Compliance: Page 14

-

More companies are tying ESG metrics to executive compensation: WTW

Despite political blowback in the U.S., companies are increasingly incorporating ESG metrics into performance measures and incentive plans, according to the insurance services provider.

By Suman Bhattacharyya • May 9, 2024 -

Generative AI enables small accounting firms to challenge big ones: AICPA

Accountants should respond to the rapid pace of generative AI adoption by embracing it and delving into experimentation, the AICPA said.

By Jim Tyson • May 7, 2024 -

Explore the Trendline➔

Explore the Trendline➔

Getty Images

Getty Images Trendline

TrendlineTop 5 stories from CFO Dive

The disruption of the rules-based global order means CFOs need to adjust scenario planning to the prospect of higher capital costs and greater foreign exchange risks.

By CFO Dive staff -

Trump Media replaces auditor charged with fraud

The Sarasota, Florida-based media company dismissed its former auditor on Friday, the same day the SEC charged BF Borgers with “massive fraud.”

By Maura Webber Sadovi • May 6, 2024 -

Only 34% of firms deploy safeguards against generative AI threats: Splunk

Generative AI gives cyberattackers an edge over cyber-defenders, according to security experts surveyed by Splunk.

By Jim Tyson • May 6, 2024 -

"U.S. Securities and Exchange Commission headquarters" by AgnosticPreachersKid is licensed under CC BY 3.0

"U.S. Securities and Exchange Commission headquarters" by AgnosticPreachersKid is licensed under CC BY 3.0

SEC hits Trump Media auditor with $12M fine

BF Borgers, an auditor of public company financial statements, has committed massive fraud impacting more than 1,500 SEC filings, the agency said.

By Alexei Alexis • May 3, 2024 -

Deep Dive

Modern finance team makeovers: Chief accounting officers

CFOs and CAOs have developed a “symbiotic relationship” as the finance function morphs into a driver of business strategy.

By Grace Noto • April 30, 2024 -

Internal audit leaders need to hire more tech-savvy accountants: IIA

Companies hiring for internal audit need to prepare for disruption from new technology such as artificial intelligence and robotic process automation, IIA said.

By Jim Tyson • April 29, 2024 -

Opinion

Proposed PCAOB rule risks turning auditors into legal watchdogs

The NOCLAR proposal would impose on auditors greatly expanded responsibilities for identifying — or even preventing — noncompliance with a very wide range of laws, PwC’s Brian Croteau writes.

By Brian Croteau • April 25, 2024 -

"U.S. Securities and Exchange Commission headquarters in Washington, D.C., near Union Station" by AgnosticPreachersKid is licensed under CC BY 3.0

"U.S. Securities and Exchange Commission headquarters in Washington, D.C., near Union Station" by AgnosticPreachersKid is licensed under CC BY 3.0

High Court ruling eases blow of SEC’s new cyber rules: analysts

The court’s decision in Macquarie Infrastructure Corp. v. Moab Partners makes it harder for plaintiffs to bring claims based on omissions in SEC filings.

By Alexei Alexis • April 23, 2024 -

HeadSpin founder Lachwani sentenced to 18 months in prison for fraud

The former CEO of HeadSpin — ordered to pay a $1 million fine — faces a July hearing focused on compensating bilked investors.

By Jim Tyson • April 22, 2024 -

CEOs, CFOs can’t get non-prosecution agreement under DOJ pilot

Criteria released by the Department of Justice April 15 lets corporate executives know if they stand a good chance of avoiding charges for coming forward with misconduct allegations.

By Robert Freedman • April 19, 2024 -

Werfel sees IRS budget request yielding $341B in extra revenue

The IRS chief testified to a Senate committee after Republican lawmakers secured a $20-billion cut to the agency’s budget.

By Jim Tyson • April 17, 2024 -

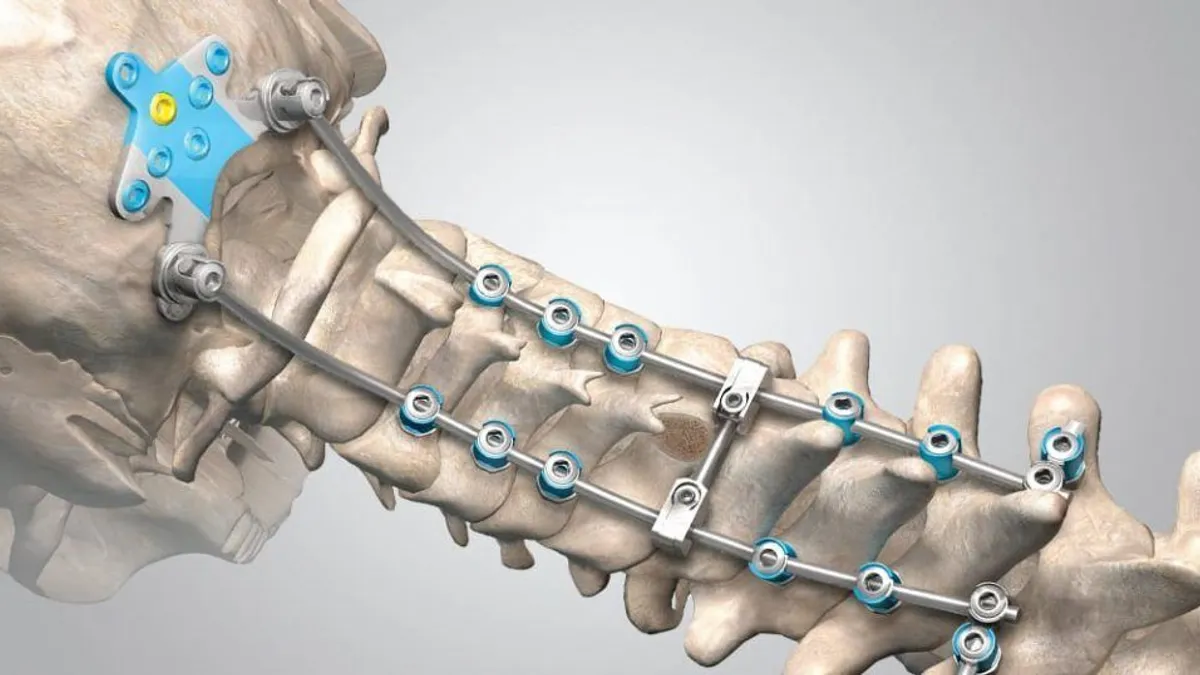

Orthofix replaces fired CLO, grapples with internal control ‘material weakness’

The new chief legal officer is joining the company as it faces a fresh set of headwinds related to its internal control over financial reports.

By Maura Webber Sadovi • April 17, 2024 -

Biden tax negotiator rejoins KPMG as election weighs on Pillar 2 prospects

Although the U.S. has yet to sign on, the OECD’s new Pillar Two tax rules already apply in more than 30 countries, Michael Plowgian said.

By Maura Webber Sadovi • April 16, 2024 -

70% of CEOs feel ready to deliver on responsible GenAI

The intense focus on safe and ethical GenAI use comes as the technology’s rapid rise is prompting scrutiny from governments around the world.

By Alexei Alexis • April 16, 2024 -

Opinion

The CFO’s role in curbing third-party cybersecurity risk

With vendor-related cyber risks spiking rapidly, the stakes are too high for CFOs to treat the issue as merely an IT concern, writes cybersecurity consultant AJ Yawn.

By AJ Yawn • April 16, 2024 -

CFOs mull future benefits for AI in tax: insightsoftware

When it comes to bringing AI into tax, it remains a bit of a “wait and see” for finance chiefs, said insightsoftware’s Josh Schauer.

By Grace Noto • April 11, 2024 -

Suspended ADM CFO’s pay ticked up in 2023 to $4.5M

The majority of Vikram Luthar’s pay package for last year came from $3.4 million in stock awards, according to Archer Daniels Midland’s proxy filing.

By Maura Webber Sadovi • April 11, 2024 -

Lack of uniform standards and disclosures a roadblock to scaling transition finance: report

A lack of standardized definitions, metrics and transition finance instruments endorsed by international organizations threatens broader adoption, the CFA Institute said.

By Suman Bhattacharyya • April 11, 2024 -

PCAOB levies record $25M fine on KPMG Netherlands for exam cheating

The $25 million penalty is the largest fine of any type imposed by the auditor watchdog since it was created in 2002 following the Enron accounting scandal.

By Maura Webber Sadovi • April 10, 2024 -

Nation-state actors drive up cyberthreats

Microsoft and Hewlett Packard Enterprise are among companies that have recently reported high-profile cyber intrusions attributed to nation-state actors.

By Alexei Alexis • April 9, 2024 -

Companies fall short on curbing cybersecurity risks from vendors: Moody’s

Cyberrisks are mounting, with artificial intelligence likely to increase the threat of attack in the short to medium term, Moody’s said.

By Jim Tyson • April 8, 2024 -

Deploying AI in accounting poses 12 audit risks: CAQ study

CFOs see the value of generative artificial intelligence but may not fully grasp its audit risks, according to the Center for Audit Quality.

By Jim Tyson • April 5, 2024 -

FASB to borrow from international rules for government grants

Many businesses and financial report preparers already rely on the IAS government grant accounting rules because GAAP is silent on the subject.

By Maura Webber Sadovi • April 5, 2024 -

NY AG prods for missing email relating to ex-Trump CFO’s perjury plea

Allen Weisselberg’s testimony surrounding the triplex was central to the charges of perjury levied against the former CFO, who is set to begin a five-month jail sentence on April 10.

By Grace Noto • April 5, 2024