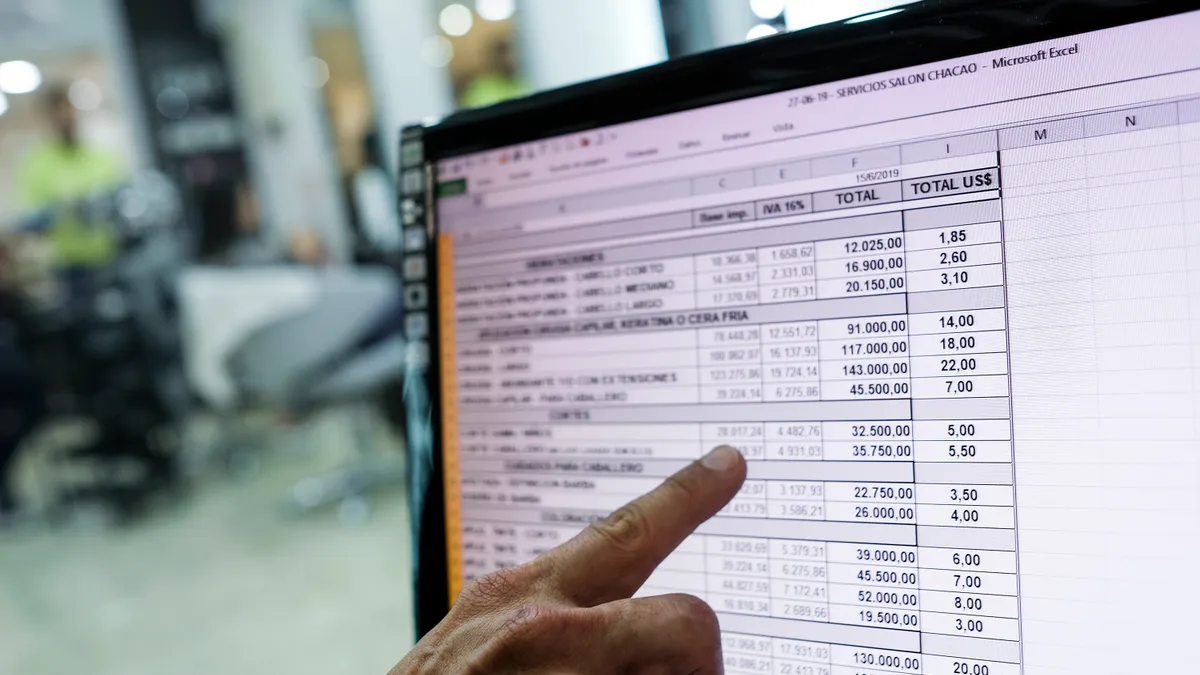

Excel skills remain top of list for FP&A roles: report

Advanced use of Excel is still required for the majority of FP&A jobs, with nine out of 10 top U.S. companies still seeking out Excel proficiency when filling financial analysis roles, DataRails finds.

By Grace Noto • July 1, 2022 -

Technology literacy is key for candidates aspiring to the CFO seat

Fostering greater technological literacy and taking on the responsibility of growing and enhancing their organization’s data utilization could be one way future CFO candidates differentiate themselves from the pack come hiring.

By Grace Noto • June 24, 2022 -

Businesses nudged to decentralize cybersecurity leadership

The push to enable employees to make informed security decisions comes amid an increase in the rate and severity of cyberattacks.

By Lindsey Wilkinson • June 24, 2022 -

Successful AI deployment relies on finding key talent: Gartner

CFOs should implement four key behaviors to drive AI in finance out of its infancy and see quicker returns, according to Gartner.

By Grace Noto • June 23, 2022 -

Affirm CFO takes on BNPL skeptics, shrugs off new competition

Apple's entry into the buy now-pay later market isn't a concern for Affirm, the company's Chief Financial Officer Michael Linford asserted Tuesday.

By Jonathan Berr • June 17, 2022 -

Comera Life Sciences taps Boston Scientific veteran for CFO role

Boston Scientific alum Michael Campbell will act as CFO for recently public life sciences Comera, taking the helm approximately one month following the company’s SPAC merger.

By Grace Noto • June 16, 2022 -

Intel CFO sees diversification as key to combating supply chain challenges

Companies must move to increase buffer inventory, foster diverse supply chains in face of geopolitical challenges, said Intel CFO David Zinsner.

By Grace Noto • June 15, 2022 -

AI yields 30% of revenue at tech-savvy companies: Accenture

Despite a big potential boost in profits, most companies fail to seize on the full benefits from artificial intelligence, Accenture found in a survey.

By Jim Tyson • June 13, 2022 -

Sponsored by Paddle

Barriers to growth facing SaaS CFOs - 'It's the unknown unknowns that will get you'

An expert's view on the changing role of SaaS finance teams, operational challenges they face, and how to overcome them.

June 13, 2022 -

Sponsored by Onplan

FP&A in spreadsheets: When 'that's how it's always been done' doesn't cut it anymore

Three signs that it's time to move away from traditional spreadsheets and consider a happy medium.

June 13, 2022 -

Controllers should close company books 'better,' not just faster: Gartner

Even after buying the newest technology, controllers may cling to decades-old procedures and miss opportunities to streamline closing of company books, according to Gartner.

By Jim Tyson • June 9, 2022 -

IKEA finance chief busts four ESG 'myths'

C-suite executives stymied by misperceptions about sustainability are slow to gain from shrinking their companies’ carbon footprints, according to Ingka Group-IKEA CFO Juvencio Maeztu.

By Jim Tyson • June 8, 2022 -

CFOs should use AI to navigate 'dark horizons' in scenario planning: Gartner

CFOs aiming to improve scenario planning with artificial intelligence need to overcome an aversion to gathering and analyzing a broad variety of data, according to Gartner.

By Jim Tyson • June 7, 2022 -

CFOs must divorce currency from technology to take advantage of crypto: Gartner

For CFOs intrigued by the promises of cryptocurrency, decoupling the movements of the coin from the promise of virtual currencies’ underlying technology will be key to successful adoption, says Gartner.

By Grace Noto • June 7, 2022 -

Many CFO-led teams still follow 20-year-old ‘steward’ role: Microsoft

CFOs and other finance executives identified as the most disruptive business trend the imperative to streamline team collaboration, Microsoft found in a survey.

By Jim Tyson • June 6, 2022 -

Big tech pushes passwordless for payments

Google, Microsoft and Apple this month began a big, new push in their campaign for a passwordless standard that's aimed at improving digital identity verification, including for payments.

By Lynne Marek • May 27, 2022 -

Is regulation shifting how CFOs should think about digital assets?

Regulators have been prompted to take a closer look at cryptocurrency as several digital assets have plummeted in value.

By Grace Noto • May 26, 2022 -

How one CFO used ERP to tackle COVID-19 testing

Updating Impact Health’s manual finance systems as demand for testing soared felt like “building a 747 in the air,” CFO Jennifer Herdler said.

By Maura Webber Sadovi • May 25, 2022 -

Compliance costs to surge, straining tight budgets: Accenture

Many compliance executives lack the funding needed to contain an expanding range of risks, Accenture found in a survey.

By Jim Tyson • May 24, 2022 -

SoftBank CFO advises automation over bloated finance teams

Leaning on automation can help companies free up key resources and keep team sizes small, allowing CFOs to think more strategically about periods of accelerating growth, says Navneet Govil, CFO of SoftBank Investment Advisers.

By Grace Noto • May 23, 2022