Treasury: Page 14

-

Delinquencies rise as household debt hits record high: NY Fed

Rising consumer debt and delinquencies, along with an increase in unemployment, have shown no signs of dampening consumer spending.

By Jim Tyson • Aug. 7, 2024 -

Job market setbacks do not ‘portend’ broad slump: Conference Board

Investors fearing a recession have pulled back from risk since a report on Friday that unemployment last month rose to 4.3%.

By Jim Tyson • Aug. 6, 2024 -

Fed’s Goolsbee seeks to cool speculation of sudden turn to rate policy

The central bank official cited signs of solid economic growth, including a 2.8%-annual-rate increase in gross domestic product during the second quarter.

By Jim Tyson • Aug. 5, 2024 -

Fed holds rates steady; points to ‘totality’ of data needed for potential September cut

The central bank continued to maintain rates at their 23-year high, but cracked open the door for a potential cut in September.

By Grace Noto • July 31, 2024 -

Deep Dive

7 CFO tips for yielding high ROI during the rush into generative AI

Financial executives willing to chance big spending on generative AI can take steps to reduce risk and seize the payoffs.

By Jim Tyson • July 26, 2024 -

Zelle, big banks challenge senators on scam reimbursements

Forcing banks to reimburse authorized payments could encourage bad behavior and would not deter scammers, bank executives said in a Senate hearing.

By Patrick Cooley • July 26, 2024 -

Deep Dive

‘Surge Moment’: Generative AI upends time-tested measurements of ROI

CFOs gauging the return on investment from generative artificial intelligence are trying to map fuzzy terrain, according to financial executives and AI experts.

By Jim Tyson • July 19, 2024 -

Opinion

Finance leaders need to move quickly to prep for the ‘tax trifecta’

U.S. businesses must begin scenario planning ahead of the presidential election to avoid being caught off guard by sudden shifts in tax policy, KPMG’s Rema Serafi writes.

By Rema Serafi • July 19, 2024 -

‘Say-on-pay’ proxy support rises despite concerns about PSUs: EY

The number of investor activist campaigns this proxy season rose to 691, a 2.4% increase compared with 2023, according to EY.

By Jim Tyson • July 17, 2024 -

CFOs plan to raise salaries 3.9% in 2025: WTW

U.S. companies are trimming salary increases as the labor market loosens, recovering from a pandemic period of high resignations, job hopping and wage gains.

By Jim Tyson • July 16, 2024 -

Powell says data lift Fed confidence inflation cooling toward 2% goal

Federal Reserve Chair Jerome Powell welcomed recent inflation data, including a report that the core consumer price index rose last month at the slowest pace since early 2021.

By Jim Tyson • July 15, 2024 -

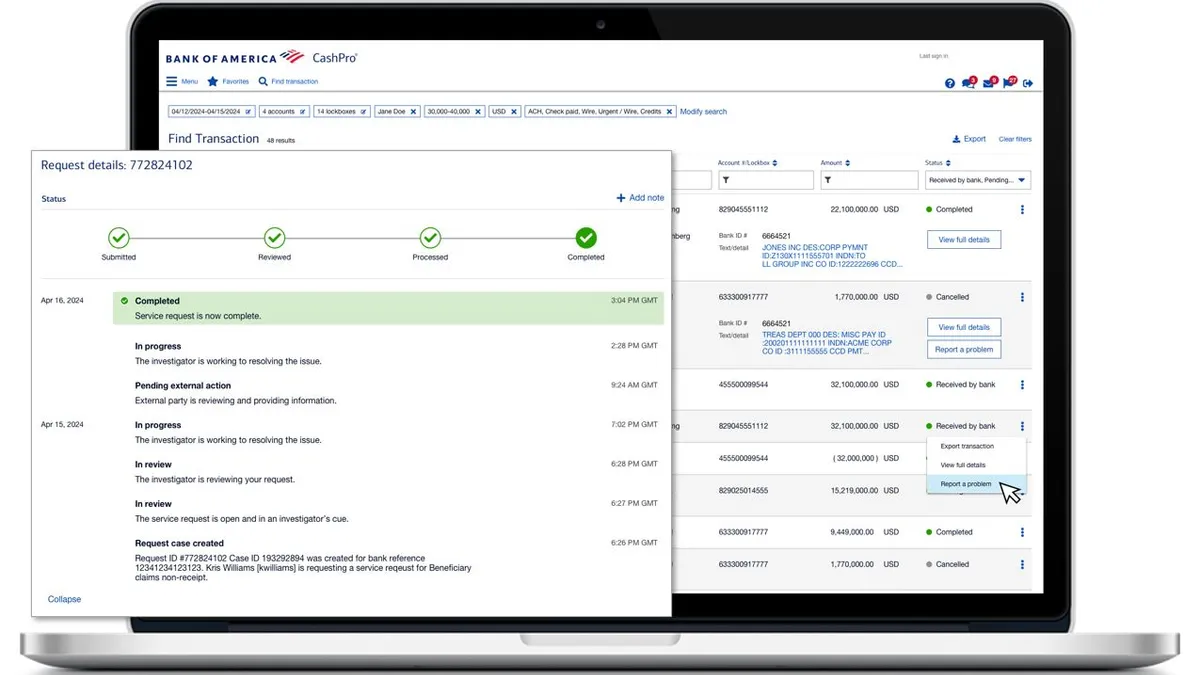

BofA tackles digital banking’s transaction pain points

The latest CashPro platform update is designed to better address transaction-related inquiries — one of the top reasons business customers call and email the bank.

By Maura Webber Sadovi • July 12, 2024 -

Fed will cut main rate before inflation falls to its 2% goal: Powell

A decline in the Federal Reserve’s preferred inflation measure to 2.6% has prompted policymakers to focus more on the cooling job market, Fed Chair Jerome Powell said.

By Jim Tyson • July 10, 2024 -

Powell spotlights risks to jobs, wants more gains against inflation

The job market in recent months has shown signs of returning to its pre-pandemic trend, with demand for labor easing and unemployment rising to 4.1% in June.

By Jim Tyson • July 9, 2024 -

Crypto theft doubles to $1.38B

The May theft of over $300 million worth of bitcoin from Japanese cryptocurrency exchange DMM Bitcoin is the largest digital currency heist so far this year.

By Alexei Alexis • July 8, 2024 -

Inflation persists as top concern among small businesses: U.S. Chamber

Businesses in services and manufacturing find price pressures more troublesome than their counterparts in other sectors, the U.S. Chamber said.

By Jim Tyson • July 3, 2024 -

Powell sees gains against inflation, wants more progress before rate cuts

After Powell’s comments, traders in interest rate futures increased the odds the Fed will cut the main interest rate by a quarter point in September.

By Jim Tyson • July 2, 2024 -

IPO market quickens as stocks hit record highs during H1 2024, EY says

In coming months the IPO market in the U.S. and beyond faces possible turbulence from intensifying regional conflicts and “an election super-cycle,” EY said.

By Jim Tyson • July 1, 2024 -

Commercial property vacancy rate to peak in 2026 at 24%: Moody’s

“The preference of many employees to work from home cannot be overlooked,” Moody’s economists said.

By Jim Tyson • June 28, 2024 -

Trump’s 10% tariff would annually harm households by at least $1,700: AAF

Damage from a sweeping tariff would spread beyond the U.S., “threatening key relationships with allies and inviting a global trade war,” AAF said.

By Jim Tyson • June 26, 2024 -

Consumer confidence falls amid sagging income, business expectations

“Signs of strain continue to emerge among consumers with low-to-moderate incomes,” Federal Reserve Governor Lisa Cook said Tuesday.

By Jim Tyson • June 25, 2024 -

Supreme Court ruling douses repatriation tax refund hopes

The court affirmed the constitutionality of the one-time Mandatory Repatriation Tax on income from investments in foreign corporations.

By Maura Webber Sadovi • June 24, 2024 -

Restatements decline, with small companies more prone to error: CAQ

The Sarbanes-Oxley Act of 2002 prompted a long-term reduction in restatements by tightening financial reporting and audit rules, CAQ said.

By Jim Tyson • June 24, 2024 -

Role clarity is key to fractional CFO pay

Contract finance executives must understand the services they truly offer in order to charge — and be paid — what they’re worth, Joe Woodard said Sunday at his firm’s accounting tech conference.

By Chris Gaetano • June 21, 2024 -

Homebuilding sags to four-year low, stifled by higher-for-longer rates

Mortgage activity last month slumped 8.5% compared with April and 7.3% compared with May 2023, Freddie Mac said Thursday.

By Jim Tyson • June 20, 2024