Compliance: Page 13

-

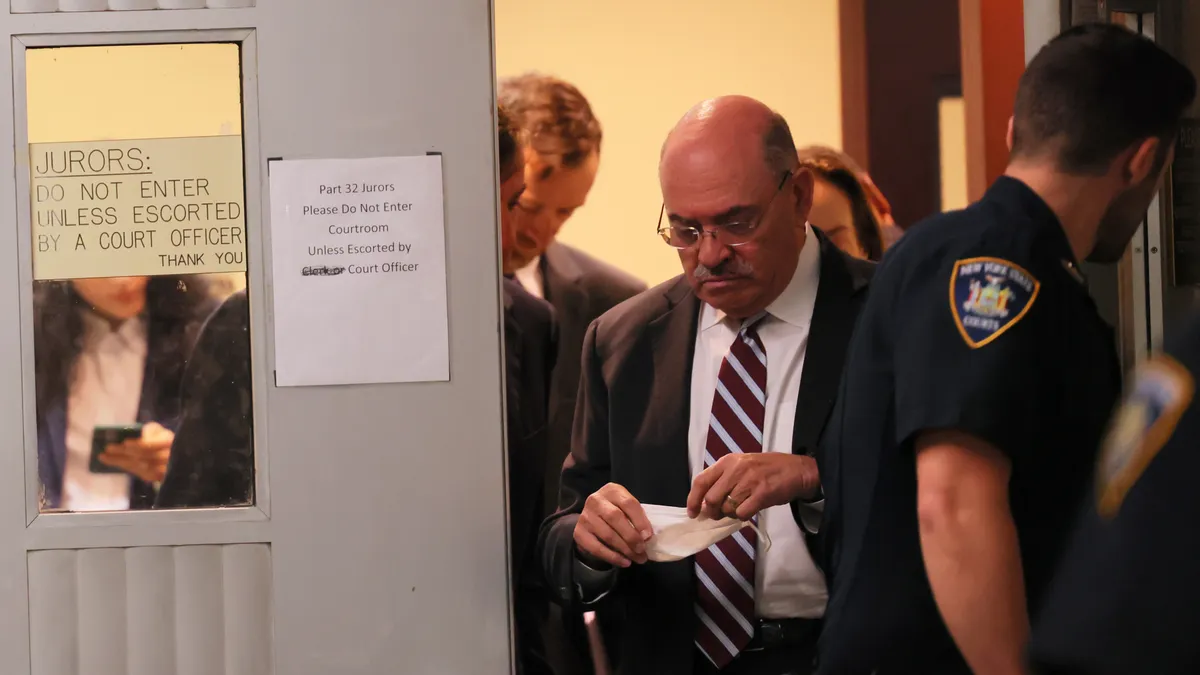

Ex-Trump CFO lied under oath, Forbes says

The ex-finance chief perjured himself while testifying in the state of New York’s $250 million civil-fraud case against his former boss, Forbes alleged.

By Alexei Alexis • Oct. 13, 2023 -

PCAOB says 42% of auditors botched quality reviews

Since early 2022 the PCAOB has tightened standards, stepped up enforcement and intensified inspections of auditing firms.

By Jim Tyson • Oct. 13, 2023 -

SEC cyber rules send execs scrambling as deadlines near

Companies face the thorny challenge of determining what constitutes a “material” cyber breach for reporting purposes.

By Alexei Alexis • Oct. 10, 2023 -

JPMorgan, Citi critique FASB’s credit losses fix

The CECL standard was originally aimed at encouraging timelier reporting of deteriorated asset values.

By Maura Webber Sadovi • Oct. 5, 2023 -

Why CFOs must steer benefits audits to avoid fines, penalties

Total monetary recoveries arising from ERISA enforcement actions exceeded $1.4 billion in fiscal 2022.

By Suman Bhattacharyya • Oct. 4, 2023 -

Senate bill would let SMBs use SBA loans to cover fintech fees

The Financial Technology Association is backing a bill that would clarify that loans made through the Small Business Administration’s flagship lending program can be used to pay for fintech services.

By Anna Hrushka • Oct. 4, 2023 -

FASB revisits GAAP cleanup

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

By Maura Webber Sadovi • Oct. 3, 2023 -

SEC fines Newell Brands $12.5M for misleading investors

Newell veiled sub-par sales using various accounting changes and disregarded warnings from its audit committee and auditor, the SEC said.

By Jim Tyson • Oct. 3, 2023 -

PCAOB fines Deloitte affiliate $900,000

Sanctions by the PCAOB against Deloitte’s affiliate in Colombia reflect tougher oversight by the U.S. audit watchdog under the Biden administration.

By Jim Tyson • Sept. 28, 2023 -

Gensler warns federal shutdown would freeze IPOs, SEC enforcement

Democratic lawmakers predicted a partial government closure would harm the competitiveness of U.S. capital markets.

By Jim Tyson • Sept. 27, 2023 -

SEC fines CFO, others for stock trade filing ‘delinquencies’

The charged corporate insiders and companies deprived investors of timely information related to over $90 million in transactions, SEC’s Gurbir Grewal said.

By Alexei Alexis • Sept. 27, 2023 -

Non-profit’s former executives arrested for $3.7M fraud scheme

The criminal charges follow a three-year investigation by the state of Florida into misconduct by the nonprofit’s former CEO and CFO.

By Grace Noto • Sept. 27, 2023 -

3 valuation takeaways from fraud ruling in Trump asset case

The judge’s ruling is a cautionary tale for financial executives who might look to disclaimers to defend a potentially flawed real estate appraisal.

By Maura Webber Sadovi • Sept. 27, 2023 -

75% of companies unprepared for coming ESG audits: KPMG

As regulators worldwide begin to mandate ESG disclosures, only 25% of companies are ready for audits of their reports, KPMG said.

By Jim Tyson • Sept. 26, 2023 -

22 Republican AGs accuse net-zero alliance of antitrust violations

The letter, led by Tennessee Attorney General Jonathan Skrmetti, alleges the Net Zero Financial Services Providers Alliance’s market influence could “deprive disfavored companies of economic opportunities.”

By Lamar Johnson • Sept. 19, 2023 -

FASB hands businesses some tax wins

The FASB made a few changes that companies wanted before moving forward with new tax rules last month, KPMG Partner Brett Weaver said.

By Maura Webber Sadovi • Sept. 18, 2023 -

SEC fines Lyft for failing to disclose $424M, pre-IPO stock sale

Lyft is required under federal securities laws to disclose stock transactions exceeding $120,000 that involve a person with ties to the company, the SEC said.

By Jim Tyson • Sept. 18, 2023 -

Apple backs California climate bill requiring large companies to disclose carbon footprint

Senate Bill 253 would require businesses operating in the Golden State that make over $1 billion to report their greenhouse gas emissions annually.

By Zoya Mirza • Sept. 14, 2023 -

Grayscale CFO says FASB met the crypto moment

Ed McGee’s praise for the new crypto rules comes as the digital asset manager is battling the SEC to launch the first bitcoin exchange-traded fund.

By Maura Webber Sadovi • Sept. 13, 2023 -

Brookings’ Klein calls for regulators to speed up ‘tepid’ FedNow adoption

It’s risky to rely entirely on market forces to drive the use of the Fed’s new instant payments service, says Brookings Senior Fellow Aaron Klein.

By Suman Bhattacharyya • Sept. 13, 2023 -

Gensler says Scope 3 emissions flap delays final climate risk rule

Republican senators criticized Gensler for what they said is a burdensome and divisive regulatory agenda.

By Jim Tyson • Sept. 12, 2023 -

SEC fines Monolith for violating whistleblower safeguards

Privately held companies, like their publicly traded counterparts, must uphold SEC-mandated safeguards for whistleblowers, the agency said.

By Jim Tyson • Sept. 11, 2023 -

Investor coalition lobbies standard setter to prioritize human and workers’ rights

ShareAction’s letter urges the International Sustainability Standards Board to also look at human capital and human rights together when it considers disclosures reporting.

By Lamar Johnson • Sept. 11, 2023 -

SEC fines Fluor $14.5M for accounting flaws

Fluor last decade failed to deploy the internal controls needed for its use of the percentage of completion accounting method, the SEC said.

By Jim Tyson • Sept. 7, 2023 -

CFOs are ‘squarely’ in ERP decision process, Deloitte’s Farhat says

Transformation is a key way for CFOs to cut costs and boost profit, but finance chiefs need to keep compliance front and center, Deloitte’s Isa Farhat advises.

By Grace Noto • Sept. 6, 2023